Answered step by step

Verified Expert Solution

Question

1 Approved Answer

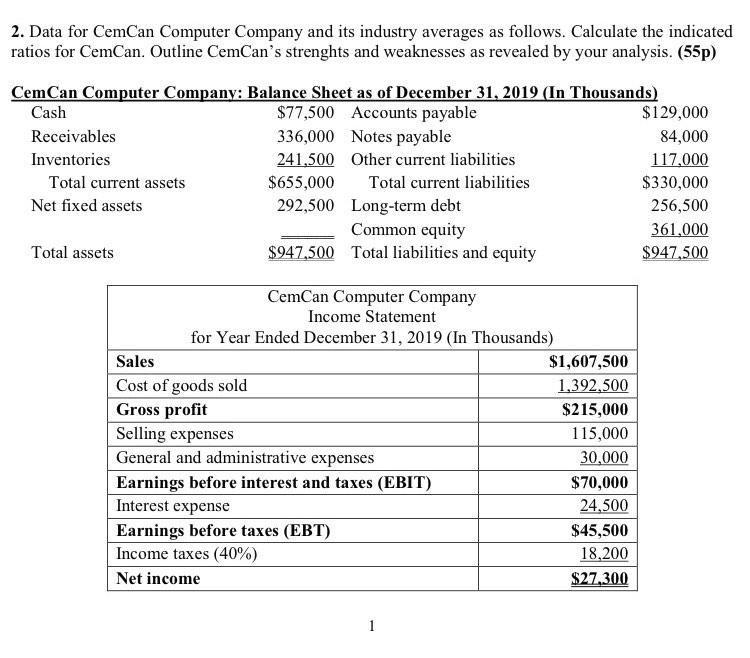

2. Data for CemCan Computer Company and its industry averages as follows. Calculate the indicated ratios for CemCan. Outline CemCan's strenghts and weaknesses as revealed

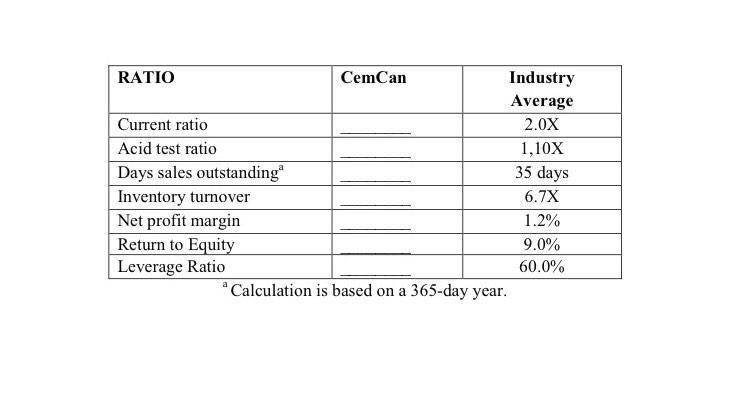

2. Data for CemCan Computer Company and its industry averages as follows. Calculate the indicated ratios for CemCan. Outline CemCan's strenghts and weaknesses as revealed by your analysis. (55p) CemCan Computer Company: Balance Sheet as of December 31, 2019 (In Thousands) Cash $77,500 Accounts payable $129,000 Receivables 336,000 Notes payable 84,000 Inventories 241,500 Other current liabilities 117,000 Total current assets $655,000 Total current liabilities $330,000 Net fixed assets 292,500 Long-term debt 256,500 Common equity 361,000 Total assets $947,500 Total liabilities and equity $947,500 CemCan Computer Company Income Statement for Year Ended December 31, 2019 (In Thousands) Sales $1,607,500 Cost of goods sold 1,392,500 Gross profit $215,000 Selling expenses 115,000 General and administrative expenses 30,000 Earnings before interest and taxes (EBIT) $70,000 Interest expense 24,500 Earnings before taxes (EBT) $45,500 Income taxes (40%) 18.200 Net income $27,300 1 35 days RATIO CemCan Industry Average Current ratio 2.0X Acid test ratio 1,10X Days sales outstanding Inventory turnover 6.7X Net profit margin 1.2% Return to Equity 9.0% Leverage Ratio 60.0% Calculation is based on a 365-day year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started