Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Does Exhibit 2 add enough information to the analysis? If not, what kind of additional information is needed? This is Matt Garcia's first week

2. Does Exhibit 2 add enough information to the analysis? If not, what kind of additional information is needed?

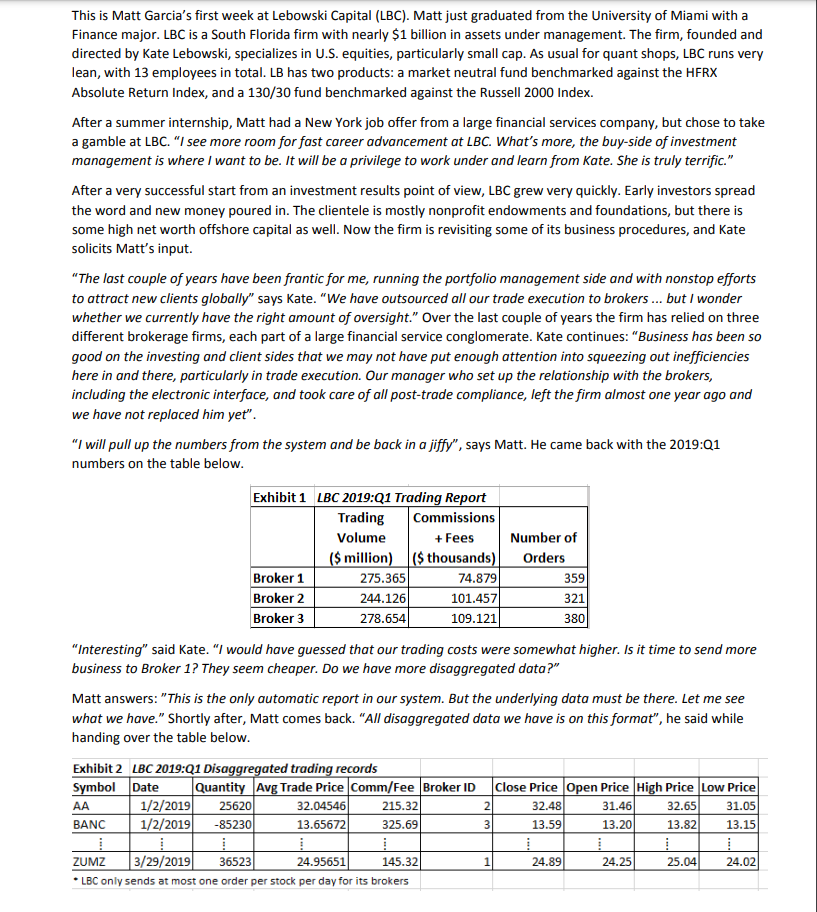

This is Matt Garcia's first week at Lebowski Capital (LBC). Matt just graduated from the University of Miami with a Finance major. LBC is a South Florida firm with nearly $1 billion in assets under management. The firm, founded and directed by Kate Lebowski, specializes in U.S. equities, particularly small cap. As usual for quant shops, LBC runs very lean, with 13 employees in total. LB has two products: a market neutral fund benchmarked against the HFRX Absolute Return Index, and a 130/30 fund benchmarked against the Russell 2000 Index. After a summer internship, Matt had a New York job offer from a large financial services company, but chose to take a gamble at LBC. "I see more room for fast career advancement at LBC. What's more, the buy-side of investment management is where I want to be. It will be a privilege to work under and learn from Kate. She is truly terrific." After a very successful start from an investment results point of view, LBC grew very quickly. Early investors spread the word and new money poured in. The clientele is mostly nonprofit endowments and foundations, but there is some high net worth offshore capital as well. Now the firm is revisiting some of its business procedures, and Kate solicits Matt's input. "The last couple of years have been frantic for me, running the portfolio management side and with nonstop efforts to attract new clients globally" says Kate. "We have outsourced all our trade execution to brokers.... but I wonder whether we currently have the right amount of oversight." Over the last couple of years the firm has relied on three different brokerage firms, each part of a large financial service conglomerate. Kate continues: "Business has been so good on the investing and client sides that we may not have put enough attention into squeezing out inefficiencies here in and there, particularly in trade execution. Our manager who set up the relationship with the brokers, including the electronic interface, and took care of all post-trade compliance, left the firm almost one year ago and we have not replaced him yet". "I will pull up the numbers from the system and be back in a jiffy", says Matt. He came back with the 2019:Q1 numbers on the table below. Exhibit 1 LBC 2019:Q1 Trading Report Trading Commissions Volume Number of ($ million) (s thousands) Orders Broker 1 275.365 74.879 359 Broker 2 244.126 101.4571 321 Broker 3 109.121 380 "Interesting" said Kate. "I would have guessed that our trading costs were somewhat higher. Is it time to send more business to Broker 1? They seem cheaper. Do we have more disaggregated data?" Matt answers: "This is the only automatic report in our system. But the underlying data must be there. Let me see what we have." Shortly after, Matt comes back. "All disaggregated data we have is on this format", he said while handing over the table below. + Fees 278.654 Exhibit 2 LBC 2019:Q1 Disaggregated trading records Symbol Date Quantity Avg Trade Price Comm/Fee Broker ID AA 1/2/2019 25620 32.04546 215.32 BANC 1/2/2019 -85230 13.65672 325.69 2 Close Price Open Price High Price Low Price 32.48 31.46 32.65 31.05 13.59 13.20 