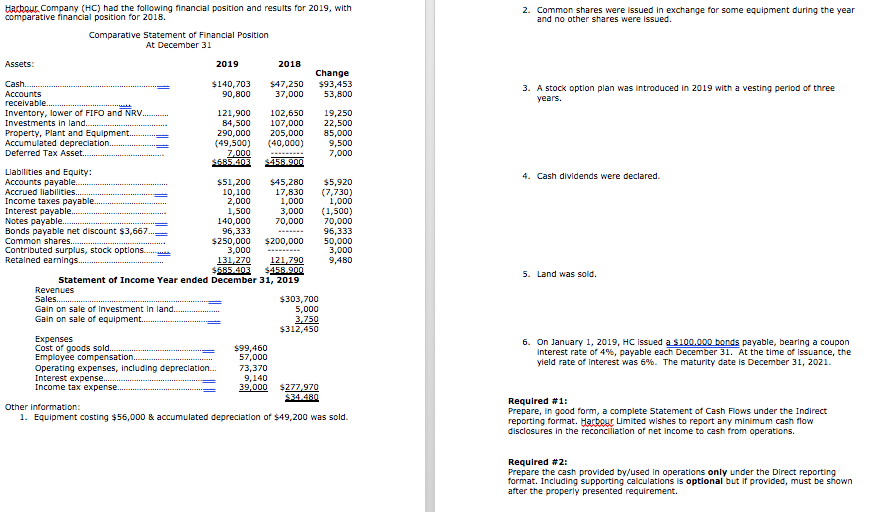

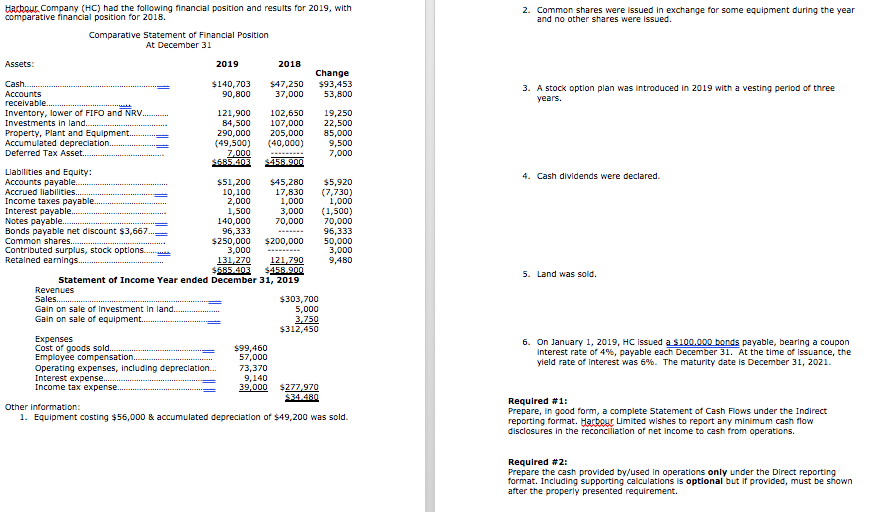

2. Common shares were issued in exchange for some equipment during the year and no other shares were issued. Harbour Company (HC) had the following financial position and results for 2019, with comparative financial position for 2018. Comparative Statement of Financial Position At December 31 3. A stock option plan was introduced in 2019 with a vesting period of three years. 4. Cash dividends were declared. Assets: 2019 2018 Change Cash $140,703 $47,250 $93,453 Accounts 90,800 37,000 53,800 receivable... Inventory, lower of FIFO and NRV 121,900 102,650 19,250 Investments in land. 84,500 107,000 22,500 Property, plant and Equipment. 290,000 205,000 85,000 Accumulated depreciation (49,500) (40,000) 9,500 Deferred Tax Asset... 7,000 7,000 $695.00 $458.900 Liabilities and Equity: Accounts payable. $51,200 $45,280 $5,920 Accrued liabilities. 10,100 17,830 (7,730) Income taxes payable 2,000 1,000 1,000 Interest payable. 1,500 3,000 (1,500) Notes payable.. 140,000 70,000 70,000 Bonds payable net discount $3,667... 96,333 96,333 Common shares... $250,000 $200,000 50,000 Contributed surplus, stock options...... 3,000 3,000 Retained earnings... 131,270 121.790 9,480 $685.403 $458.900 Statement of Income Year ended December 31, 2019 Revenues Sales... $303,700 Gain on sale of investment in land. 5,000 Gain on sale of equipment. 3.750 $312,450 Expenses Cost of goods sold. $99,460 Employee compensation 57,000 Operating expenses, including depreciation... 73,370 Interest expense.. 9,140 Income tax expense 39,000 $277.970 $34.480 Other information: 1. Equipment costing $56,000 & accumulated depreciation of $49,200 was sold. 5. Land was sold. 6. On January 1, 2019, HC issued a $100.000 bonds payable, bearing a coupon interest rate of 4%, payable each December 31. At the time of issuance, the yield rate of interest was 5%. The maturity date is December 31, 2021. Required #1: Prepare, in good form, a complete Statement of Cash Flows under the Indirect reporting format. Harbour Limited wishes to report any minimum cash flow disclosures in the reconciliation of net income to cash from operations. Required #2: Prepare the cash provided by/used in operations only under the Direct reporting format. Including supporting calculations is optional but if provided, must be shown after the properly presented requirement