Answered step by step

Verified Expert Solution

Question

1 Approved Answer

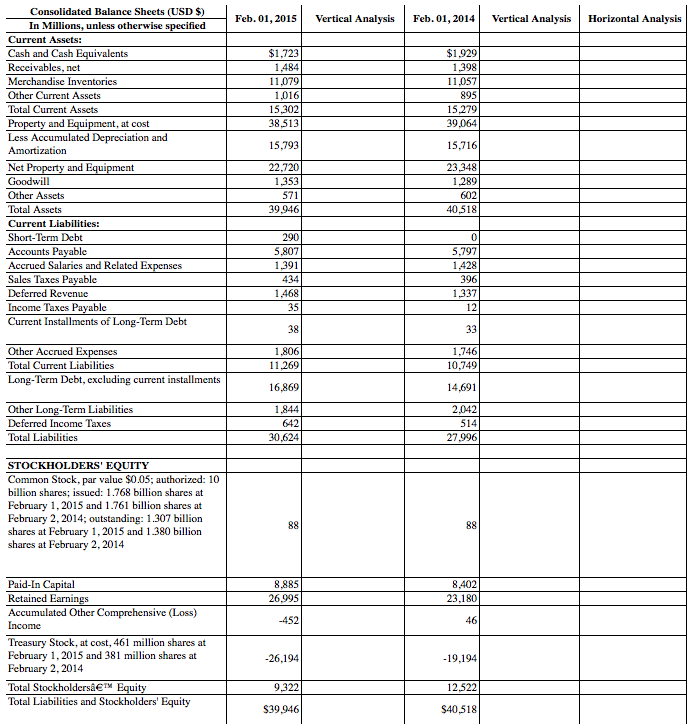

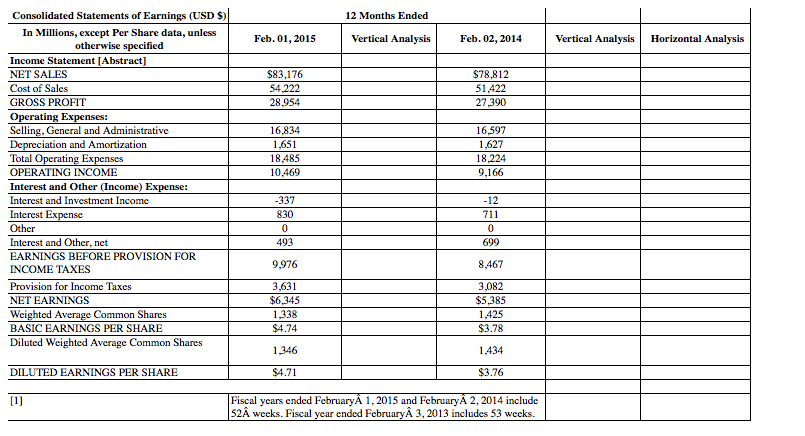

2. Complete a vertical and horizontal analysis on the tabs labeled Balance Sheet and Income Statement, use total assets on the balance sheet and net

2. Complete a vertical and horizontal analysis on the tabs labeled "Balance Sheet" and "Income Statement," use total assets on the balance sheet and net sales on the income statement for your vertical analysis.