13.82 13.15 3 1 24.89 24.25 25.04 24.02 ZUMZ 3/29/2019 36523 24.95651 145.321 LBC only sends at most one order per stock per day for its brokers This is Matt Garcia's first week at Lebowski Capital (LBC). Matt just graduated from the University of Miami with a Finance major. LBC is a South Florida firm with nearly $1 billion in assets under management. The firm, founded and directed by Kate Lebowski, specializes in U.S. equities, particularly small cap. As usual for quant shops, LBC runs very lean, with 13 employees in total. LB has two products: a market neutral fund benchmarked against the HFRX Absolute Return Index, and a 130/30 fund benchmarked against the Russell 2000 Index. After a summer internship, Matt had a New York job offer from a large financial services company, but chose to take a gamble at LBC. "I see more room for fast career advancement at LBC. What's more, the buy-side of investment management is where I want to be. It will be a privilege to work under and learn from Kate. She is truly terrific." After a very successful start from an investment results point of view, LBC grew very quickly. Early investors spread the word and new money poured in. The clientele is mostly nonprofit endowments and foundations, but there is some high net worth offshore capital as well. Now the firm is revisiting some of its business procedures, and Kate solicits Matt's input. "The last couple of years have been frantic for me, running the portfolio management side and with nonstop efforts to attract new clients globally" says Kate. "We have outsourced all our trade execution to brokers.... but I wonder whether we currently have the right amount of oversight." Over the last couple of years the firm has relied on three different brokerage firms, each part of a large financial service conglomerate. Kate continues: "Business has been so good on the investing and client sides that we may not have put enough attention into squeezing out inefficiencies here in and there, particularly in trade execution. Our manager who set up the relationship with the brokers, including the electronic interface, and took care of all post-trade compliance, left the firm almost one year ago and we have not replaced him yet". "I will pull up the numbers from the system and be back in a jiffy", says Matt. He came back with the 2019:Q1 numbers on the table below. Exhibit 1 LBC 2019:Q1 Trading Report Trading Commissions Volume Number of ($ million) (s thousands) Orders Broker 1 275.365 74.879 359 Broker 2 244.126 101.4571 321 Broker 3 109.121 380 "Interesting" said Kate. "I would have guessed that our trading costs were somewhat higher. Is it time to send more business to Broker 1? They seem cheaper. Do we have more disaggregated data?" Matt answers: "This is the only automatic report in our system. But the underlying data must be there. Let me see what we have." Shortly after, Matt comes back. "All disaggregated data we have is on this format", he said while handing over the table below. + Fees 278.654 Exhibit 2 LBC 2019:Q1 Disaggregated trading records Symbol Date Quantity Avg Trade Price Comm/Fee Broker ID AA 1/2/2019 25620 32.04546 215.32 BANC 1/2/2019 -85230 13.65672 325.69 2 Close Price Open Price High Price Low Price 32.48 31.46 32.65 31.05 13.59 13.20 13.82 13.15 3 1 24.89 24.25 25.04 24.02 ZUMZ 3/29/2019 36523 24.95651 145.321 LBC only sends at most one order per stock per day for its brokersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started