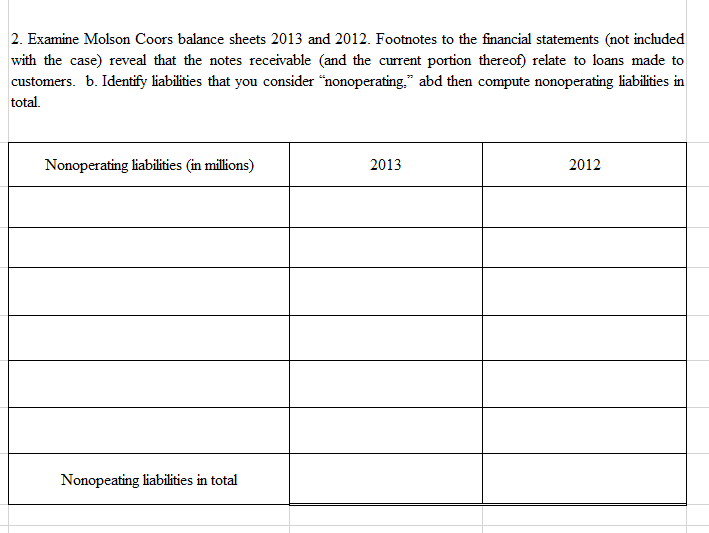

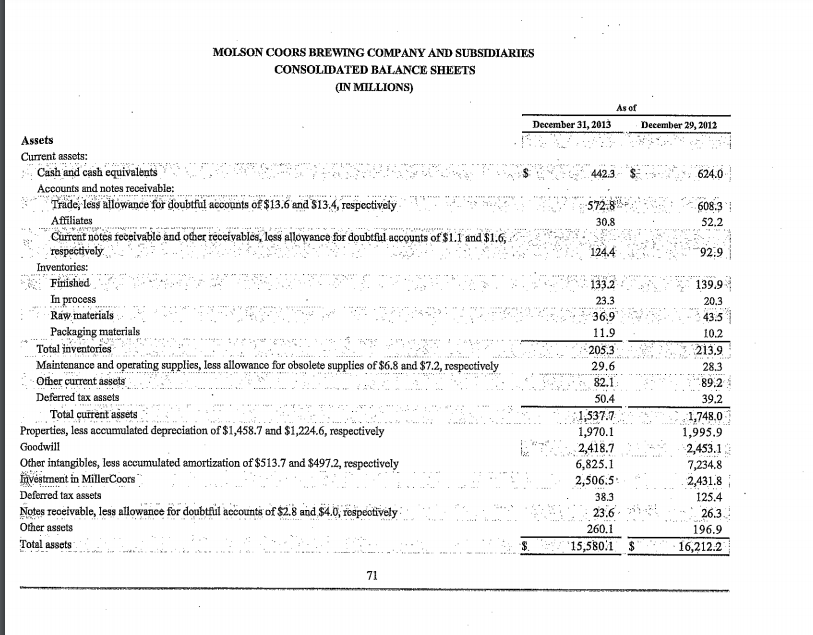

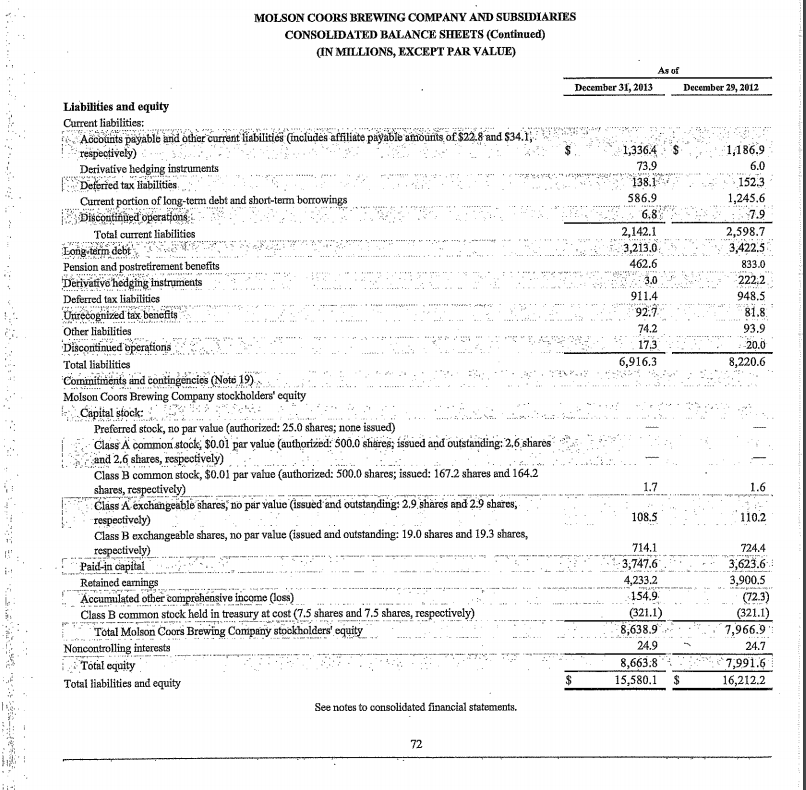

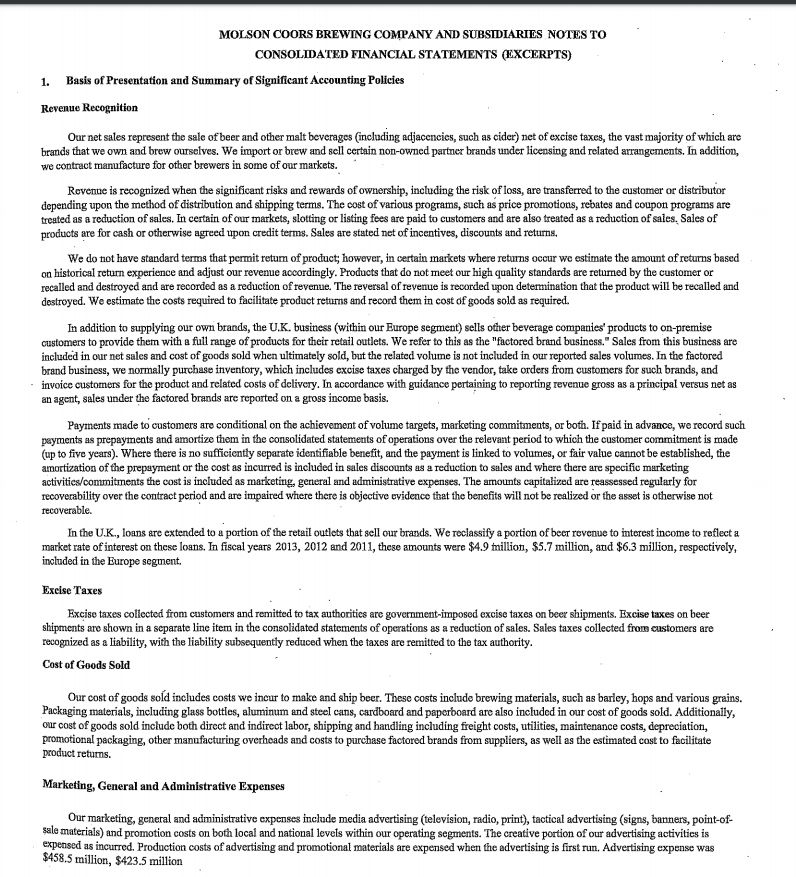

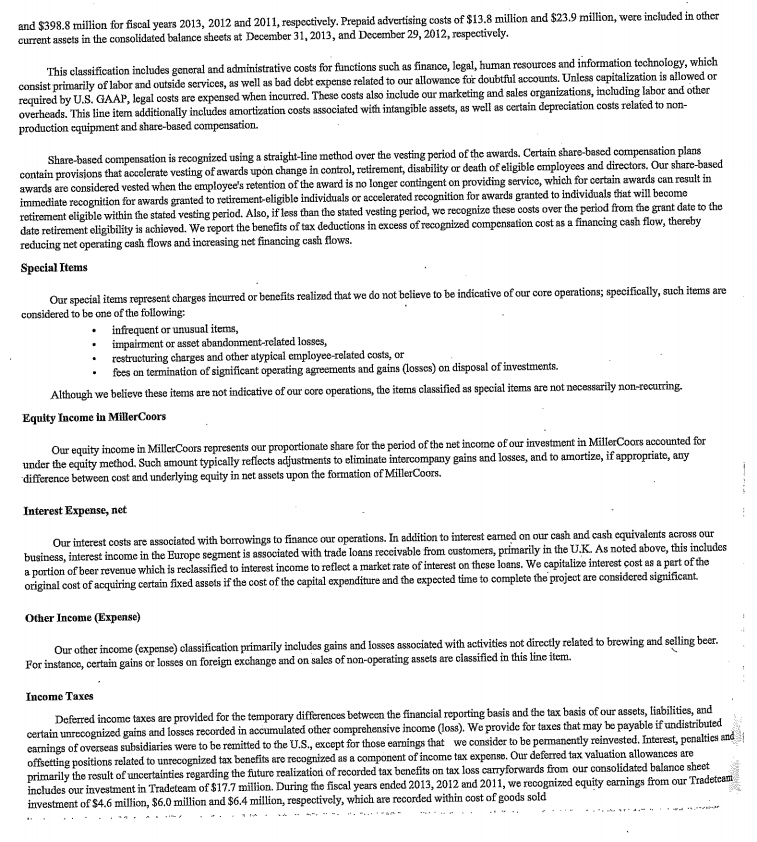

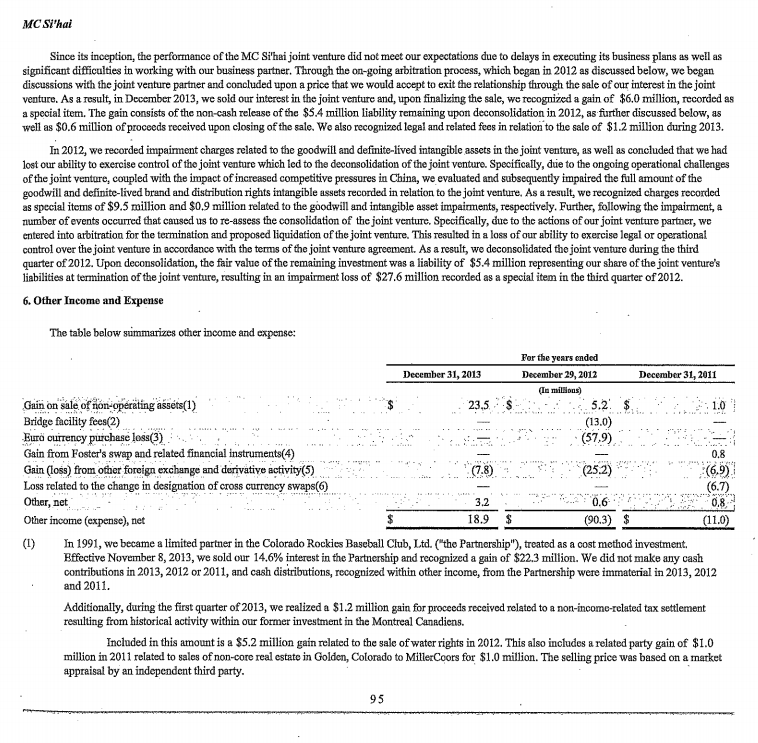

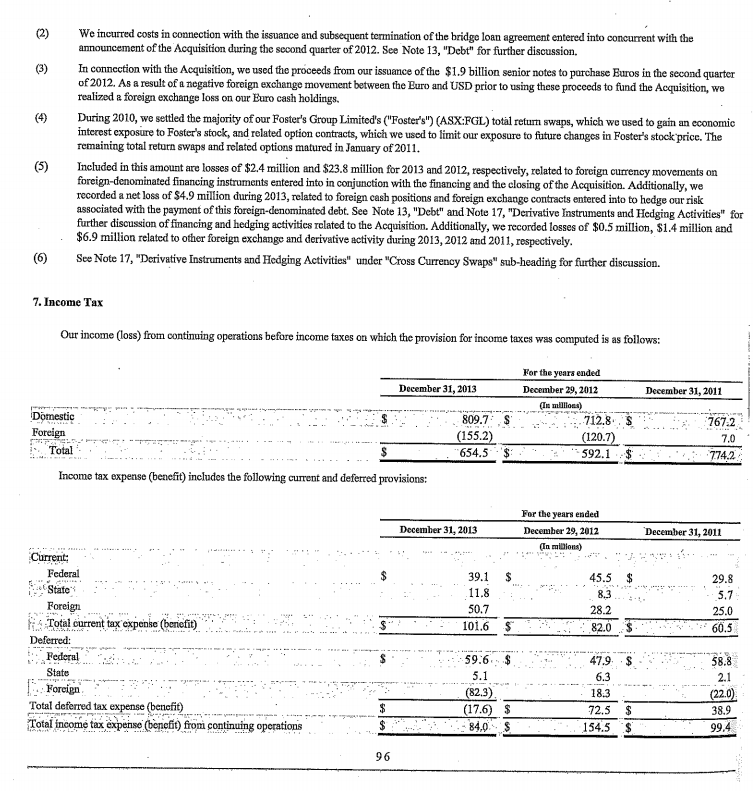

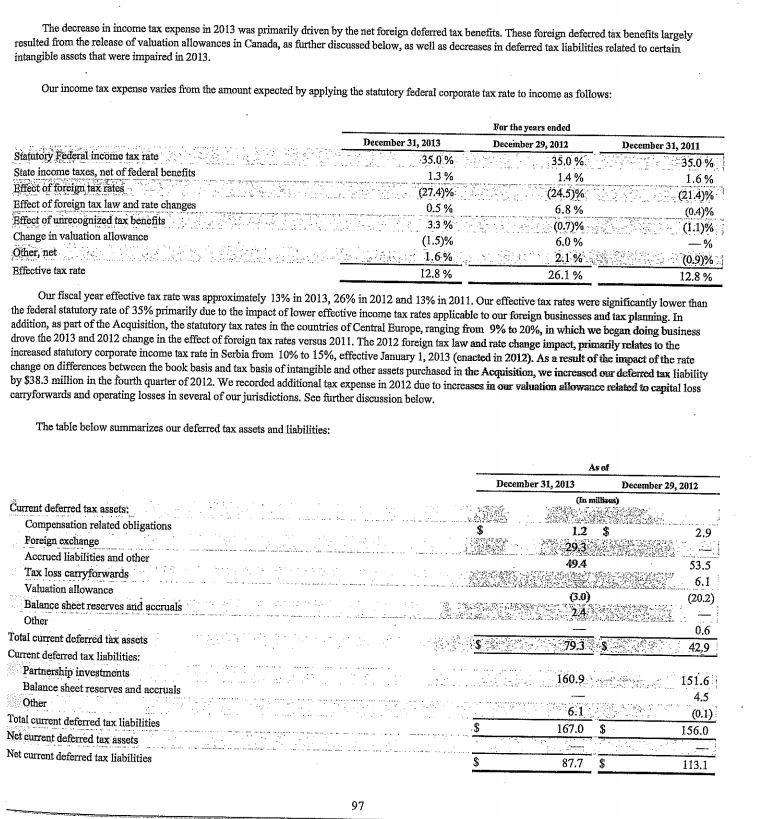

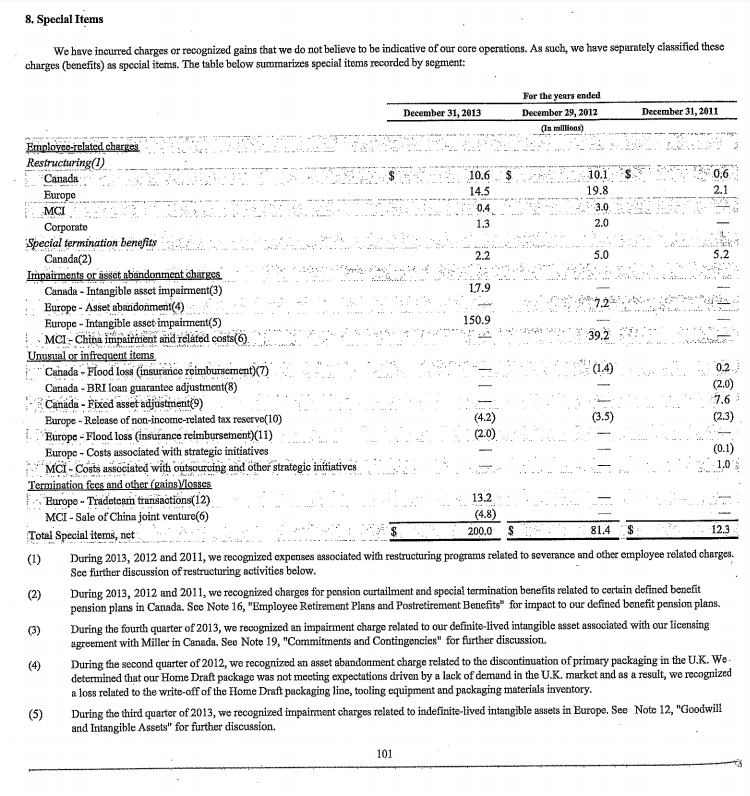

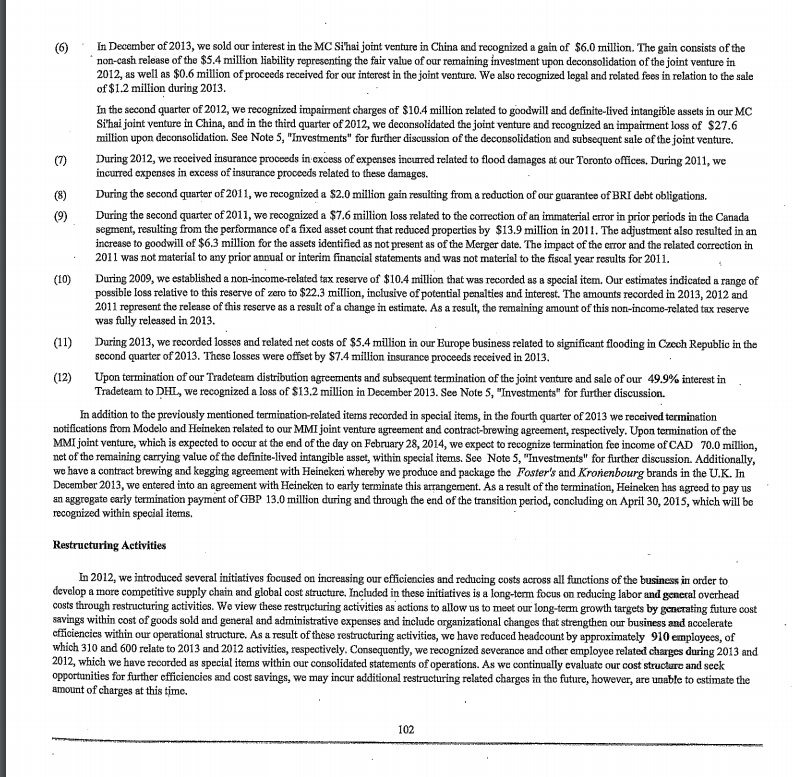

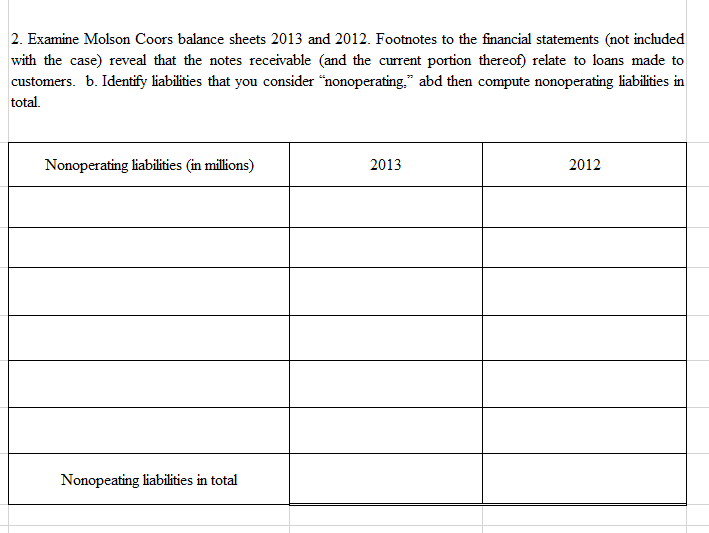

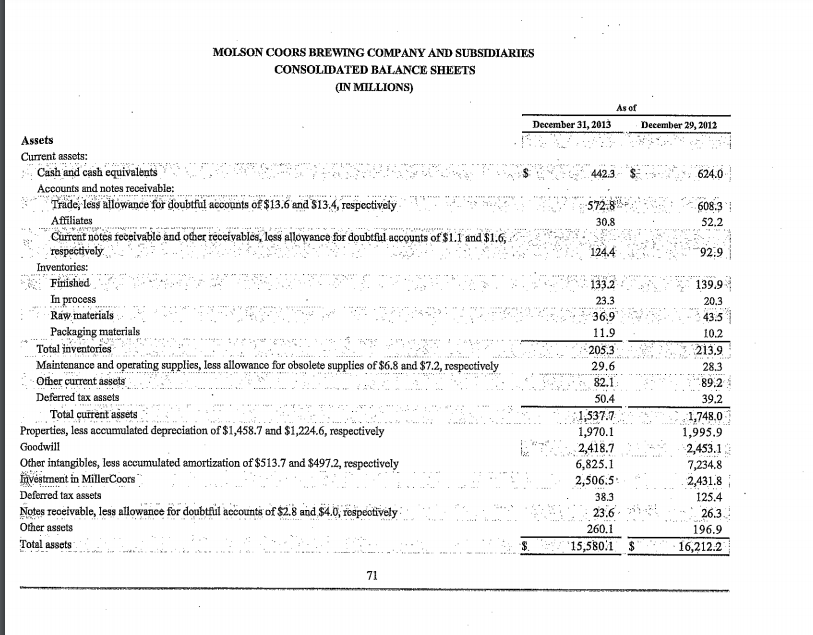

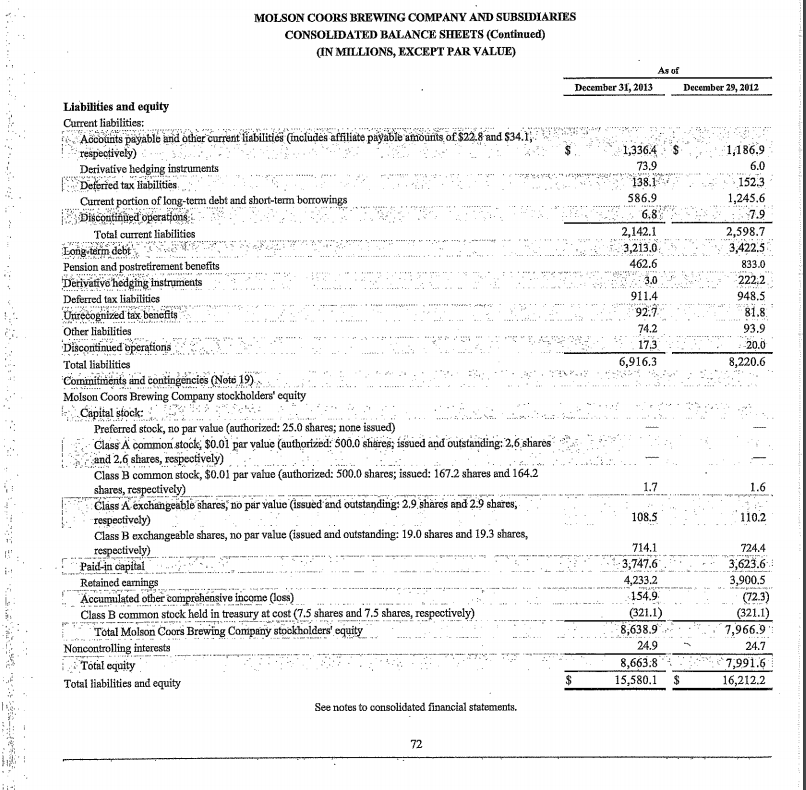

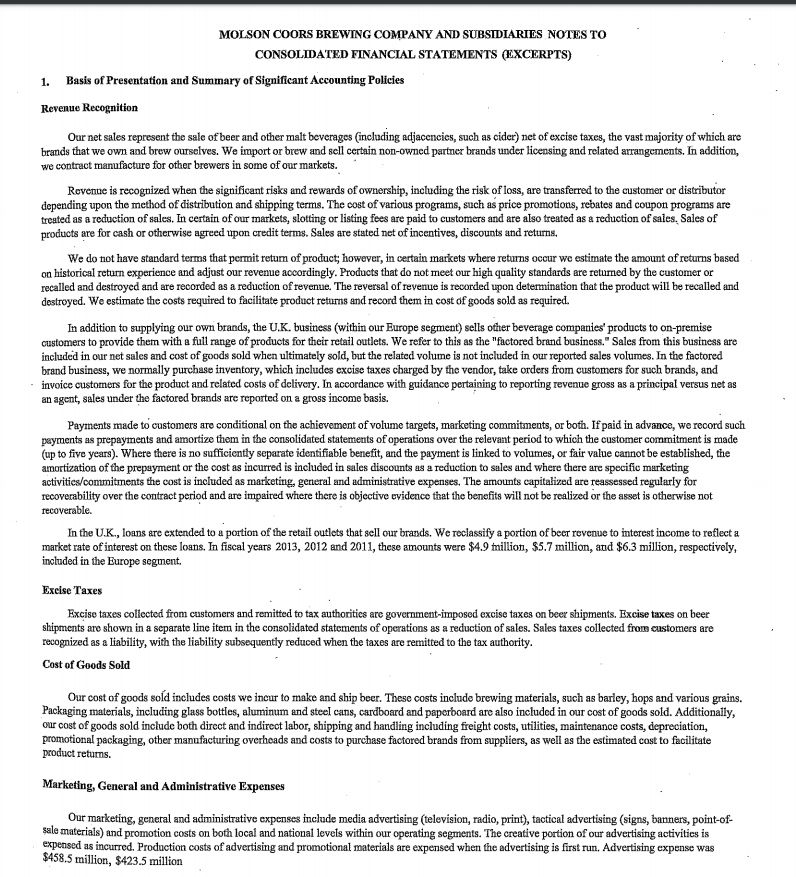

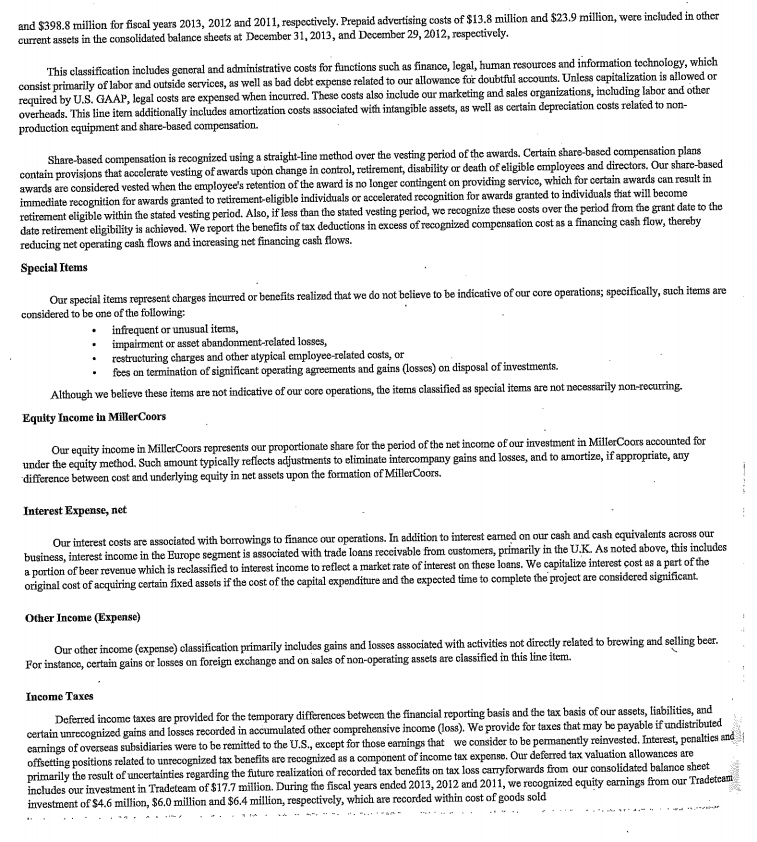

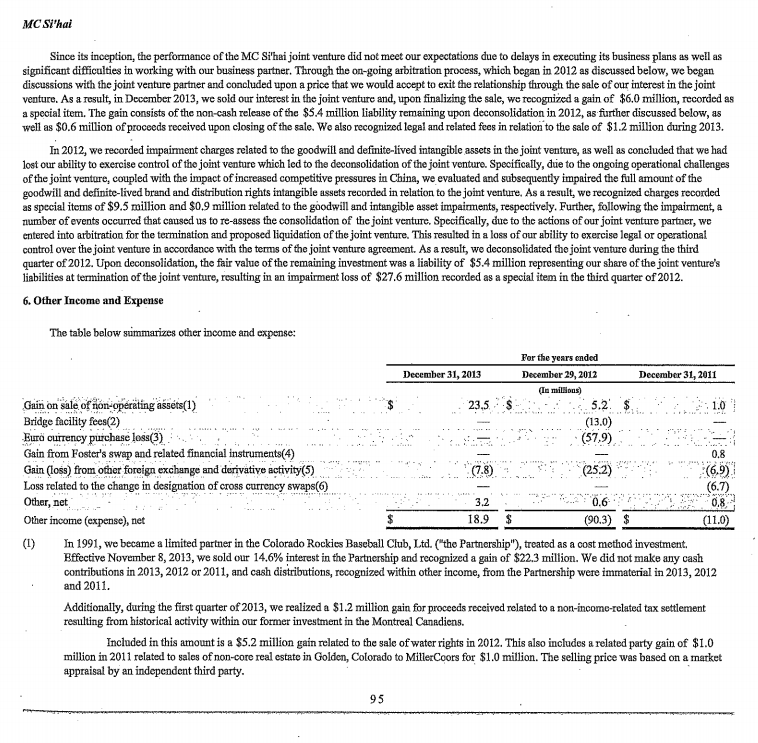

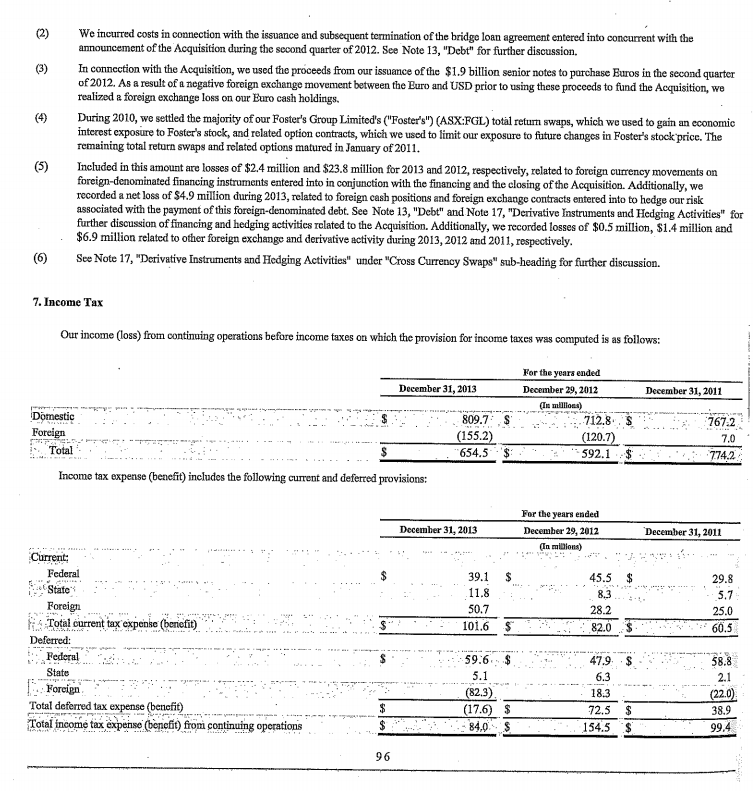

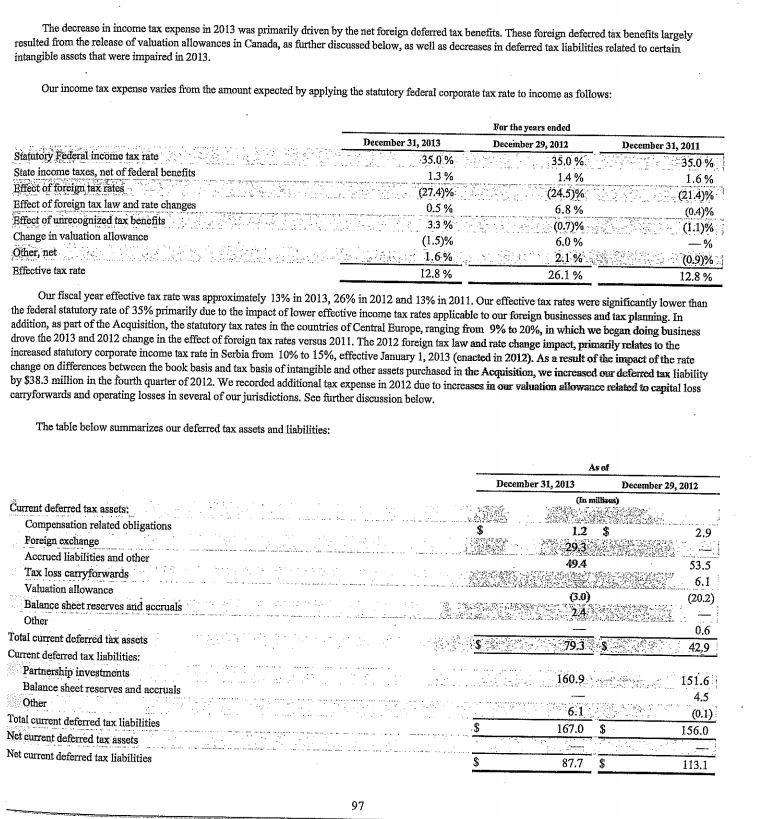

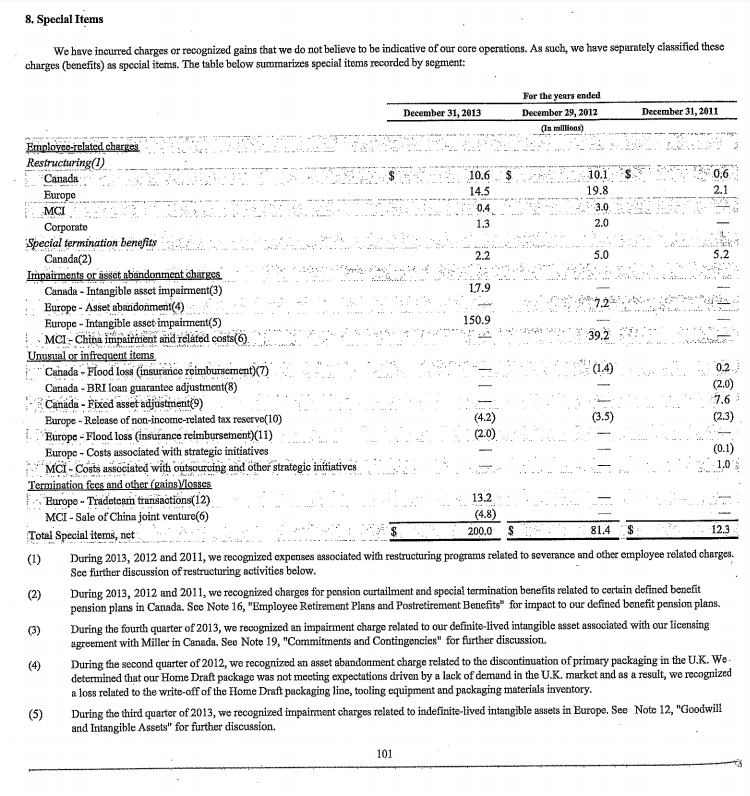

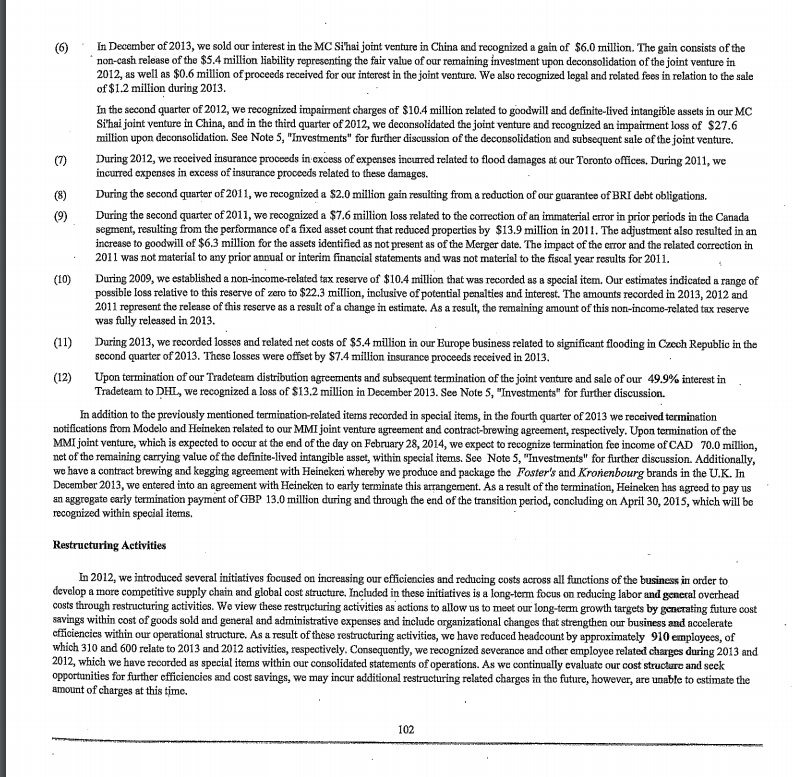

2. Examine Molson Coors balance sheets 2013 and 2012. Footnotes to the financial statements (not included with the case) reveal that the notes receivable (and the current portion thereof) relate to loans made to customers. b. Identify liabilities that you consider "nonoperating," abd then compute nonoperating liabilities in total 2013 2012 Nonoperating liabilities (in millions) Nonopeating liabilities in total MOLSON COORS BREWING COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (IN MILLIONS) As of December 31, 2013 December 29, 2012 Assets Current assots Cash and cash equivalents 442.3 624.0 Accounts and notes receivable: taetet Trade, less allowance for doubtful accounts of $13.6 and S13.4, respectively 572.8 608.3 Affiliates Current notes feceivablo and other receivables, less allowance for doubtful accounts of $1.1 and $1.6, respectively 52.2 30.8 124.4 92.9 Inventories: ry1 Finished 133.2 139.9 In process 23.3 20.3 36.9 Raw materials 43.5 Packaging materials Total inventories Maintenance and operating supplies, less allowance for obsolete supplies of $6.8 and $7.2, respectively 11.9 10.2 213.9 205.3 29,6 28.3 Ofher current assets 82.1 89.2 S Deferred tax assets 50.4 39.2 Total current assets 1,537.7 1,970.1 2,418.7 6,825.1 