Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Depreciation is calculated as follows: Industrial building: 15% per annum using the diminishing balance method. Machinery: 15% per annum using the straight-line method.

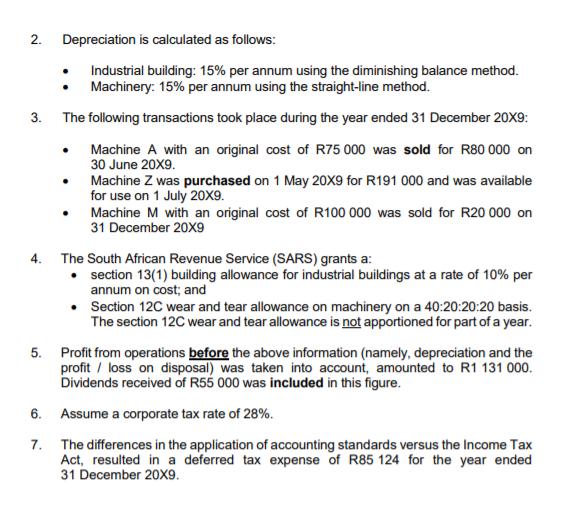

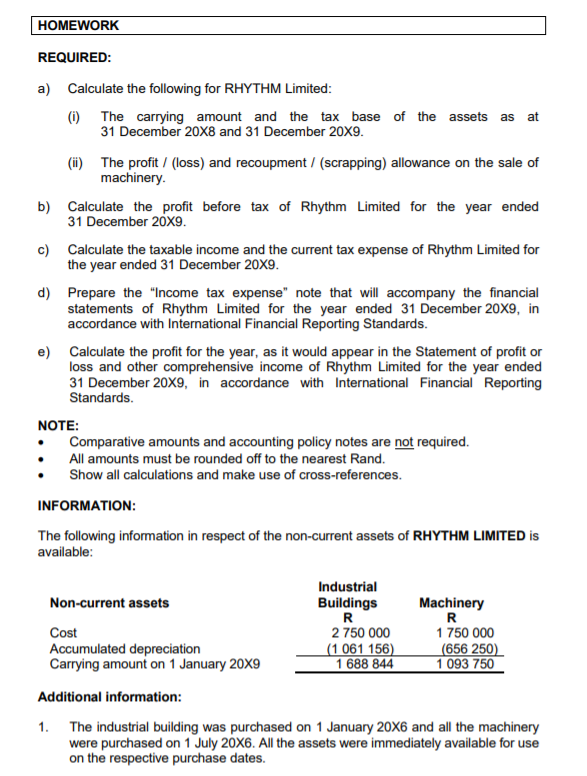

2. Depreciation is calculated as follows: Industrial building: 15% per annum using the diminishing balance method. Machinery: 15% per annum using the straight-line method. 3. The following transactions took place during the year ended 31 December 20X9: Machine A with an original cost of R75 000 was sold for R80 000 on 30 June 20X9. Machine Z was purchased on 1 May 20X9 for R191 000 and was available for use on 1 July 20X9. Machine M with an original cost of R100 000 was sold for R20 000 on 31 December 20X9 4. The South African Revenue Service (SARS) grants a: .section 13(1) building allowance for industrial buildings at a rate of 10% per annum on cost; and Section 12C wear and tear allowance on machinery on a 40:20:20:20 basis. The section 12C wear and tear allowance is not apportioned for part of a year. 5. Profit from operations before the above information (namely, depreciation and the profit loss on disposal) was taken into account, amounted to R1 131 000. Dividends received of R55 000 was included in this figure. 6. Assume a corporate tax rate of 28%. 7. The differences in the application of accounting standards versus the Income Tax Act, resulted in a deferred tax expense of R85 124 for the year ended 31 December 20X9. HOMEWORK REQUIRED: a) Calculate the following for RHYTHM Limited: (i) The carrying amount and the tax base of the assets as at 31 December 20X8 and 31 December 20X9. (ii) The profit /(loss) and recoupment / (scrapping) allowance on the sale of machinery. b) Calculate the profit before tax of Rhythm Limited for the year ended 31 December 20X9. c) Calculate the taxable income and the current tax expense of Rhythm Limited for the year ended 31 December 20X9. d) Prepare the "Income tax expense" note that will accompany the financial statements of Rhythm Limited for the year ended 31 December 20X9, in accordance with International Financial Reporting Standards. e) Calculate the profit for the year, as it would appear in the Statement of profit or loss and other comprehensive income of Rhythm Limited for the year ended 31 December 20X9, in accordance with International Financial Reporting Standards. NOTE: Comparative amounts and accounting policy notes are not required. All amounts must be rounded off to the nearest Rand. Show all calculations and make use of cross-references. INFORMATION: The following information in respect of the non-current assets of RHYTHM LIMITED is available: Industrial Non-current assets Buildings R Machinery R Cost Accumulated depreciation 2 750 000 (1 061 156) 1 750 000 (656 250) Carrying amount on 1 January 20X9 1 688 844 1 093 750 Additional information: 1. The industrial building was purchased on 1 January 20X6 and all the machinery were purchased on 1 July 20X6. All the assets were immediately available for use on the respective purchase dates.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started