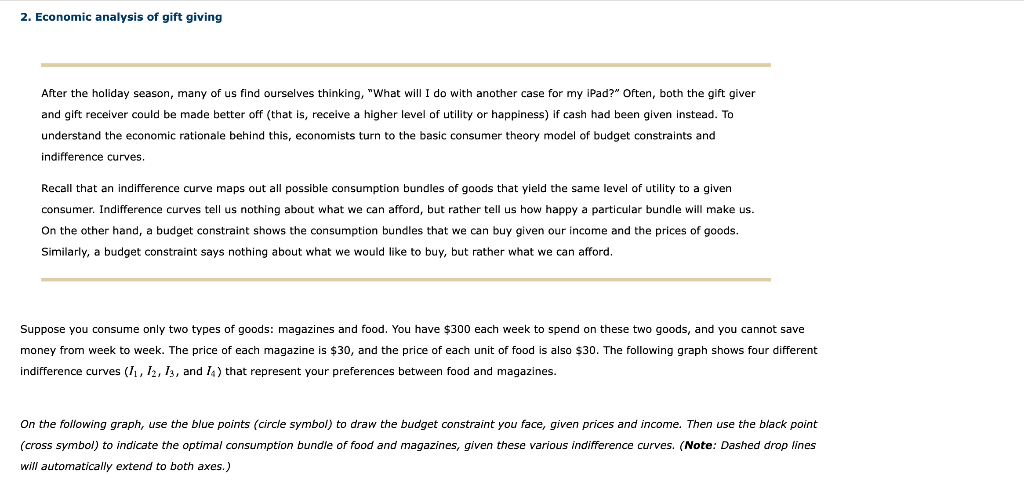

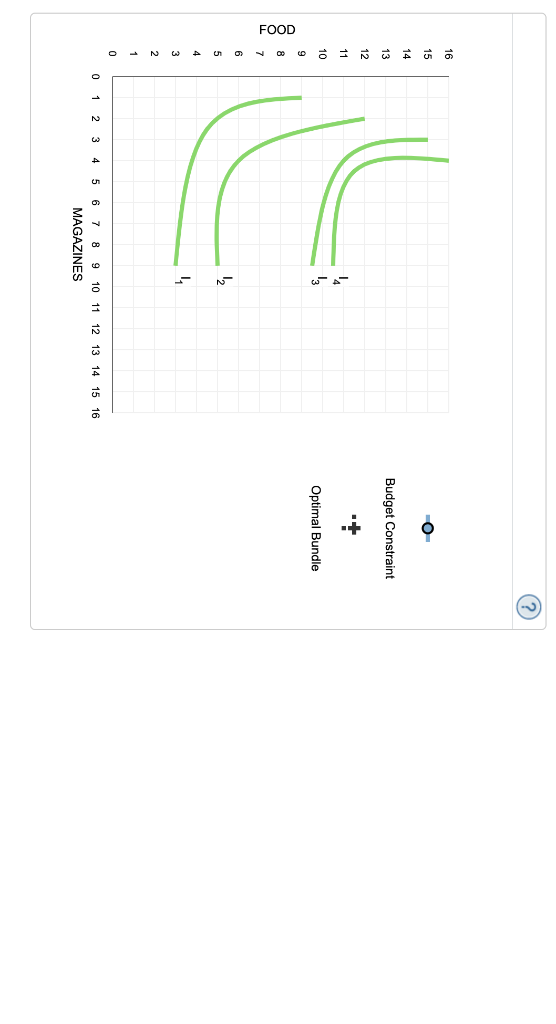

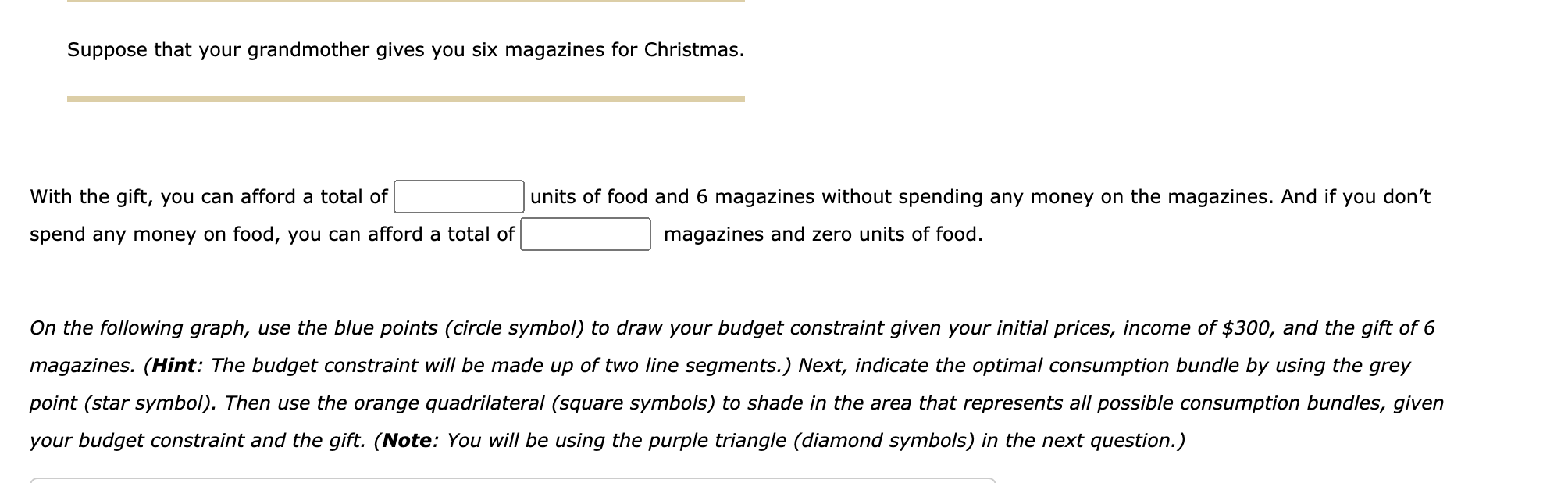

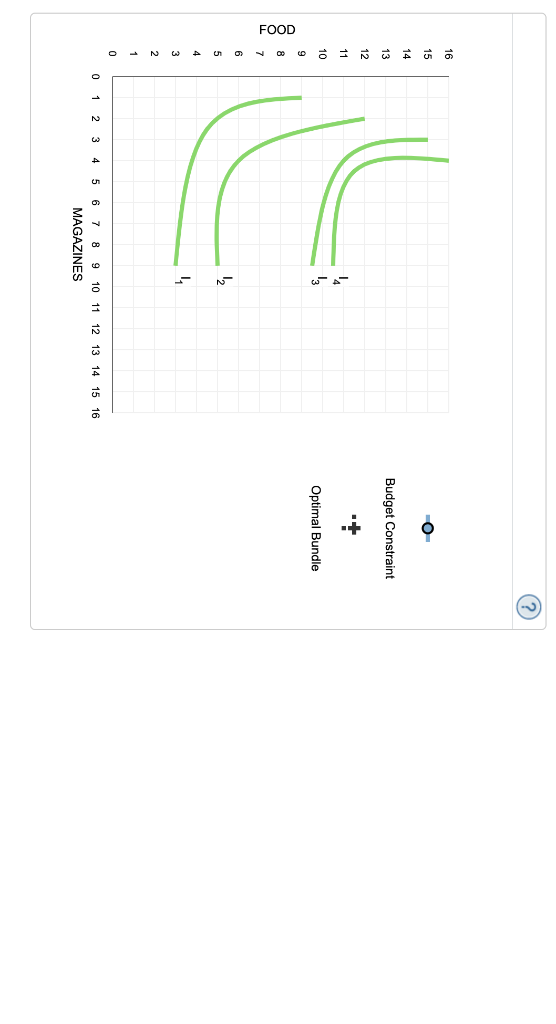

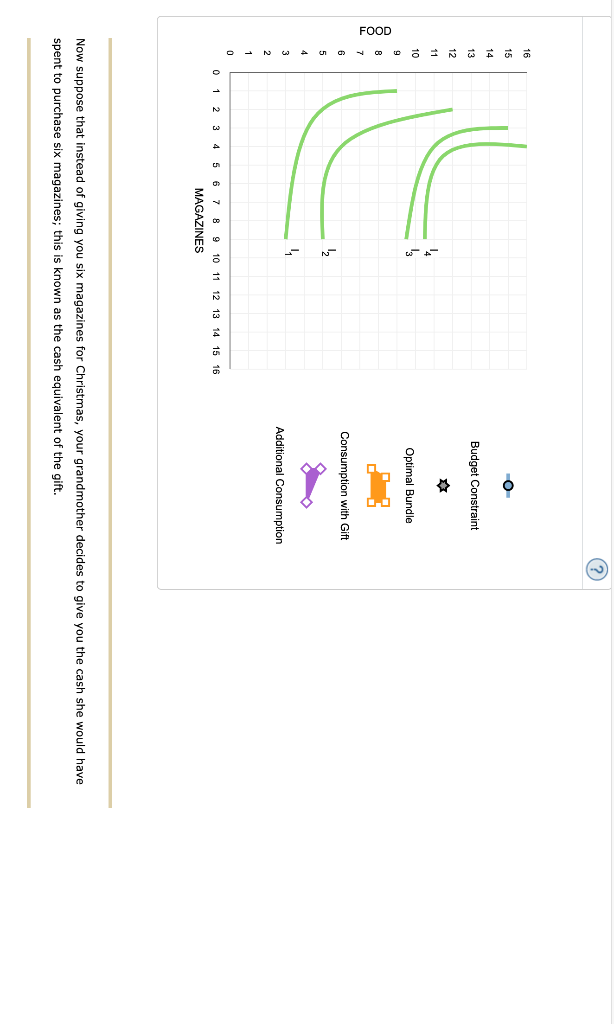

2. Economic analysis of gift giving After the holiday season, many of us find ourselves thinking, "What will I do with another case for my iPad?" Often, both the gift giver and gift receiver could be made better off (that is, receive a higher level of utility or happiness) if cash had been given instead. To understand the economic rationale behind this, economists turn to the basic consumer theory model of budget constraints and indifference curves. Recall that an indifference curve maps out all possible consumption bundles of goods that yield the same level of utility to a given consumer. Indifference curves tell us nothing about what we can afford, but rather tell us how happy a particular bundle will make us. On the other hand, a budget constraint shows the consumption bundles that we can buy given our income and the prices of goods. Similarly, a budget constraint says nothing about what we would like to buy, but rather what we can afford. Suppose you consume only two types of goods: magazines and food. You have $300 each week to spend on these two goods, and you cannot save money from week to week. The price of each magazine is $30, and the price of each unit of food is also $30. The following graph shows four different indifference curves (I1,I2,I3, and I4) that represent your preferences between food and magazines. On the following graph, use the blue points (circle symbol) to draw the budget constraint you face, given prices and income. Then use the black point (cross symbol) to indicate the optimal consumption bundle of food and magazines, given these various indifference curves. (Note: Dashed drop lines Suppose that your grandmother gives you six magazines for Christmas. With the gift, you can afford a total of units of food and 6 magazines without spending any money on the magazines. And if you don't spend any money on food, you can afford a total of magazines and zero units of food. On the following graph, use the blue points (circle symbol) to draw your budget constraint given your initial prices, income of $300, and the gift of 6 magazines. (Hint: The budget constraint