Answered step by step

Verified Expert Solution

Question

1 Approved Answer

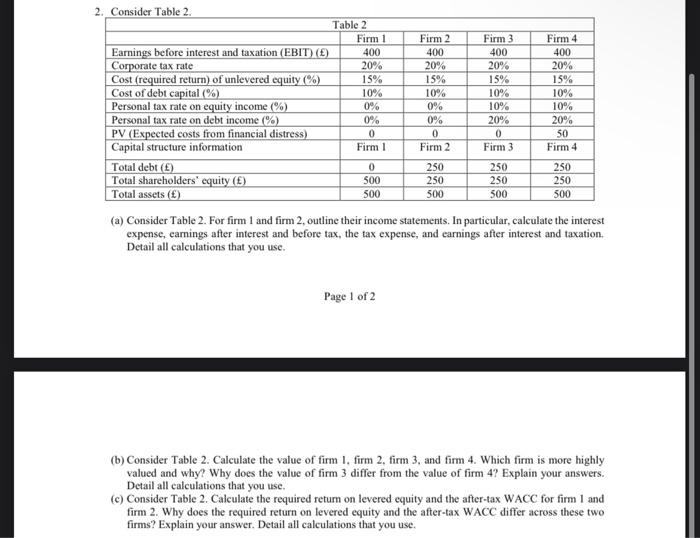

2. Consider Table 2. Earnings before interest and taxation (EBIT) () Corporate tax rate Cost (required return) of unlevered equity (%) Cost of debt capital

2. Consider Table 2. Earnings before interest and taxation (EBIT) () Corporate tax rate Cost (required return) of unlevered equity (%) Cost of debt capital (%) Personal tax rate on equity income (%) Personal tax rate on debt income (%) PV (Expected costs from financial distress) Capital structure information Total debt () Total shareholders' equity () Total assets () Table 2 Firm 1 400 20% 15% 10% 0% 0% 0 Firm 1 0 500 500 Firm 2 400 20% 15% Page 1 of 2 10% 0% 0% 0 Firm 2 250 250 500 Firm 3 400 20% 15% 10% 10% 20% 0 Firm 3 250 250 500 Firm 4 400 20% 15% 10% 10% 20% 50 Firm 4 250 250 500 (a) Consider Table 2. For firm 1 and firm 2, outline their income statements. In particular, calculate the interest expense, earnings after interest and before tax, the tax expense, and earnings after interest and taxation. Detail all calculations that you use. (b) Consider Table 2. Calculate the value of firm 1, firm 2, firm 3, and firm 4. Which firm is more highly valued and why? Why does the value of firm 3 differ from the value of firm 4? Explain your answers. Detail all calculations that you use. (c) Consider Table 2. Calculate the required return on levered equity and the after-tax WACC for firm 1 and firm 2. Why does the required return on levered equity and the after-tax WACC differ across these two firms? Explain your answer. Detail all calculations that you use.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started