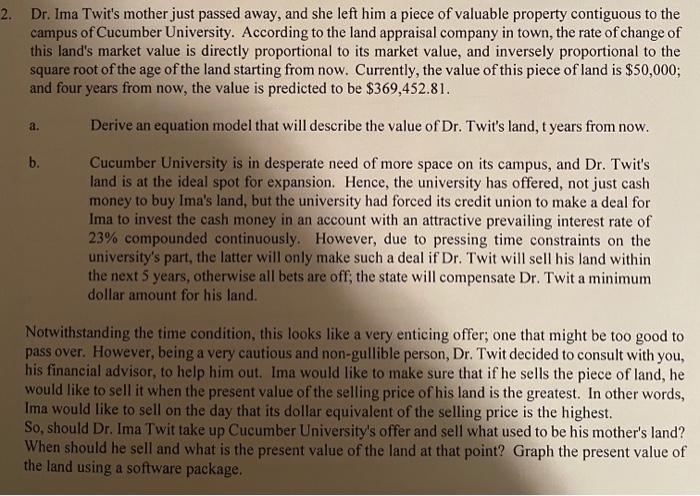

2. Dr. Ima Twit's mother just passed away, and she left him a piece of valuable property contiguous to the campus of Cucumber University. According to the land appraisal company in town, the rate of change of this land's market value is directly proportional to its market value, and inversely proportional to the square root of the age of the land starting from now. Currently, the value of this piece of land is $50,000; and four years from now, the value is predicted to be $369,452.81. a. Derive an equation model that will describe the value of Dr. Twit's land, t years from now. b. Cucumber University is in desperate need of more space on its campus, and Dr. Twit's land is at the ideal spot for expansion. Hence, the university has offered, not just cash money to buy Ima's land, but the university had forced its credit union to make a deal for Ima to invest the cash money in an account with an attractive prevailing interest rate of 23% compounded continuously. However, due to pressing time constraints on the university's part, the latter will only make such a deal if Dr. Twit will sell his land within the next 5 years, otherwise all bets are off the state will compensate Dr. Twit a minimum dollar amount for his land. Notwithstanding the time condition, this looks like a very enticing offer; one that might be too good to pass over. However, being a very cautious and non-gullible person, Dr. Twit decided to consult with you, his financial advisor, to help him out. Ima would like to make sure that if he sells the piece of land, he would like to sell it when the present value of the selling price of his land is the greatest. In other words, Ima would like to sell on the day that its dollar equivalent of the selling price is the highest. So, should Dr. Ima Twit take up Cucumber University's offer and sell what used to be his mother's land? When should he sell and what is the present value of the land at that point? Graph the present value of the land using a software package. 2. Dr. Ima Twit's mother just passed away, and she left him a piece of valuable property contiguous to the campus of Cucumber University. According to the land appraisal company in town, the rate of change of this land's market value is directly proportional to its market value, and inversely proportional to the square root of the age of the land starting from now. Currently, the value of this piece of land is $50,000; and four years from now, the value is predicted to be $369,452.81. a. Derive an equation model that will describe the value of Dr. Twit's land, t years from now. b. Cucumber University is in desperate need of more space on its campus, and Dr. Twit's land is at the ideal spot for expansion. Hence, the university has offered, not just cash money to buy Ima's land, but the university had forced its credit union to make a deal for Ima to invest the cash money in an account with an attractive prevailing interest rate of 23% compounded continuously. However, due to pressing time constraints on the university's part, the latter will only make such a deal if Dr. Twit will sell his land within the next 5 years, otherwise all bets are off the state will compensate Dr. Twit a minimum dollar amount for his land. Notwithstanding the time condition, this looks like a very enticing offer; one that might be too good to pass over. However, being a very cautious and non-gullible person, Dr. Twit decided to consult with you, his financial advisor, to help him out. Ima would like to make sure that if he sells the piece of land, he would like to sell it when the present value of the selling price of his land is the greatest. In other words, Ima would like to sell on the day that its dollar equivalent of the selling price is the highest. So, should Dr. Ima Twit take up Cucumber University's offer and sell what used to be his mother's land? When should he sell and what is the present value of the land at that point? Graph the present value of the land using a software package