will be made up of two line segments.) Next, indicate the optimal consumption bundle by using the grey point (star symbol). Then use the orange quadrilateral (square symbols) to shade in the area that represents all possible consumption bundles, given your budget constraint and the gift. (Note: You will be using the purple triangle (diamond symbols) in the next question.) Now suppose that instead of giving you six magazines for Christmas, your grandmother decides to give you the cash she would have spent to purchase six magazines; this is known as the cash equivalent of the gift. The cash gift increases your income by , so now you have an income of to spend. On the previous graph, use the purple triangle (diamond symbols) to shade in the additional consumption bundles available if your grandmother gives you the cash equivalent of six magazines instead of the magazines themselves. With the cash equivalent of six magazines, which of the following consumption bundles are affordable and, at the same time, make you better off than the optimal consumption choice if your grandmother gives you six magazines? Check all that apply. 3 magazines and 13 units of food 4 magazines and 13 units of food 2 magazines and 12 units of food 4 magazines and 12 units of food 2. Economic analysis of gift giving After the holiday season, many of us find ourselves thinking, "What will I do with another case for my iPad?" Often, both the gift giver and gift receiver could be made better off (that is, receive a higher level of utility or happiness) if cash had been given instead. To understand the economic rationale behind this, economists turn to the basic consumer theory model of budget constraints and indifference curves. Recall that an indifference curve maps out all possible consumption bundles of goods that yield the same level of utility to a given consumer. Indifference curves tell us nothing about what we can afford, but rather tell us how happy a particular bundle will make us. On the other hand, a budget constraint shows the consumption bundles that we can buy given our income and the prices of goods. Similarly, a budget constraint says nothing about what we would like to buy, but rather what we can afford. Suppose you consume only two types of goods: magazines and food. You have $300 each week to spend on