Question

2 Company Data 3 Claythorne International 4 Rogers and Rogers Capital 5 Wargrave Limited 6 Seton, Lombard, and Marston Incorporated Alpha Beta 1.71% 0.6452

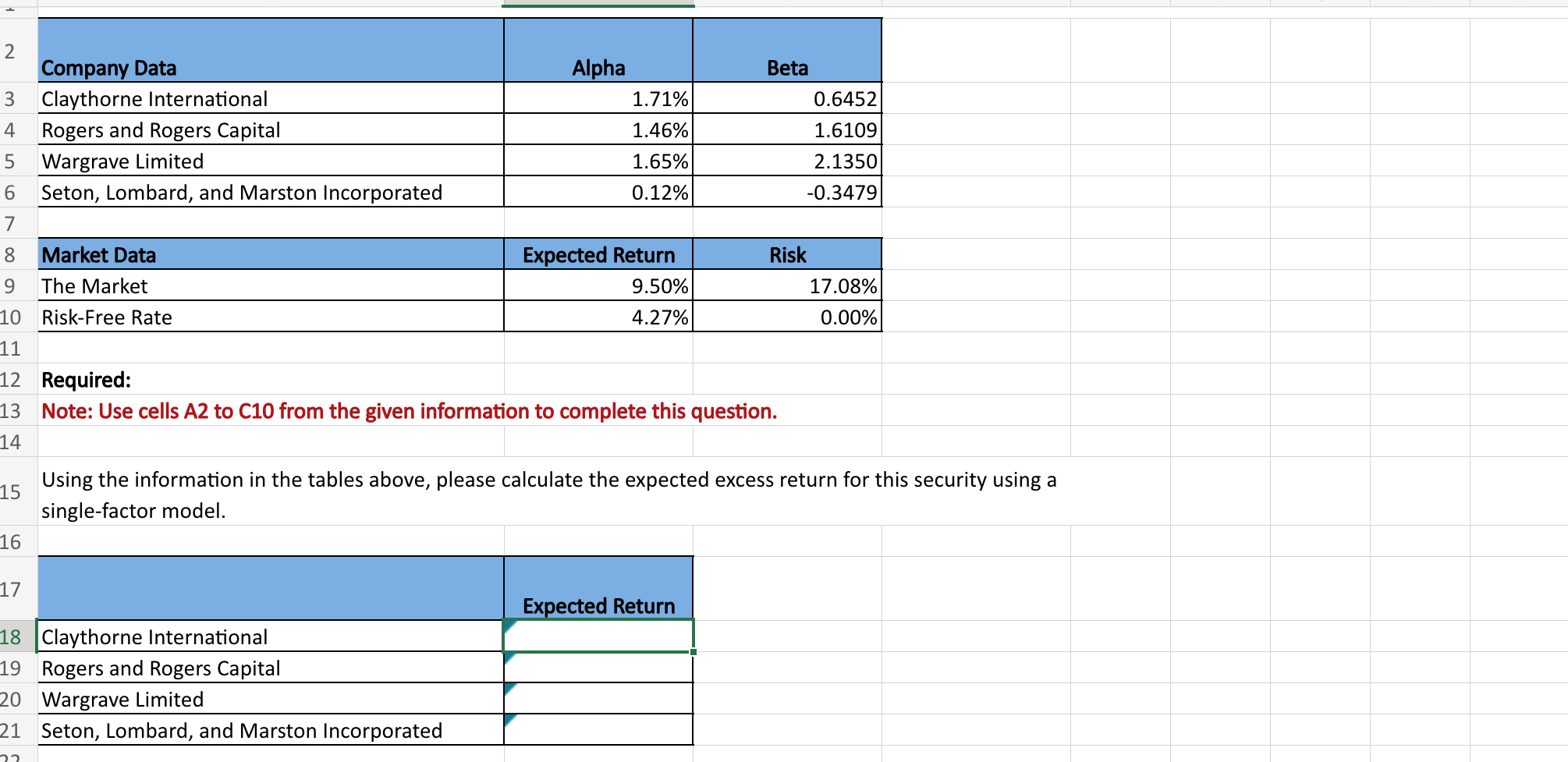

2 Company Data 3 Claythorne International 4 Rogers and Rogers Capital 5 Wargrave Limited 6 Seton, Lombard, and Marston Incorporated Alpha Beta 1.71% 0.6452 1.46% 1.6109 1.65% 2.1350 0.12% -0.3479 7 8 Market Data Expected Return Risk 9 The Market 9.50% 17.08% 10 Risk-Free Rate 4.27% 0.00% 11 12 Required: 13 Note: Use cells A2 to C10 from the given information to complete this question. 14 15 Using the information in the tables above, please calculate the expected excess return for this security using a single-factor model. 16 17 18 Claythorne International 19 Rogers and Rogers Capital 20 Wargrave Limited 21 Seton, Lombard, and Marston Incorporated 22 Expected Return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Basic Statistics

Authors: Charles Henry Brase, Corrinne Pellillo Brase

6th Edition

978-1133525097, 1133525091, 1111827028, 978-1133110316, 1133110312, 978-1111827021

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App