Answered step by step

Verified Expert Solution

Question

1 Approved Answer

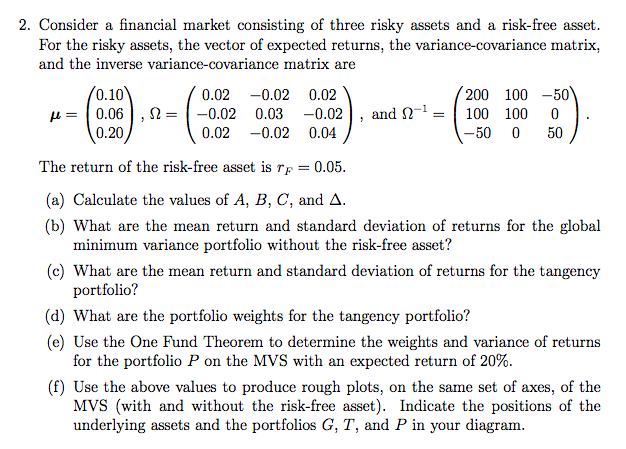

2. Consider a financial market consisting of three risky assets and a risk-free asset. For the risky assets, the vector of expected returns, the

2. Consider a financial market consisting of three risky assets and a risk-free asset. For the risky assets, the vector of expected returns, the variance-covariance matrix, and the inverse variance-covariance matrix are 0.10\ = 0.06 0.20 200 100 -50 0.02 -0.02 0.02 2=-0.02 0.02 -0.02 0.03 -0.02 0.04 and 2-1 = 100 100 0 ' -50 0 50 = 0.05. The return of the risk-free asset is r (a) Calculate the values of A, B, C, and A. (b) What are the mean return and standard deviation of returns for the global minimum variance portfolio without the risk-free asset? (c) What are the mean return and standard deviation of returns for the tangency portfolio? (d) What are the portfolio weights for the tangency portfolio? (e) Use the One Fund Theorem to determine the weights and variance of returns for the portfolio P on the MVS with an expected return of 20%. (f) Use the above values to produce rough plots, on the same set of axes, of the MVS (with and without the risk-free asset). Indicate the positions of the underlying assets and the portfolios G, T, and P in your diagram.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started