1,748,0 Properties, less accumulated depreciation of $1,458.7 and $1,224.6, respectively 1,995.9 2,453.1 7,234.8 2,431.8 Goodwill Other intangibles, less accumulated amortization of $513.7 and $497.2, respectively tur- investment in MillerCoors 2,506.5 A ALIE Deferred tax assets 125.4 38.3 Notes reoeivable, less allowance for doubtful accounts of $2.8 and $4.0, respeotively 23,6 26.3 Other assets 260.1 196.9 15,5801 $ Total assets 16,212.2 71 MOLSON COORS BREWING COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Continued) IN MILLIONS, EXCEPT PAR VALUE) As of December 31, 2013 December 29, 2012 Liabilities and equity Current liabilities: tAccounts payable and other current liabilities (includes affiliate payable amounts of $22.8 and $34.1. respectively) Derivative hedging instruments 1,186.9 1,336.4 $ 73.9 6.0 138.1. 152.3 Deferred tax liabilities 586.9 1,245.6 Current portion of long-term debt and short-term borrowings : Discontifued operations 6.8 7.9 2,142.1 2,5 Total current liabilities Long 3,213.0 3,422.5 term debt 462.6 833.0 Pension and p0stretirement benefits Derivative hedging instruments 3.0 222.2 911.4 948.5 Deferred tax liabilitics 92.7 81.8 Unrecognized tax benefits 74.2 93.9 Other liabilities 173 a -20.0 Discontinued operations 6,916.3 8,220.6 Total liabilities Commitments and contingencies (Noto 19) Molson Coors Brewing Company stockholdens' equity Capital stock: Preferred stock, no par value (authorized: 25.0 shares; none Class A common stock, $0.01 par value (authorized: 500.0 shares; issued and outstanding: 2,6 shares and 2.6 shares, respectively) Class B common stock, $0.01 par value (authorized: 500.0 shares; issued: 167.2 shares and 164.2 shares, respectively) Class A exchangeable shares, no par value (issued and outstanding: 2.9. shares and 2.9 shares, respectively) Class B exchangeable shares, respectively) Paid-in capital issued) 1.7 1.6 110.2 108.5 no par value (issued and outstanding: 19.0 shares and 19.3 shares, 724.4 714.1 3,623.6 3,900.5 3,747.6 4,233.2 154.9 Retained earnings Accumulated other comprehensive income (loss) Class B common stock held in treasury at cost (7.5 shares and 7.5 shares, respectively) (72.3) (321.1) 7,966.9 (321.1) 8,638.9 Total Molson Coors Brewing Company stockholders' equity 24.9 24.7 Noncontrolling interests Total equity 8,663.8 7,991.6 15,580.1 16,212.2 Total liabilities and equity See notes to consolidated financial statements. 72 MOLSON COORS BREWING COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (EXCERPTS) Basis of Presentation and Summary of Significant Accounting Policies 1. Revenue Recognition Our net sales represent the sale ofbeer and other malt beverages (including adjacencies, such as cider) net of excise taxes, the vast majority of which arc brands that we own and brew ourselves. We import or brew and sell certain non-owned partner brands under licensing and related arrangements. In addition, we contract manufacture for other brewers in some of our markets. Rovenue is recognized when the significant risks and rewards of ownership, including the risk of loss, are transferred to the customer or distributor depending upon the method of distribution and shipping terms. The cost of various programs, such as price promotions, rebates and coupon programs are treated as a reduction of sales. In certain of our markets, slotting products are for cash or otherwise agreed upon credit terms. Sales are stated net of incentives, discounts and returns listing fees are paid to customers and are also treated as a reduction of sales, Sales of or We do not have standard terms that permit retum of product; however, in certain markets where returns occur we estimate the amount ofreturns based an historical return experience and adjust our revenue accordingly. Products that do not meet our high quality standards are retumed by the customer or recalled and destroycd and are recorded as a reduction of revenue. The reversal of revenue is recorded upon determination that the product will be recalled and destroyed. We estimate the costs required to fiacilitate product retums and record them in cost of goods sold as required. In addition to supplying