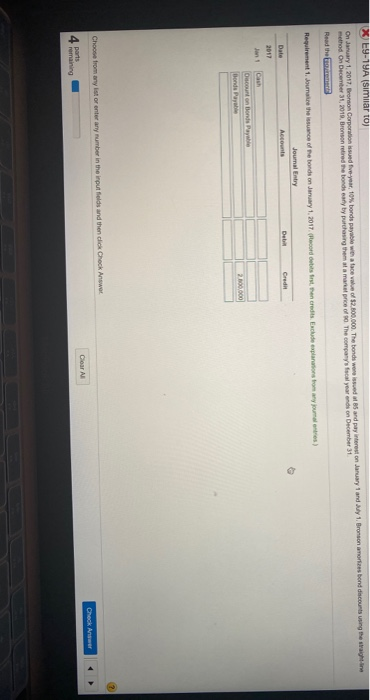

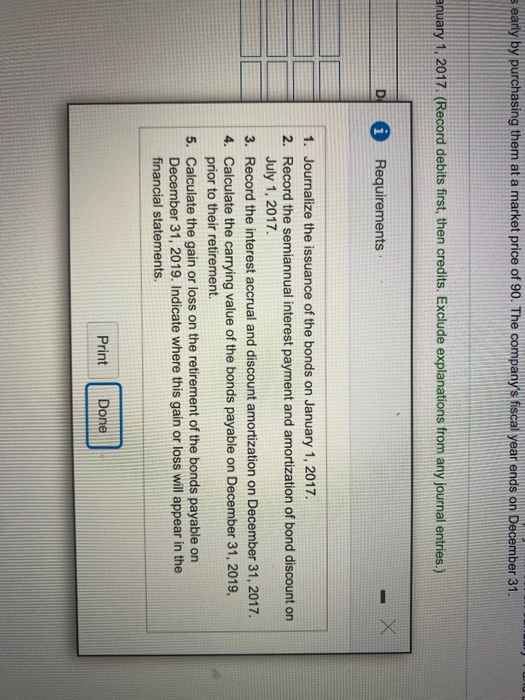

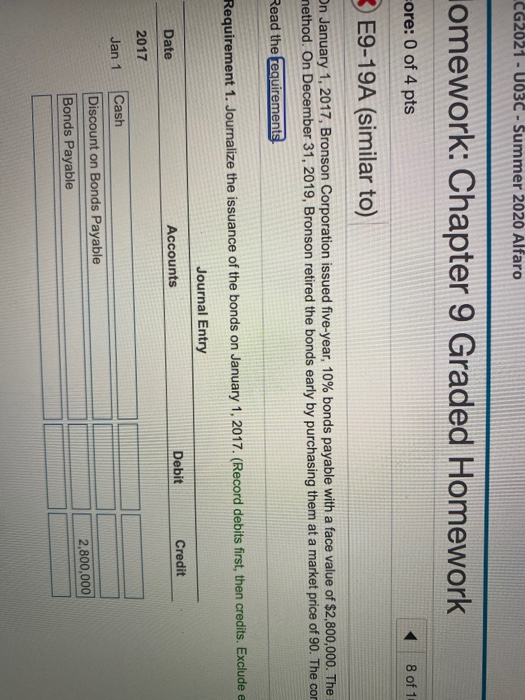

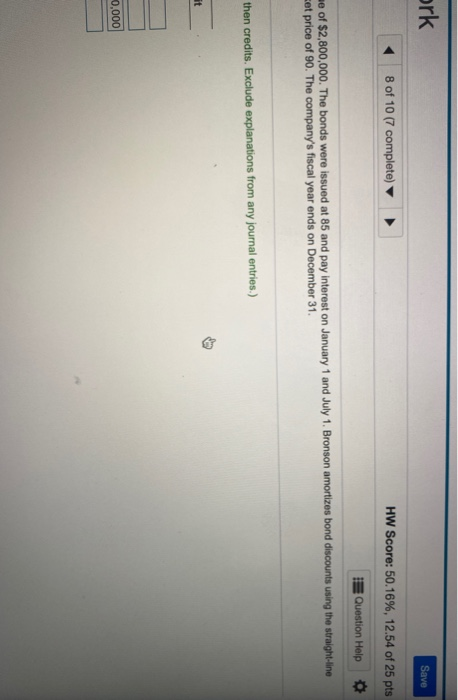

(2) E9-19A (similar to) On January 1, 2017 Bronson Corporation sued five-year, 10% bonds payable watace 2.800,000. The bonds were issued at B5 and pay interest on January 1 andy1 Bronson amores bond discounts using the right method On December 31, 2010, Bronson retired the bonds cany by purchasing them atamarat prices The company's focal year ends on December 31 Read the Requirement 1. Journaise the issuance of the bonds on January 1, 2017(ecord debits to the credits Exclude explanations to any juma) Journal Entry Date Accounts De Credh 2017 Ca Oct on Bonds Payali Bonds Payable 200.00 Choose from any it or enter any number in the input fields and then click Check Answer Check Answer Clear parts remaining Searly by purchasing them at a market price of 90. The company's fiscal year ends on December 31. anuary 1, 2017. (Record debits first, then credits. Exclude explanations from any journal entries.) D i Requirements 1. Journalize the issuance of the bonds on January 1, 2017. 2. Record the semiannual interest payment and amortization of bond discount on July 1, 2017 3. Record the interest accrual and discount amortization on December 31, 2017 4. Calculate the carrying value of the bonds payable on December 31, 2019, prior to their retirement 5. Calculate the gain or loss on the retirement of the bonds payable on December 31, 2019. Indicate where this gain or loss will appear in the financial statements. Print Done CG2021 - U03C - Summer 2020 Alfaro lomework: Chapter 9 Graded Homework core: 0 of 4 pts 8 of 1 E9-19A (similar to) On January 1, 2017, Bronson Corporation issued five-year, 10% bonds payable with a face value of $2,800,000. The nethod. On December 31, 2019, Bronson retired the bonds early by purchasing them at a market price of 90. The con Read the requirements Requirement 1. Journalize the issuance of the bonds on January 1, 2017. (Record debits first, then credits. Exclude e Journal Entry Credit Debit Accounts Date 2017 Jan 1 Cash Discount on Bonds Payable Bonds Payable 2,800,000 ork Save 8 of 10 (7 complete) HW Score: 50.16%, 12.54 of 25 pts Question Help me of $2,800,000. The bonds were issued at 85 and pay interest on January 1 and July 1. Bronson amortizes bond discounts using the straight-line Eet price of 90. The company's fiscal year ends on December 31. then credits. Exclude explanations from any journal entries.) it 0.000