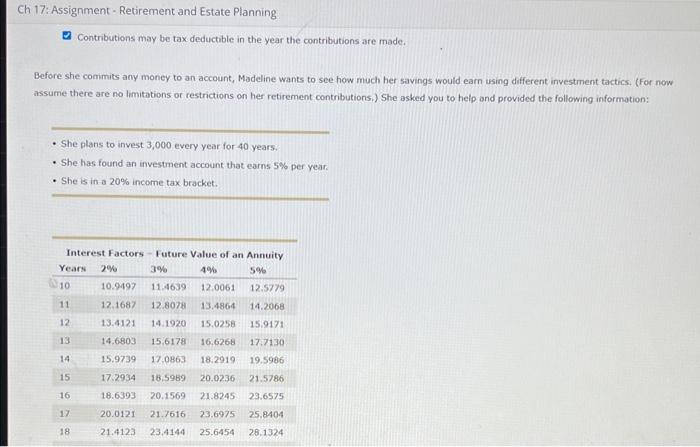

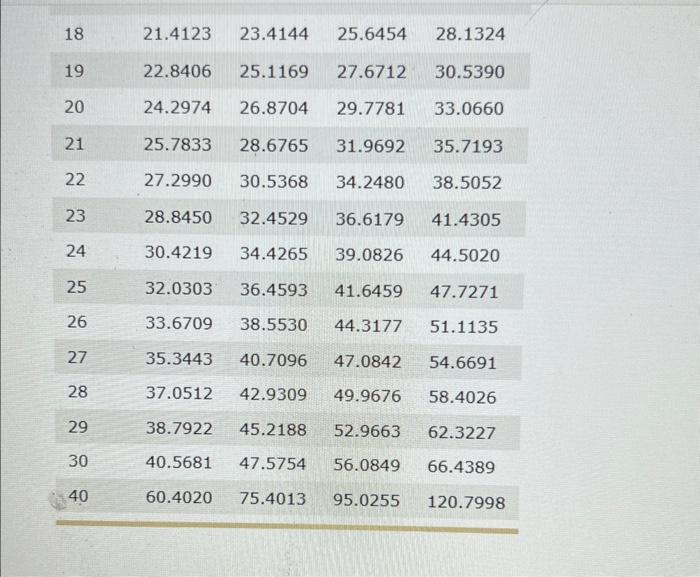

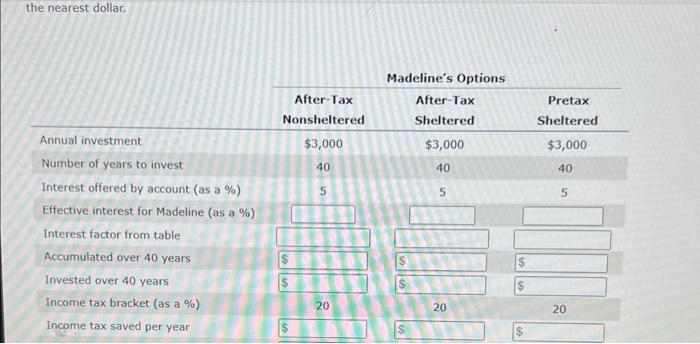

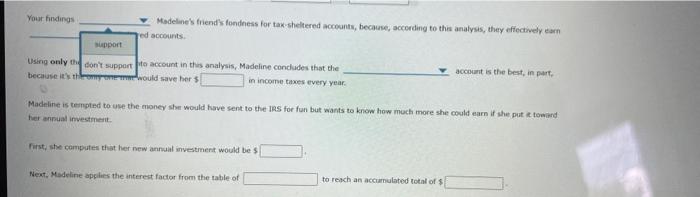

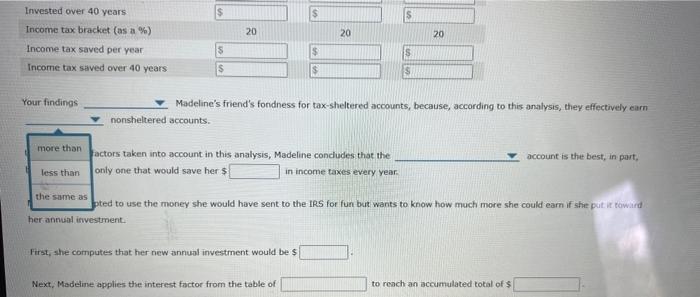

2 Contributions may be tax deductible in the year the contributions are made, Before she comimits any money to an account, Madeline wants to see how much her savings would earn using different investment tactics. (For now assume there are no limitations or restrictions on her retirement contributions.) She asked you to help and provided the following information: - She plans to invest 3,000 every year for 40 years. - She has found an investment account that earns 5% per year. - She is in a 20% incorne tax bracket. \begin{tabular}{|l|l|l|l|l|} \hline 18 & 21.4123 & 23.4144 & 25.6454 & 28.1324 \\ \hline 19 & 22.8406 & 25.1169 & 27.6712 & 30.5390 \\ \hline 20 & 24.2974 & 26.8704 & 29.7781 & 33.0660 \\ \hline 21 & 25.7833 & 28.6765 & 31.9692 & 35.7193 \\ \hline 22 & 27.2990 & 30.5368 & 34.2480 & 38.5052 \\ \hline 23 & 28.8450 & 32.4529 & 36.6179 & 41.4305 \\ \hline 24 & 30.4219 & 34.4265 & 39.0826 & 44.5020 \\ \hline 25 & 32.0303 & 36.4593 & 41.6459 & 47.7271 \\ \hline 26 & 33.6709 & 38.5530 & 44.3177 & 51.1135 \\ \hline 27 & 35.3443 & 40.7096 & 47.0842 & 54.6691 \\ \hline 28 & 37.0512 & 42.9309 & 49.9676 & 58.4026 \\ \hline 29 & 38.7922 & 45.2188 & 52.9663 & 62.3227 \\ \hline 30 & 40.5681 & 47.5754 & 56.0849 & 66.4389 \\ \hline 40 & 60.4020 & 75.4013 & 95.0255 & 120.7998 \\ \hline & & & & \\ \hline \end{tabular} the nearest dollar. Your findings Madeline's friend's fondhess for tax-sheltered accoants, because, according to tha analyss, they effectively earn. ed acciourits. Winig only th to account in thes analysis, Madeline cond udes that the beciuse isktin tis would save her $ accouat is the best, in part, in income taxes every year. Madeline is tempted to-use the emoney she would have sent to the IRS for fun but wants to know how moch more she could alam if she put it towierd her orrisual investonert Fist, ste computes th her new annali investinent would be $ Niest, Madeline apglies the interest factor from the rable of to reach an accumulated zotal of \$ Your findings Madeline's friend's fondness for tax-sheltered accounts, because, according to this analysis, they effectively earn nonsheltered accounts. actors taken into account in this analysis, Madeline condudes that the account is the best, in part, only one that would save her $ in income taxes every year. pted to use the money she would have sent to the IRS for fun boit wants to know how much more she could earn if shit put. it toward her annsal iewestment. First, she computes that her new annual investrnent would be $ Next, Madeline applies the interest factor from the table of to reach an accumulated total of $ Your findints Madehne's friend's fondness for tax-sheltered accounts, because, according to this afalyas, they effectively earn nonsheltered accounts. Using oaly the factors taken into account in this analysis, Madeline concludes that the account is the best, in part. because it's the only one that would save her s in income taxes every yea Madeline is tempted to use the money she would have sent to the IRS for fun but want she could earn if she put it toward her annual investment. First, she computes that her new annual investment