Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Estimate the unrealized gain/loss on this trade as of November 19 (two weeks after the initial transaction date). Assume the following: repo rate

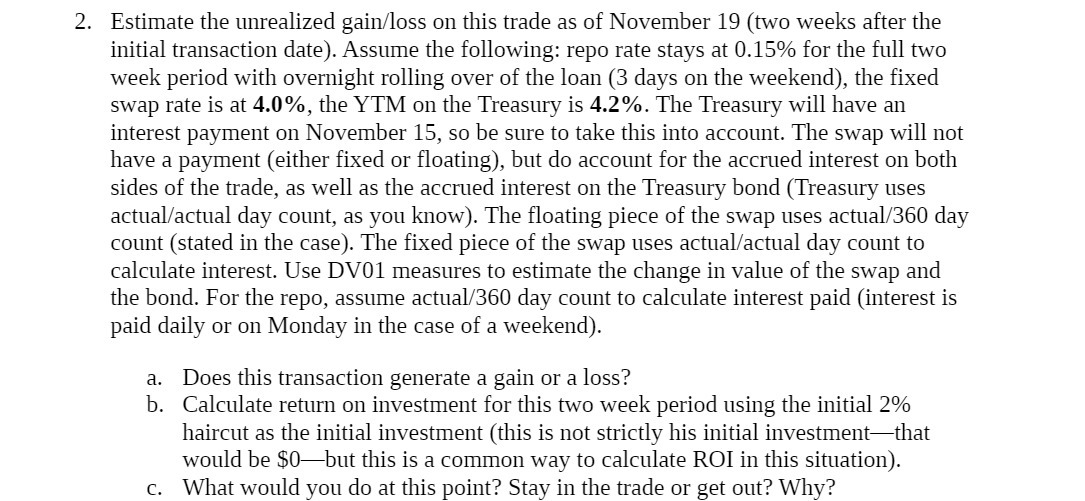

2. Estimate the unrealized gain/loss on this trade as of November 19 (two weeks after the initial transaction date). Assume the following: repo rate stays at 0.15% for the full two week period with overnight rolling over of the loan (3 days on the weekend), the fixed swap rate is at 4.0%, the YTM on the Treasury is 4.2%. The Treasury will have an interest payment on November 15, so be sure to take this into account. The swap will not have a payment (either fixed or floating), but do account for the accrued interest on both sides of the trade, as well as the accrued interest on the Treasury bond (Treasury uses actual/actual day count, as you know). The floating piece of the swap uses actual/360 day count (stated in the case). The fixed piece of the swap uses actual/actual day count to calculate interest. Use DV01 measures to estimate the change in value of the swap and the bond. For the repo, assume actual/360 day count to calculate interest paid (interest is paid daily or on Monday in the case of a weekend). a. Does this transaction generate a gain or a loss? b. Calculate return on investment for this two week period using the initial 2% haircut as the initial investment (this is not strictly his initial investment-that would be $0-but this is a common way to calculate ROI in this situation). c. What would you do at this point? Stay in the trade or get out? Why?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Analysis of the Trade as of November 19 Transaction Summary Repo Borrowing cash by pledging a Treasury bond Treasury Bond Unknown principal 42 YTM int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started