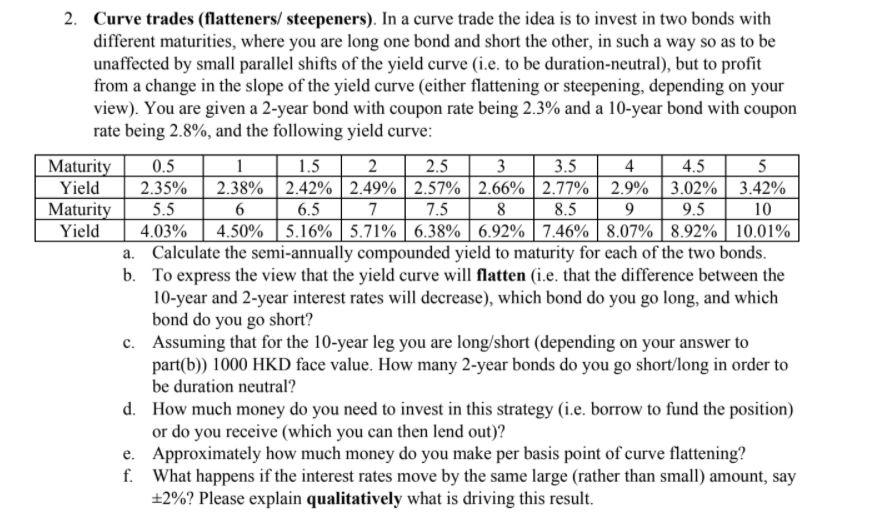

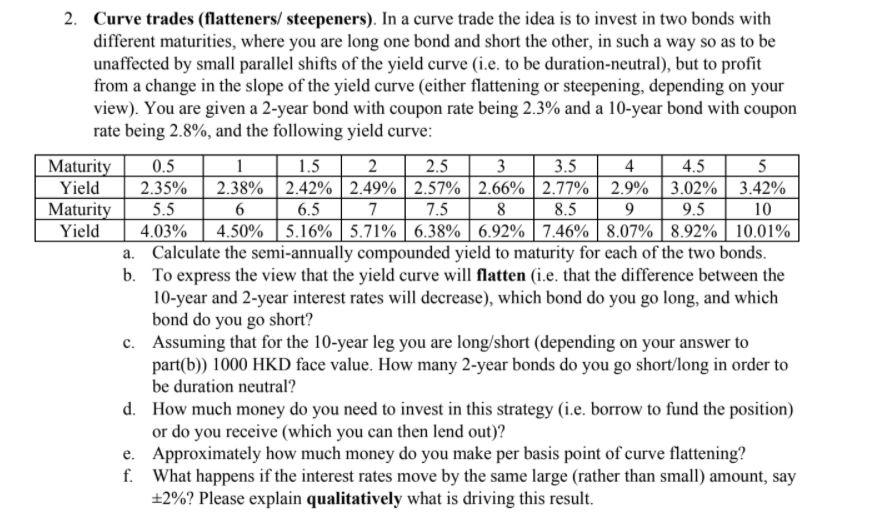

2. Curve trades (flatteners/ steepeners). In a curve trade the idea is to invest in two bonds with different maturities, where you are long one bond and short the other, in such a way so as to be unaffected by small parallel shifts of the yield curve (i.e. to be duration-neutral), but to profit from a change in the slope of the yield curve (either flattening or steepening, depending on your view). You are given a 2-year bond with coupon rate being 2.3% and a 10-year bond with coupon rate being 2.8%, and the following yield curve: Maturity 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 Yield 2.35% 2.38% 2.42% 2.49% 2.57% 2.66% 2.77% 2.9% 3.02% 3.42% Maturity 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 Yield 4.03% 4.50% 5.16% 5.71% 6.38% 6.92% 7.46% 8.07% 8.92% 10.01% a. Calculate the semi-annually compounded yield to maturity for each of the two bonds. b. To express the view that the yield curve will flatten (i.e. that the difference between the 10-year and 2-year interest rates will decrease), which bond do you go long, and which bond do you go short? c. Assuming that for the 10-year leg you are long/short (depending on your answer to part(b)) 1000 HKD face value. How many 2-year bonds do you go short/long in order to be duration neutral? d. How much money do you need to invest in this strategy (i.e. borrow to fund the position) or do you receive (which you can then lend out)? e. Approximately how much money do you make per basis point of curve flattening? f. What happens if the interest rates move by the same large (rather than small) amount, say +2%? Please explain qualitatively what is driving this result. 2. Curve trades (flatteners/ steepeners). In a curve trade the idea is to invest in two bonds with different maturities, where you are long one bond and short the other, in such a way so as to be unaffected by small parallel shifts of the yield curve (i.e. to be duration-neutral), but to profit from a change in the slope of the yield curve (either flattening or steepening, depending on your view). You are given a 2-year bond with coupon rate being 2.3% and a 10-year bond with coupon rate being 2.8%, and the following yield curve: Maturity 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 Yield 2.35% 2.38% 2.42% 2.49% 2.57% 2.66% 2.77% 2.9% 3.02% 3.42% Maturity 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 Yield 4.03% 4.50% 5.16% 5.71% 6.38% 6.92% 7.46% 8.07% 8.92% 10.01% a. Calculate the semi-annually compounded yield to maturity for each of the two bonds. b. To express the view that the yield curve will flatten (i.e. that the difference between the 10-year and 2-year interest rates will decrease), which bond do you go long, and which bond do you go short? c. Assuming that for the 10-year leg you are long/short (depending on your answer to part(b)) 1000 HKD face value. How many 2-year bonds do you go short/long in order to be duration neutral? d. How much money do you need to invest in this strategy (i.e. borrow to fund the position) or do you receive (which you can then lend out)? e. Approximately how much money do you make per basis point of curve flattening? f. What happens if the interest rates move by the same large (rather than small) amount, say +2%? Please explain qualitatively what is driving this result