2)

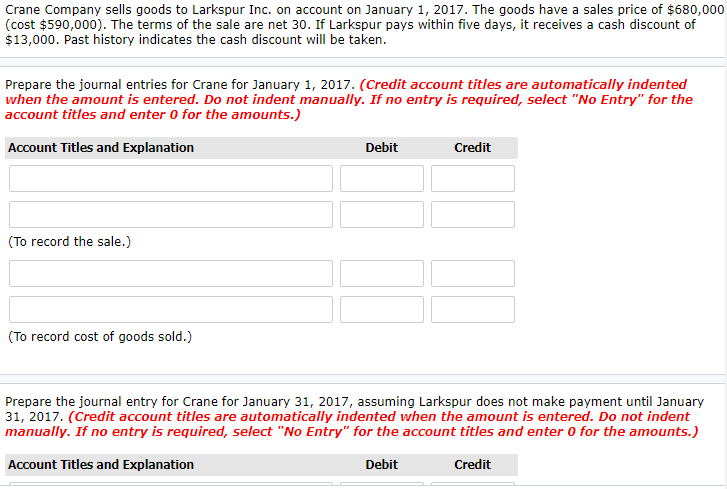

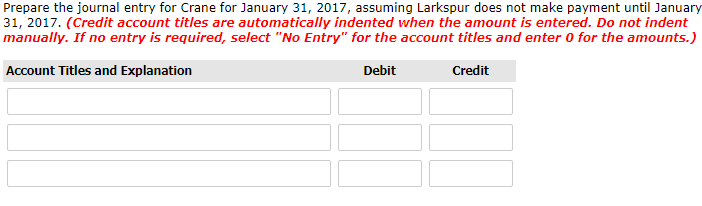

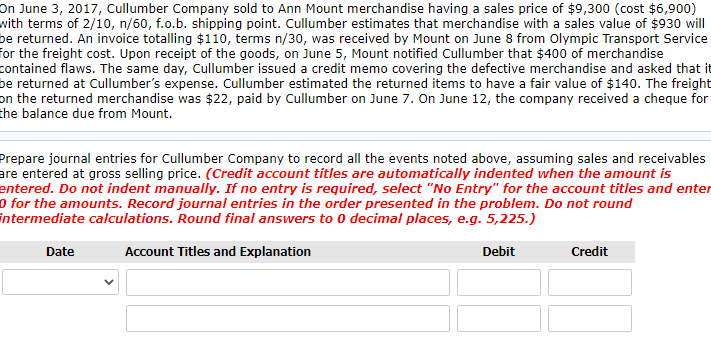

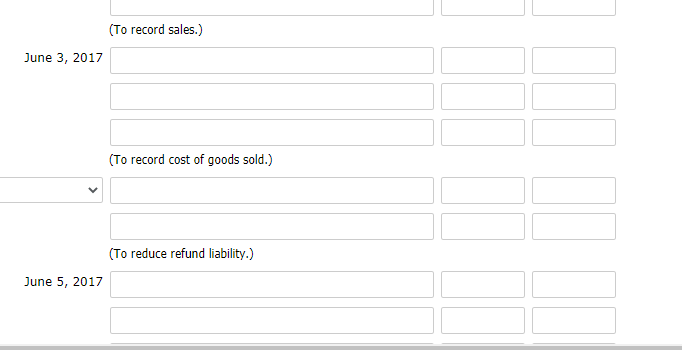

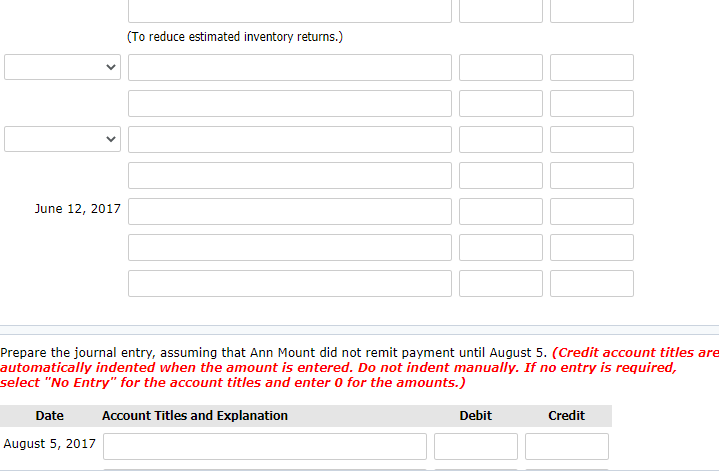

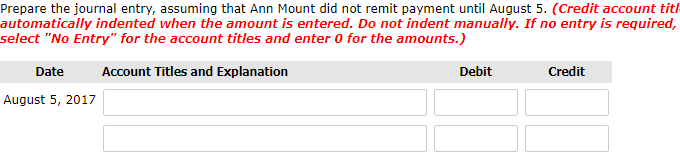

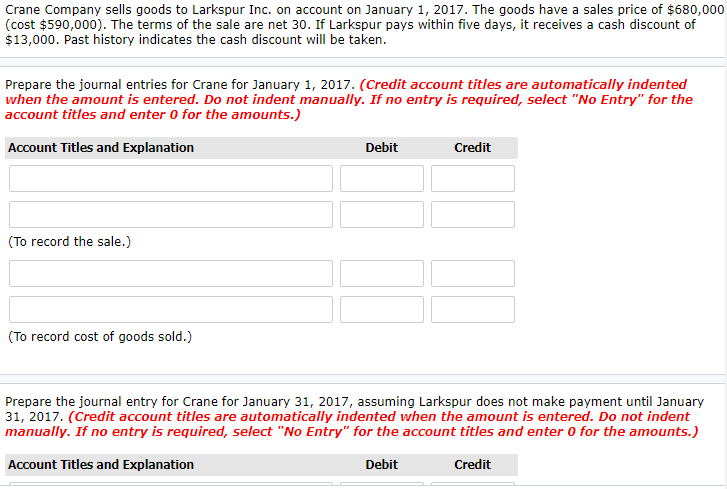

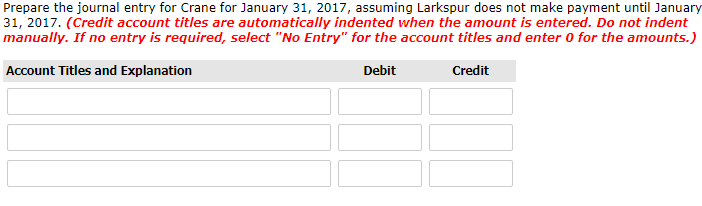

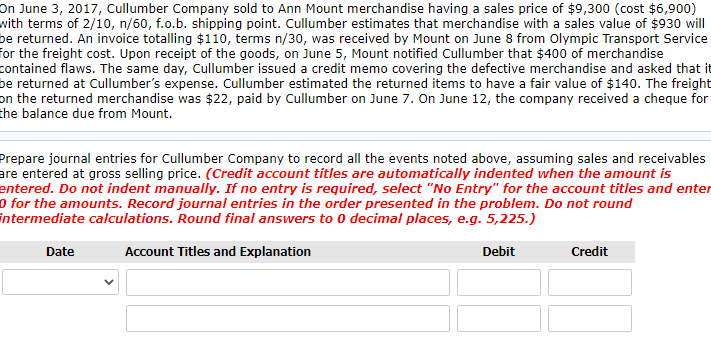

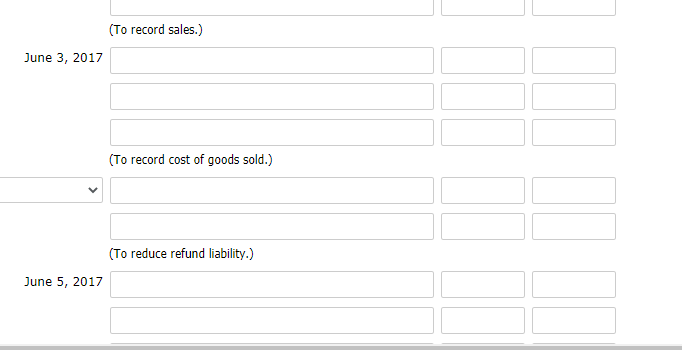

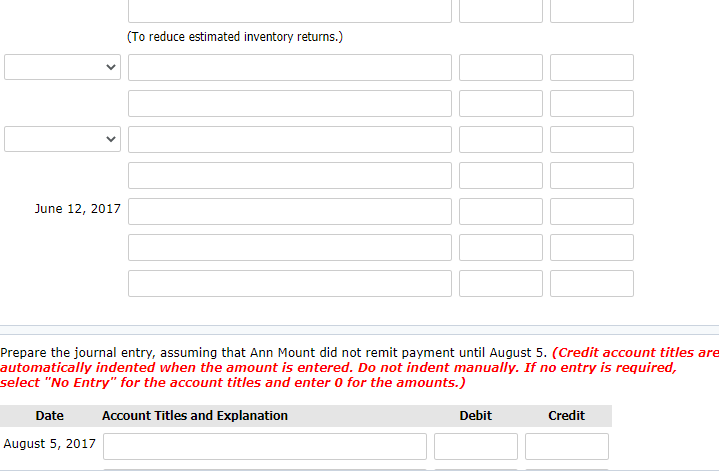

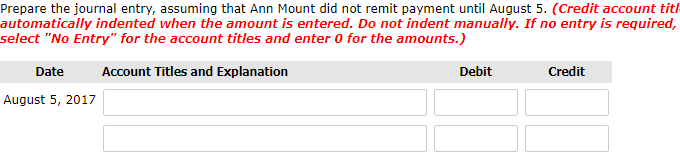

Crane Company sells goods to Larkspur Inc. on account on January 1, 2017. The goods have a sales price of $680,000 (cost $590,000). The terms of the sale are net 30. If Larkspur pays within five days, it receives a cash discount of $13,000. Past history indicates the cash discount will be taken. Prepare the journal entries for Crane for January 1, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit (To record the sale.) (To record cost of goods sold.) Prepare the journal entry for