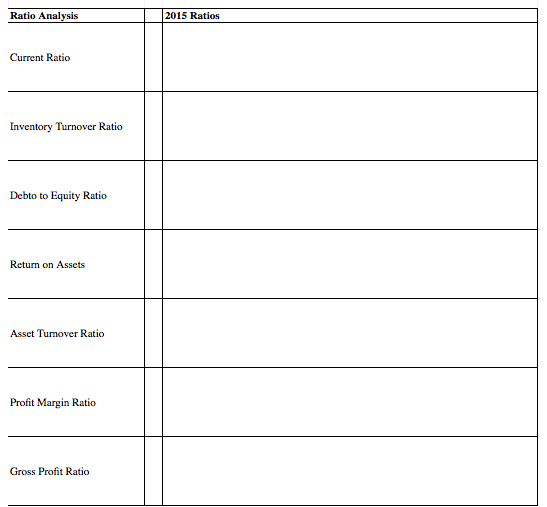

3. Using the balance sheet and income statement, complete the ratios on the tab labeled "Ratios."

Consolidated Balance Sheets (USD $) In Millions, unless o Feb. 01,2015 Vertical AnalysisFeb. 01,2014Vertical AnalysisHorizontal Analysis therwises fied Current Assets: Cash and Cash Equivalents Receivables, net Merchandise Inventories Other Current Assets Total Current Assets $1.723 1484 11079 1016 15302 38.513 $1929 1.398 11,057 895 15,279 39,064 at cost Depreciation and 15,716 15.793 22,720 1353 571 39946 23.348 1.289 602 40,518 ent Goodwill Other Assets Total Assets Current Liabilities: Accounts Pavable Accrued Salarics and Rclated Expenses Sales Taxes Payable Deferred Revenue Income Taxes Payable Current Installments of Long-Term 5,807 1391 434 1468 35 5,797 1428 1337 Debt 1.746 10.749 Other Accrued Total Current Liabilitics Long-Term Debt, excluding current installments 1,806 11.269 16,869 14,691 2,042 514 27.996 Other Long-Term Liabilitics Deferred Income Taxes Total Liabilities 1.844 642 30,624 STOCKHOLDERS' EQUITY Common Stock, par value $0.05; authorized: 10 billion shares; issued: 1.768 billion shares at February 1,2015 and 1.761 billion shares at February 2,2014; outstanding: 1.307 billion shares at February 1.2015 and 1.380 billion shares at February 2, 2014 8,885 26.995 8402 23.180 Retained Earnings Other Comprehensive (Loss) -452 Treasury Stock, at cost, 461 million shares at February 1.2015 and 381 million shares at February 2,2014 Total StockholderseT Total Liabilities and Stockholders' Equity 19,.194 12,522 $40,518 26.194 9.322 $39,946 Consolidated Statements of Earnings (USD S) 12 Months Ended In Millions, except Per Share data, unless Feb. 01,2015 Vertical Analysis Feb. 02,2014 Vertical AnalysisHorizontal Analysis otherwise specified Income Statement [Abstract] NET SALES Cost of Sales GROSS PROFIT $83,176 54 222 28,954 51-422 27390 ating Ex 16.597 1,627 18,224 9,166 Selling, General and Administrative 16,834 1,651 18.485 10469 ciation and Amortization Total Operating Expenses OPERATING INCOME Interest and Other (Income) Ex Interest and Investment Income Interest Expensc Other Interest and Other, net EARNINGS BEFORE PROVISION FOR INCOME TAXES Provision for Income Taxes NET EARNINGS Weighted Average Common Shares BASIC EARNINGS PER SHARE Diluted Weighted Average Common Shares 337 830 493 8467 3,082 $5.385 1425 9,976 3,631 $6,345 1338 $4.74 1,346 1.434 $3.76 DILUTED EARNINGS PER SHARE $4.71 Fiscal years ended FebruaryA 1,2015 and FebruaryA 2, 2014 include 52A wecks. Fiscal year ended F A 3,2013 includes 53 weeks Ratio Analysis 2015 Ratios Current Ratio Inventory Turnover Ratio Debto to Equity Ratio Return on Assets Asset Turmover Ratio Profit Margin Ratio Gross Profit Ratio Consolidated Balance Sheets (USD $) In Millions, unless o Feb. 01,2015 Vertical AnalysisFeb. 01,2014Vertical AnalysisHorizontal Analysis therwises fied Current Assets: Cash and Cash Equivalents Receivables, net Merchandise Inventories Other Current Assets Total Current Assets $1.723 1484 11079 1016 15302 38.513 $1929 1.398 11,057 895 15,279 39,064 at cost Depreciation and 15,716 15.793 22,720 1353 571 39946 23.348 1.289 602 40,518 ent Goodwill Other Assets Total Assets Current Liabilities: Accounts Pavable Accrued Salarics and Rclated Expenses Sales Taxes Payable Deferred Revenue Income Taxes Payable Current Installments of Long-Term 5,807 1391 434 1468 35 5,797 1428 1337 Debt 1.746 10.749 Other Accrued Total Current Liabilitics Long-Term Debt, excluding current installments 1,806 11.269 16,869 14,691 2,042 514 27.996 Other Long-Term Liabilitics Deferred Income Taxes Total Liabilities 1.844 642 30,624 STOCKHOLDERS' EQUITY Common Stock, par value $0.05; authorized: 10 billion shares; issued: 1.768 billion shares at February 1,2015 and 1.761 billion shares at February 2,2014; outstanding: 1.307 billion shares at February 1.2015 and 1.380 billion shares at February 2, 2014 8,885 26.995 8402 23.180 Retained Earnings Other Comprehensive (Loss) -452 Treasury Stock, at cost, 461 million shares at February 1.2015 and 381 million shares at February 2,2014 Total StockholderseT Total Liabilities and Stockholders' Equity 19,.194 12,522 $40,518 26.194 9.322 $39,946 Consolidated Statements of Earnings (USD S) 12 Months Ended In Millions, except Per Share data, unless Feb. 01,2015 Vertical Analysis Feb. 02,2014 Vertical AnalysisHorizontal Analysis otherwise specified Income Statement [Abstract] NET SALES Cost of Sales GROSS PROFIT $83,176 54 222 28,954 51-422 27390 ating Ex 16.597 1,627 18,224 9,166 Selling, General and Administrative 16,834 1,651 18.485 10469 ciation and Amortization Total Operating Expenses OPERATING INCOME Interest and Other (Income) Ex Interest and Investment Income Interest Expensc Other Interest and Other, net EARNINGS BEFORE PROVISION FOR INCOME TAXES Provision for Income Taxes NET EARNINGS Weighted Average Common Shares BASIC EARNINGS PER SHARE Diluted Weighted Average Common Shares 337 830 493 8467 3,082 $5.385 1425 9,976 3,631 $6,345 1338 $4.74 1,346 1.434 $3.76 DILUTED EARNINGS PER SHARE $4.71 Fiscal years ended FebruaryA 1,2015 and FebruaryA 2, 2014 include 52A wecks. Fiscal year ended F A 3,2013 includes 53 weeks Ratio Analysis 2015 Ratios Current Ratio Inventory Turnover Ratio Debto to Equity Ratio Return on Assets Asset Turmover Ratio Profit Margin Ratio Gross Profit Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started