Question

2. Corporate Bonds - Corporate bonds are haircut based on both their time to maturity and whether they are rated as investment grade (defined by

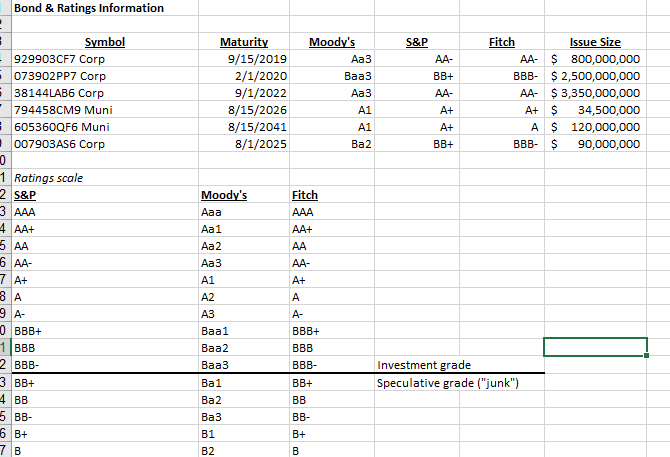

2. Corporate Bonds - Corporate bonds are haircut based on both their time to maturity and whether they are rated as investment grade (defined by S&P and Fitch as BBB- and above and by Moody's as Baa3 and above)[1] by at least two of the nationally recognized statistical rating organizations. If the bonds qualify as investment grade, use Exhibit 2 to determine the haircut of the bonds. If they do not qualify as investment grade, then they are considered non-marketable and follow the haircut rules as stated in Exhibit 3.

It is important to note that the haircut is calculated using the absolute value of the market value of the relevant bond.

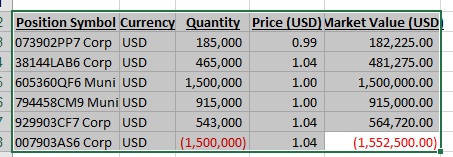

What is the total haircut in USD on the positions in the accompanying spreadsheet as of 2017-12-31?

EXHIBIT #2 (c)(2) Definitions: Net Capital (Continued) (vi) SECURITIES HAIRCUTS (F) NONCONVERTIBLE DEBT SECURITIES

(1) In the case of nonconvertible debt securities having a fixed interest rate and a fixed maturity date and which are not traded flat or in default as to principal or interest and which are rated in one of the four highest rating categories by at least two of the nationally recognized statistical rating organizations, the applicable percentages of the market of the greater of the long or short position in each of the categories specific below are: (i) Less than 1 year to maturity........2% (ii) 1 year but less than 2 years to maturity...3% (iii) 2 years but less than 3 years to maturity....5% (iv) 3 years but less than 5 years to maturity.6% (v) 5 years but less than 10 years to maturity..7% (vi) 10 years but less than 15 years to maturity..7 % (vii) 15 years but less than 20 years to maturity....8% (viii) 20 years but less than 25 years to maturity.8 % (ix) 25 years or more to maturity..9%

(2) A broker or dealer may elect to exclude from the above categories long or short positions that are hedged with short or long positions in securities issued by the United States or any agency thereof or nonconvertible debt securities having a fixed interest rate and a fixed maturity date and which are not traded flat or in default as to principal or interest and which are rated in one of the four highest rating categories by at least two of the nationally recognized statistical rating organizations if such securities have maturity dates: (i) Less than five years and within 6 months of each other, (ii) Between 5 years and 10 years and within 9 months of each other, (iii) Between 10 and 15 years and within 2 years of each other; or (iv) 15 years or more and within 10 years of each other.

EXHIBIT #3 (c)(2) Definitions: Net Capital (Continued) (vii) NON-MARKETABLE SECURITIES (Continued) /09 Marketability of Money Market Instruments (Continued) Note: For purpose of this interpretation 15c3-1(c)(2)(vii)/09 only, major money markets include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, United States and United Kingdom /10 Marketability of Nonconvertible Debt Securities Which Are Not Highly Rated The SEC Division of Market Regulation will not recommend enforcement action to the Commission if broker-dealers apply the haircuts described below to nonconvertible debt securities held in their proprietary accounts which are not rated in one of the four highest rating categories by at least two NRSROs provided the following conditions are met: 1. The securities can be publicly sold without registration with the Commission under Section 5 of the Securities Act of 1933, and 2. Current information concerning the issuer is available to the public. Current information is deemed to be available to the public if:

a. The issuer filed with the Commission public reports consisting of the most recently required periodic financial report, or

b. The issuer (provided it is the subject of a bankruptcy proceeding) filed with a bankruptcy court, public information that is sufficient to value the assets and liabilities of the issuer and such information is dated not more than six months prior to the date of the brokerdealers capital computation. The current information requirement will also be deem to be satisfied by the existence of current ratings by two NRSROs on any issuance of the issuer. A rating by an NRSRO is considered to be current if the NRSRO itself continues to hold out its rating for the issuance of the issuer. Non-investment grade nonconvertible debt securities shall be treated as follows:

1. The broker-dealer shall deduct from its net worth the following percentages applied to the greater of the gross long or the gross short market value of non-investment grade, nonconvertible debt securities positions in each of the categories specified below:

a. An initial issuance of at least $100 million..15%

b. An initial issuance of at least $75 million and less than $100 million..20%

c. An initial issuance of at least $50 million and less than $75 million....25%

d. An initial issuance of at least $20 million and less than $50 million....50%

e. An initial issuance of less than $20 million or have been held in inventory for more than 90 days as the result of the failure to complete an underwriting100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started