Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Cougar Gold Mining Corporation (CGMC) has 5 million shares of common stock outstanding and 200,000 bonds with a 6 percent coupon rate outstanding,

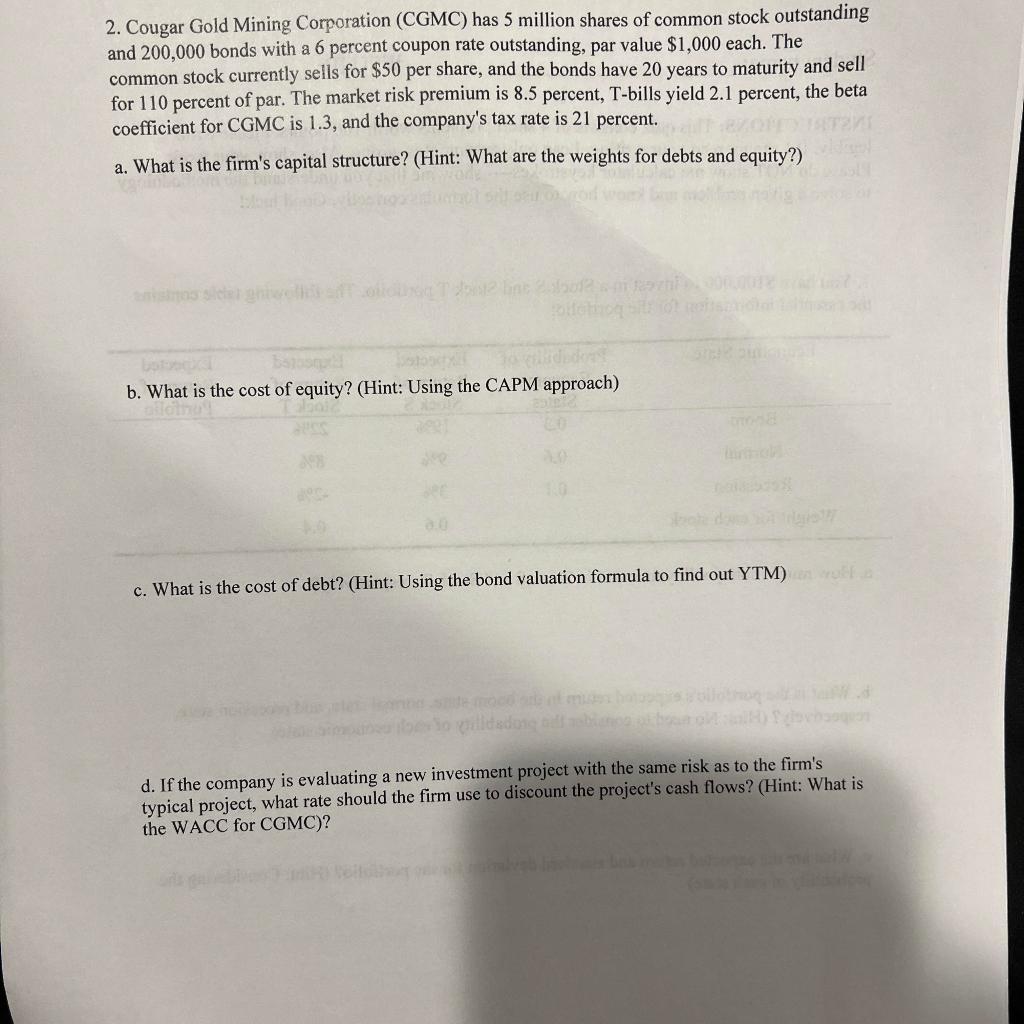

2. Cougar Gold Mining Corporation (CGMC) has 5 million shares of common stock outstanding and 200,000 bonds with a 6 percent coupon rate outstanding, par value $1,000 each. The common stock currently sells for $50 per share, and the bonds have 20 years to maturity and sell for 110 percent of par. The market risk premium is 8.5 percent, T-bills yield 2.1 percent, the beta coefficient for CGMC is 1.3, and the company's tax rate is 21 percent. VIDERE a. What is the firm's capital structure? (Hint: What are the weights for debts and equity?) hog Tost batospl b. What is the cost of equity? (Hint: Using the CAPM approach) 3.0 c. What is the cost of debt? (Hint: Using the bond valuation formula to find out YTM) d. If the company is evaluating a new investment project with the same risk as to the firm's typical project, what rate should the firm use to discount the project's cash flows? (Hint: What is the WACC for CGMC)? badore (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the firms capital structure we need to calculate the weights for debt and equity Total Equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started