would be 5 Next, Madeline apghins the interest factor from the table of to reach an accumulated total of 5 2 Contributions may be tax deductible in the year the contributions are made, Before she comimits any money to an account, Madeline wants to see how much her savings would earn using different investment tactics. (For now assume there are no limitations or restrictions on her retirement contributions.) She asked you to help and provided the following information: - She plans to invest 3,000 every year for 40 years. - She has found an investment account that earns 5% per year. - She is in a 20% incorne tax bracket. \begin{tabular}{|l|l|l|l|l|} \hline 18 & 21.4123 & 23.4144 & 25.6454 & 28.1324 \\ \hline 19 & 22.8406 & 25.1169 & 27.6712 & 30.5390 \\ \hline 20 & 24.2974 & 26.8704 & 29.7781 & 33.0660 \\ \hline 21 & 25.7833 & 28.6765 & 31.9692 & 35.7193 \\ \hline 22 & 27.2990 & 30.5368 & 34.2480 & 38.5052 \\ \hline 23 & 28.8450 & 32.4529 & 36.6179 & 41.4305 \\ \hline 24 & 30.4219 & 34.4265 & 39.0826 & 44.5020 \\ \hline 25 & 32.0303 & 36.4593 & 41.6459 & 47.7271 \\ \hline 26 & 33.6709 & 38.5530 & 44.3177 & 51.1135 \\ \hline 27 & 35.3443 & 40.7096 & 47.0842 & 54.6691 \\ \hline 28 & 37.0512 & 42.9309 & 49.9676 & 58.4026 \\ \hline 29 & 38.7922 & 45.2188 & 52.9663 & 62.3227 \\ \hline 30 & 40.5681 & 47.5754 & 56.0849 & 66.4389 \\ \hline 40 & 60.4020 & 75.4013 & 95.0255 & 120.7998 \\ \hline & & & & \\ \hline \end{tabular} the nearest dollar. Your findings Madeline's friend's fondhess for tax-sheltered accoants, because, according to tha analyss, they effectively earn. ed acciourits. Winig only th to account in thes analysis, Madeline cond udes that the beciuse isktin tis would save her $ accouat is the best, in part, in income taxes every year. Madeline is tempted to-use the emoney she would have sent to the IRS for fun but wants to know how moch more she could alam if she put it towierd her orrisual investonert Fist, ste computes th her new annali investinent would be $ Niest, Madeline apglies the interest factor from the rable of to reach an accumulated zotal of \$ Your findings Madeline's friend's fondness for tax-sheltered accounts, because, according to this analysis, they effectively earn nonsheltered accounts. actors taken into account in this analysis, Madeline condudes that the account is the best, in part, only one that would save her $ in income taxes every year. pted to use the money she would have sent to the IRS for fun boit wants to know how much more she could earn if shit put. it toward her annsal iewestment. First, she computes that her new annual investrnent would be $ Next, Madeline applies the interest factor from the table of to reach an accumulated total of $ Your findints Madehne's friend's fondness for tax-sheltered accounts, because, according to this afalyas, they effectively earn nonsheltered accounts. Using oaly the factors taken into account in this analysis, Madeline concludes that the account is the best, in part. because it's the only one that would save her s in income taxes every yea Madeline is tempted to use the money she would have sent to the IRS for fun but want she could earn if she put it toward her annual investment. First, she computes that her new annual investment would be 5 Next, Madeline apghins the interest factor from the table of to reach an accumulated total of 5