Answered step by step

Verified Expert Solution

Question

1 Approved Answer

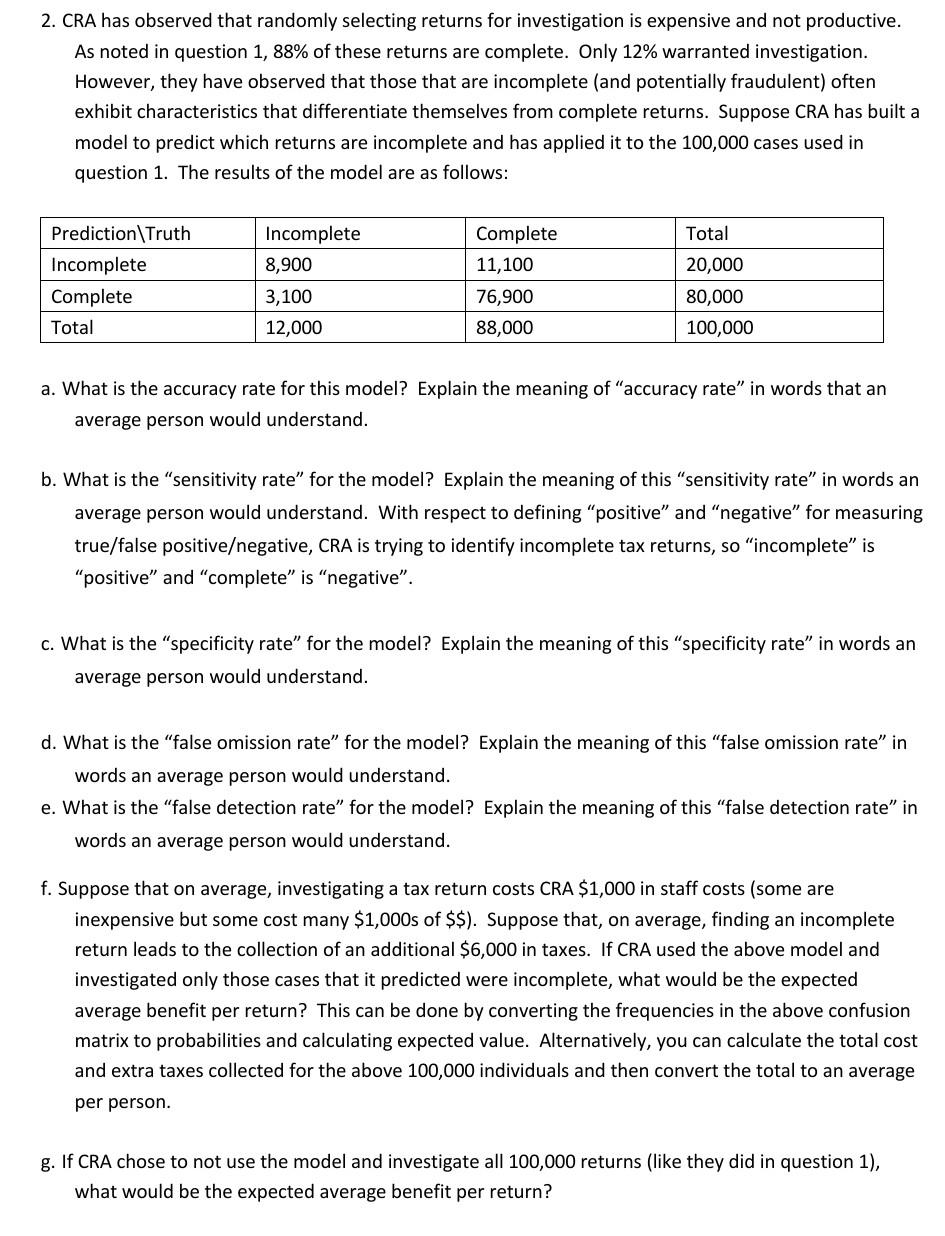

2. CRA has observed that randomly selecting returns for investigation is expensive and not productive. As noted in question 1, 88% of these returns are

2. CRA has observed that randomly selecting returns for investigation is expensive and not productive. As noted in question 1, 88% of these returns are complete. Only 12% warranted investigation. However, they have observed that those that are incomplete (and potentially fraudulent) often exhibit characteristics that differentiate themselves from complete returns. Suppose CRA has built a model to predict which returns are incomplete and has applied it to the 100,000 cases used in question 1. The results of the model are as follows: Prediction\Truth Incomplete Complete Total Incomplete 8,900 3,100 12,000 Complete 11,100 76,900 88,000 Total 20,000 80,000 100,000 a. What is the accuracy rate for this model? Explain the meaning of "accuracy rate" in words that an average person would understand. b. What is the "sensitivity rate" for the model? Explain the meaning of this "sensitivity rate" in words an average person would understand. With respect to defining positive and negative for measuring true/false positiveegative, CRA is trying to identify incomplete tax returns, so incomplete" is "positive" and "complete" is "negative". c. What is the "specificity rate for the model? Explain the meaning of this "specificity rate" in words an average person would understand. d. What is the "false omission rate" for the model? Explain the meaning of this "false omission rate" in words an average person would understand. e. What is the "false detection rate for the model? Explain the meaning of this "false detection rate" in words an average person would understand. f. Suppose that on average, investigating a tax return costs CRA $1,000 in staff costs (some are inexpensive but some cost many $1,000s of $$). Suppose that, on average, finding an incomplete return leads to the collection of an additional $6,000 in taxes. If CRA used the above model and investigated only those cases that it predicted were incomplete, what would be the expected average benefit per return? This can be done by converting the frequencies in the above confusion matrix to probabilities and calculating expected value. Alternatively, you can calculate the total cost and extra taxes collected for the above 100,000 individuals and then convert the total to an average per person. g. If CRA chose to not use the model and investigate all 100,000 returns (like they did in question 1), what would be the expected average benefit per return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started