these two goods, and you cannot save money from week to week. The price of each magazine is $30, and the price of each unit of food is also $30. The following graph shows four different indifference curves (I1,I2,I3, and I4) that represent your preferences between food and magazines. On the following graph, use the blue points (circle symbol) to draw the budget constraint you face, given prices and income. Then use the black point (cross symbol) to indicate the optimal consumption bundle of food and magazines, given these various indifference curves. (Note: Dashed drop lines Suppose that your grandmother gives you six magazines for Christmas. With the gift, you can afford a total of units of food and 6 magazines without spending any money on the magazines. And if you don't spend any money on food, you can afford a total of magazines and zero units of food. On the following graph, use the blue points (circle symbol) to draw your budget constraint given your initial prices, income of $300, and the gift of 6 magazines. (Hint: The budget constraint will be made up of two line segments.) Next, indicate the optimal consumption bundle by using the grey point (star symbol). Then use the orange quadrilateral (square symbols) to shade in the area that represents all possible consumption bundles, given your budget constraint and the gift. (Note: You will be using the purple triangle (diamond symbols) in the next question.) Now suppose that instead of giving you six magazines for Christmas, your grandmother decides to give you the cash she would have spent to purchase six magazines; this is known as the cash equivalent of the gift. The cash gift increases your income by , so now you have an income of to spend. On the previous graph, use the purple triangle (diamond symbols) to shade in the additional consumption bundles available if your grandmother gives you the cash equivalent of six magazines instead of the magazines themselves. With the cash equivalent of six magazines, which of the following consumption bundles are affordable and, at the same time, make you better off than the optimal consumption choice if your grandmother gives you six magazines? Check all that apply. 3 magazines and 13 units of food 4 magazines and 13 units of food 2 magazines and 12 units of food 4 magazines and 12 units of food