Crane for January 31, 2017, assuming Larkspur does not make payment until January 31, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Prepare the journal entry for Crane for January 31, 2017, assuming Larkspur does not make payment until January 31, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit On June 3, 2017, Cullumber Company sold to Ann Mount merchandise having a sales price of $9,300 (cost $6,900) with terms of 2/10, n/60, f.o.b. shipping point. Cullumber estimates that merchandise with a sales value of $930 will be returned. An invoice totalling $110, terms n/30, was received by Mount on June 8 from Olympic Transport Service for the freight cost. Upon receipt of the goods, on June 5, Mount notified Cullumber that $400 of merchandise contained flaws. The same day, Cullumber issued a credit memo covering the defective merchandise and asked that it be returned at Cullumber's expense. Cullumber estimated the returned items to have a fair value of $140. The freight on the returned merchandise was $22, paid by Cullumber on June 7. On June 12, the company received a cheque for the balance due from Mount. Prepare journal entries for Cullumber Company to record all the events noted above, assuming sales and receivables are entered at gross selling price. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem. Do not round intermediate calculations. Round final answers to 0 decimal places, e.g. 5,225.) Date Account Titles and Explanation Debit Credit (To record sales.) June 3, 2017 (To record cost of goods sold.) (To reduce refund liability.) June 5, 2017 (To reduce estimated inventory returns.) June 12, 2017 Prepare the journal entry, assuming that Ann Mount did not remit payment until August 5. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation August 5, 2017 Prepare the journal entry, assuming that Ann Mount did not remit payment until August 5. (Credit account tit/ automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation August 5, 2017