Question

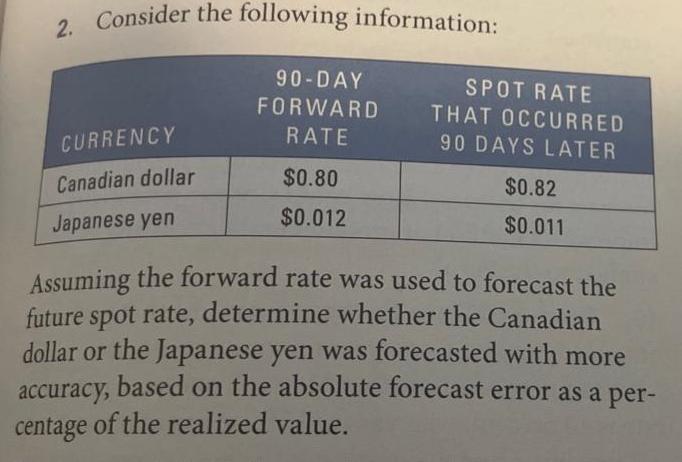

2. Consider the following information: CURRENCY Canadian dollar Japanese yen 90-DAY FORWARD RATE $0.80 $0.012 SPOT RATE THAT OCCURRED 90 DAYS LATER $0.82 $0.011

2. Consider the following information: CURRENCY Canadian dollar Japanese yen 90-DAY FORWARD RATE $0.80 $0.012 SPOT RATE THAT OCCURRED 90 DAYS LATER $0.82 $0.011 Assuming the forward rate was used to forecast the future spot rate, determine whether the Canadian dollar or the Japanese yen was forecasted with more accuracy, based on the absolute forecast error as a per- centage of the realized value.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

determine which currency was forecasted with more accuracy we need to calculate the absolute forecas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International financial management

Authors: Jeff Madura

9th Edition

978-0324593495, 324568207, 324568193, 032459349X, 9780324568202, 9780324568196, 978-0324593471

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App