Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Da, Di, and Du have been partners in a law office for 15 years. Di has decided to retire and wishes to withdraw

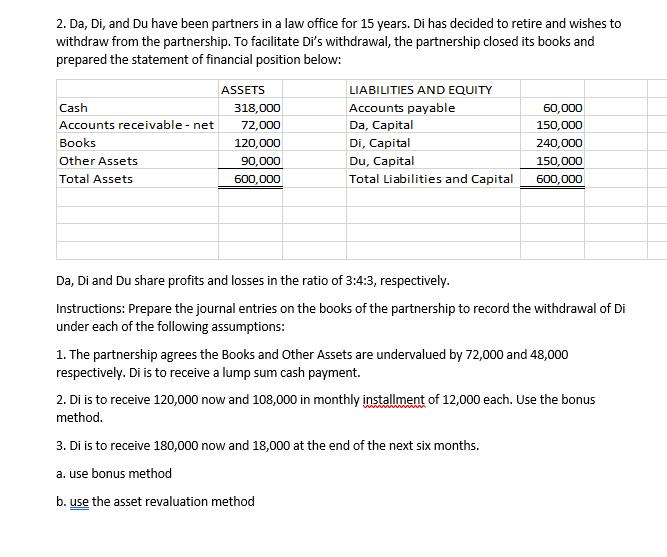

2. Da, Di, and Du have been partners in a law office for 15 years. Di has decided to retire and wishes to withdraw from the partnership. To facilitate Di's withdrawal, the partnership closed its books and prepared the statement of financial position below: Cash Accounts receivable - net Books Other Assets Total Assets ASSETS 318,000 72,000 120,000 90,000 600,000 LIABILITIES AND EQUITY Accounts payable Da, Capital Di, Capital Du, Capital Total Liabilities and Capital 60,000 150,000 240,000 150,000 600,000 Da, Di and Du share profits and losses in the ratio of 3:4:3, respectively. Instructions: Prepare the journal entries on the books of the partnership to record the withdrawal of Di under each of the following assumptions: 1. The partnership agrees the Books and Other Assets are undervalued by 72,000 and 48,000 respectively. Di is to receive a lump sum cash payment. 2. Di is to receive 120,000 now and 108,000 in monthly installment of 12,000 each. Use the bonus method. 3. Di is to receive 180,000 now and 18,000 at the end of the next six months. a. use bonus method b. use the asset revaluation method

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 JOURNAL ENTRIES WHEN DI IS AGREE TO RECEIVE A LUMP SUM ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started