our own brands, the U.K. business (within our Europe segment) sells other beverage companies' products to on-premise Customers to provide them with a full range of products for their retail outlets. We refer to this as the "factored brand business." Sales from this business are included in our net sales and cost of goods sold when ultimately sold, but the related vohume is not included in our reported sales volumes. In the factored brand business, we normally purchase inventory, which includes excise taxes charged by the vendor, take orders from customers for such brands, and invoice customers for the product and related costs of delivery. In accordance with guidance pertaining to reporting revenue gross as a principal versus net as an agent, sales under the factored brands are reported on a gross income basis. Payments made to customers are conditional on the achievement of volume targets, marketing commitments, or both. If paid in advance, we record such payments as prepayments and amortizee them in the consolidated statements of operations over the relevant period to which the customer commitment is made (up to five years). Where there is no sufficiently separate identifiable benefit, and the payment is linked to volumes, or fair value cannot be established, the amortization of the prepayment or the cost as incurred is included in sales discounts as a reduction to sales and where there are specific marketing activitics/commitments the cost is included as marketing, general and administrative expenses. The amounts capitalized are reassessed regularly for recoverability over the contract period and are impaired where there is objective evidence that fthe benefits will not be realized or the asset is otherwise not recoverable. In the U.K., loans are extended to a portion of the retail outlets that sell our brands. We reclassify a portion of beer revenue to interest income to reflect a market rate of interest on these loans. In fiscal years 2013, 2012 and 2011, these amounts were $4.9 million, $5.7 million, and $6.3 million, respectively, included in the Europe