Answered step by step

Verified Expert Solution

Question

1 Approved Answer

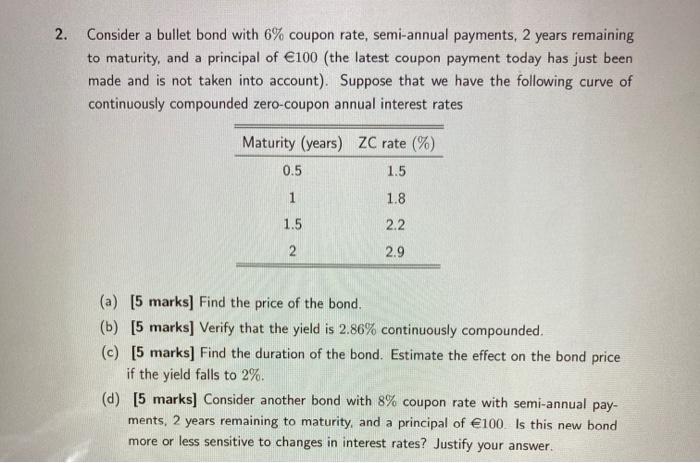

2. Consider a bullet bond with 6% coupon rate, semi-annual payments, 2 years remaining to maturity, and a principal of 100 (the latest coupon

2. Consider a bullet bond with 6% coupon rate, semi-annual payments, 2 years remaining to maturity, and a principal of 100 (the latest coupon payment today has just been made and is not taken into account). Suppose that we have the following curve of continuously compounded zero-coupon annual interest rates Maturity (years) ZC rate (%) 1.5 1.8 2.2 2.9 0.5 1 1.5 2 (a) [5 marks] Find the price of the bond. (b) [5 marks] Verify that the yield is 2.86% continuously compounded. (c) [5 marks] Find the duration of the bond. Estimate the effect on the bond price if the yield falls to 2%. (d) [5 marks] Consider another bond with 8% coupon rate with semi-annual pay- ments, 2 years remaining to maturity, and a principal of 100. Is this new bond more or less sensitive to changes in interest rates? Justify your answer.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To find the price of the bond we need to calculate the present value of the bonds future cash flows which include the coupon payments and the principal repayment Given Coupon rate 6 Semiannual payme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started