Question

2. Company A has three projects (C, D and E) which show positive NPV. But Company does not have enough money to invest in

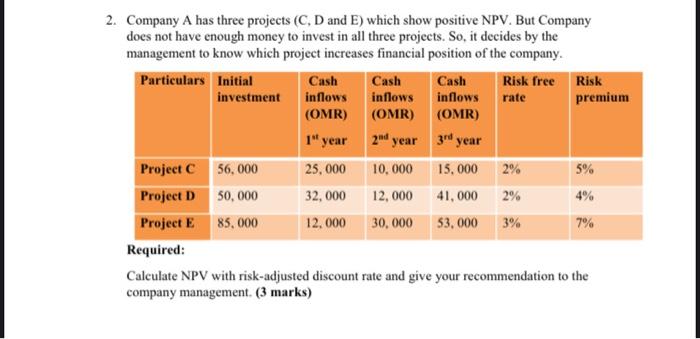

2. Company A has three projects (C, D and E) which show positive NPV. But Company does not have enough money to invest in all three projects. So, it decides by the management to know which project increases financial position of the company. Particulars Initial Cash inflows (OMR) Cash Cash Risk free Risk investment inflows inflows rate premium (OMR) (OMR) 1" year 2nd year 3rd year Project C 56, 000 25, 000 10, 000 15, 000 2% Project D 50, 000 32, 000 12, 000 41, 000 2% 4% Project E 85, 000 12, 000 30, 000 53, 000 3% 7% Required: Calculate NPV with risk-adjusted discount rate and give your recommendation to the company management. (3 marks)

Step by Step Solution

3.41 Rating (185 Votes )

There are 3 Steps involved in it

Step: 1

Risk adjusted discount rate Risk free rate Risk premium NPVPresent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments An Introduction

Authors: Herbert B Mayo

9th Edition

324561385, 978-0324561388

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App