segment. Excise Taxes Excise taxes collected from customers and remitted to tax authoritics are government-imposed excise taxes on beer shipments. Excise taxes on beer shipments are shown in a separate line item in the consolidated statements of operations as a reduction of sales. Sales taxes collected from customers are recognized as a liability, with the liability subsequently reduced when the taxes are remitted to the tax authority Cost of Goods Sold Our cost of goods sold includes costs we incur to make and ship beer. These costs include brewing materials, such as barley, hops and various grains. Packaging materials, including glass botties, aluminum and steel cans, cardboard and paperboard are also inchuded in our cost of goads sold. Additionally, our cost of goods sold include both direct and indirect labor, shipping and handling including freight costs, utilities, maintenance costs, depreciation, promotional packaging, other manufacturing overheads and costs to purchase factored brands from suppliers, as well as the estimated cost to facilitate product returns. Marketing, General and Administrative Expenses Our marketing, general and administrative expenses include media advertising (television, radio, print), tactical advertising (signs, banners, point-of- sale materials) and promotion costs on both local and national levels within our operating segments. The creative portion of our advertising activities is expensed as incurred. Production costs of advertising and promotional materials are expensed when the advertising is first run. Advertising expense was $458.5 million, $423.5 million and $398.8 million for fiscal years 2013, 2012 and 2011, respectively. Prepaid advertising costs of $13.8 million and $23.9 million, current assets in the consolidated balance sheets at December 31, 2013, and December 29, 2012, respectively. were included in other This classification includes general and administrative costs for functions such as finance, legal, human resources and information technology, which consist primarily of labor and outside services, as