Answered step by step

Verified Expert Solution

Question

1 Approved Answer

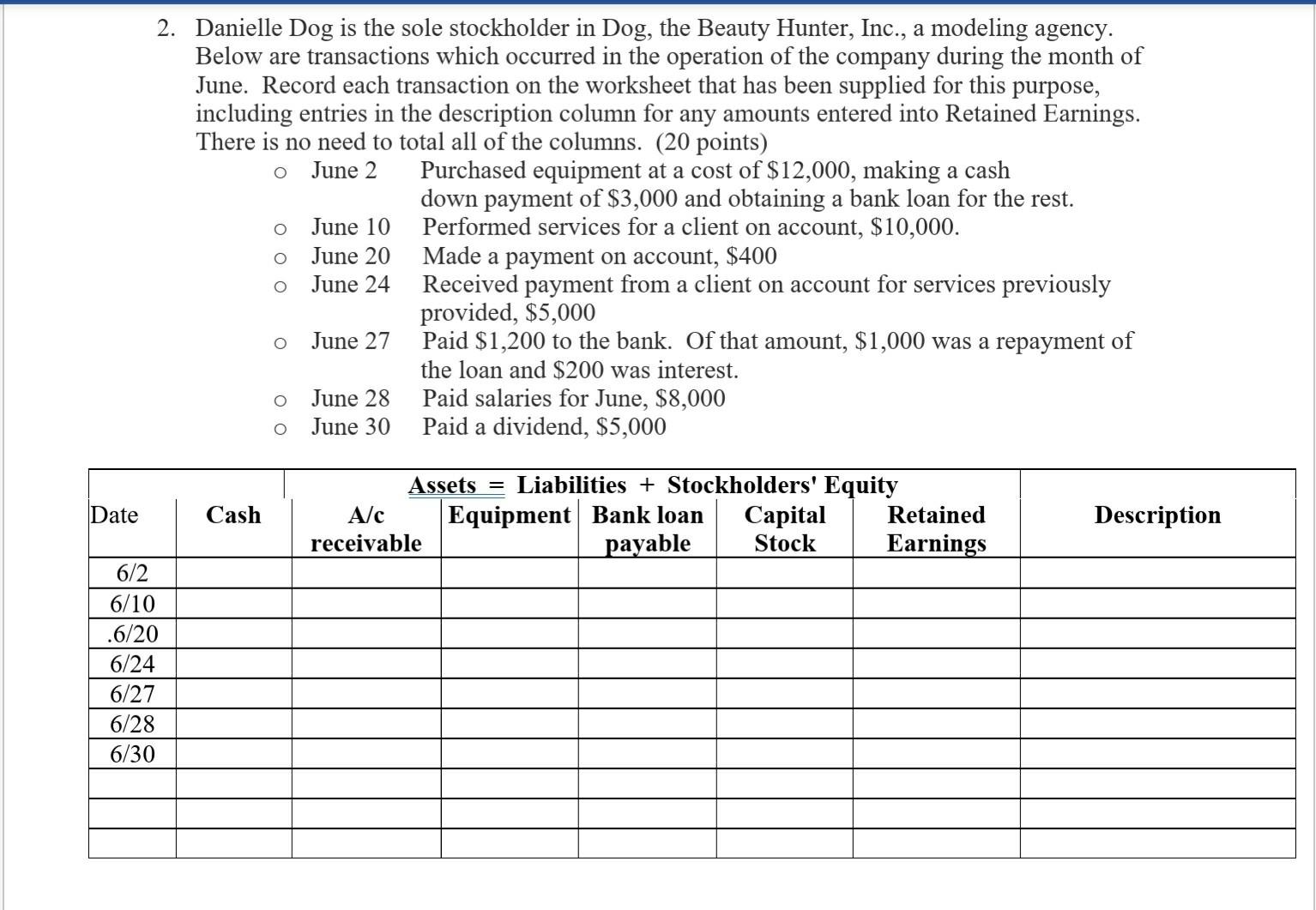

2. Danielle Dog is the sole stockholder in Dog, the Beauty Hunter, In., a modeling agency. Below are transactions which occurred in the operation

2. Danielle Dog is the sole stockholder in Dog, the Beauty Hunter, In., a modeling agency. Below are transactions which occurred in the operation of the company during the month of June. Record each transaction on the worksheet that has been supplied for this purpose, including entries in the description column for any amounts entered into Retained Earnings. There is no need to total all of the columns. (20 points) June 2 Purchased equipment at a cost of $12,000, making a cash down payment of $3,000 and obtaining a bank loan for the rest. o June 10 Performed services for a client on account, $10,000. June 20 Made a payment on account, $400 Received payment from a client on account for services previously provided, $5,000 Paid $1,200 to the bank. Of that amount, $1,000 was a repayment of the loan and $200 was interest. Paid salaries for June, $8,000 Paid a dividend, $5,000 June 24 June 27 June 28 June 30 Assets = Liabilities + Stockholders' Equity Equipment Bank loan Date Cash A/c apital Retained Description receivable payable Stock Earnings 6/2 6/10 .6/20 6/24 6/27 6/28 6/30 O O a) There are 2 reasons why certain assets depreciate. List those reasons here (1) (2) b) Dog's equipment has a useful life of 4 years. Calculate the depreciation for the month of June in the space below, showing all work. c) Dog's supplies on hand at the end of June amounted to $300. It started the month (June 1) with $800 of supplies. Make the adjustment for supplies expense for the month of June. (see the format in C above)

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Q2 Assets Liabilities Stockholders Equity DATE CASH AC RECEIVABLE EQUIPMENT BA...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started