well as bad debt expense related to our allowance for doubtful accounts. Unless capitalization is allowed or required by U.S. GAAP, legal costs are expensed when incurred. These costs also include our marketing and sales organizations, including labor and other overheads. This line item additionally includes amortization costs associated with intangible assets, as well as certain depreciation costs related to non- production cquipment and share-based compensation. Share-based compensation is recognized using a straight-line method over the vesting period of the awards. Certain share-based compensation plans contain provisions that accelcrate vesting of awards upn change in control, retirement, disability or death of eligible employees and directors. Our share-based awards are considered vested when the employee's retention of the award is no longer contingent on providing service, which for certain awards can result in immediate recognition for awards granted to retirement-eligible individuals or accelerated recognition for awards granted to individuals that will become retirement eligible within fhe stated vesting period. Also, if less than the stated vesting period, we recognize these costs over the period from the grant date to the date retirement eligibility is achieved. We report the benefits of tax deductions in excess of recognized compensation cost as a financing cash flow, thereby reducing net operating cash flows and increasing net financing cash flows. Special Items Our special items represent charges incurred or benefits realized that we do not believe to be indicative of our core operations; specifically, such items are considered to be one of the following infrequent or unusual items, impairment or asset abandonment-related losses, restructuring charges and other atypical employee-related costs, or fes on termination of significant operating agreements and gains (losses) on disposal of investments. Although we believe these iterns are not indicative of our core operations, the items classified as special items are not necessarily non-recurring Equity Income in MillerCoors Our equity income in MillerCoors represents our proportionate share for the period of the net income of our investment in MillerCoors accounted for under the equity method. Such amount typically reflects adjustments to eliminate intercompany gains and losses, and to amortize, if appropriate, any difference between cost and underlying equity in net assets upon the fomation of MillerCoors. Interest Expense, net Our interest costs are associatod with borrowings to finance our operations. In addition to interest eamed on our cash and cash equivalents across our business, interest income in the Europe segment is associated with trade loans receivable from customers, primarily in the U.K. As noted above, this includes a portion of beer revenue which is reclassified to interest income to reflect a market rate of interest on these loans. We capitalize interest cost as a part of the original cost of acquiring certain fixed assots if the cost of the capital expenditure and the expocted time to complete the project are considered significant Other Income (Expense) Our other income (expense) classification primarily includes gains and losses associated For instance, certain gains or losses on foreign exchange and on sales of non-operating assets are classified in this line item. th activities not directly related to brewing and selling beer. Income Taxes Deferred income taxes are provided for the temporary differences between the financial reporting basis and the tax basis of our assets, liabilities, and certain unrecognized gains and losses recorded in accumulated other comprehensive income (loss). We provide for taxes that may be payable if undistributed carnings of overseas subsidiaries were to be remitted to the U.S., except for those earnings that we consider to be permanently reinvested. Interest, penalties and offsctting positions related to unrecognized tax benefits are recognized as a component of income tax expenso. Our deferred tax valuation allowances are primarily the result of uncertainties regarding the future realization of recarded tax benefits on tax loss carryforwards from our consolidated balance sheet includes our investment in Tradeteam of $17.7 million. During the fiscal years ended 2013, 2012 and 2011, we recognized equity carnings from our Tradetcam investment of $4.6 million, $6.0 million and $6.4 million, respectively, which are recorded within cost of goods sold MC Si'hai Since its inception, the performance of the MC Sihai joint venture did not meet our expectations due to delays in executing its business plans as well as significant difficulties in working with our business partner. Through the on-going arbitration process, which began in 2012 as discussed below, we began discussions with the joint venture partner and concluded upon a price that we would accept to exit the relationship through the sale of our interest in the joint venture. As a result, in December 2013, we sold our interest in the joint venture and, upon finalizing the sale, we recognized a gain of $6.0 million, recorded as a special item. The gain consists of the non-cash release of the $4 milion liability remaining upon deconsolidation in 2012, as further discussed below, as well as $0.6 million of proceeds received upon closing of the sale. Wo also recognized legal and related fees in relation to the sale of $1.2 million during 2013. In 2012, we recorded impairment charges related to the goodwill and definite-lived intangible assets in the joimt venture, as well as concluded that we had lost our ability to exercise control of the joint venture which led to fhe deconsolidation of the joint venture. Specifically, duie to the ongoing operational challenges of the joint venture, coupled with the impact of increased competitive pressures in China, we evaluated and subsequently impaired the fll amount of the goodwill and definite-lived brand and distribution rights intangible assets recorded in relation to the joint venture. As a result, we recognized charges recorded as special items of $9.5 million and $0.9 million related to the goodwill and intangible asset impairments, respectively. Further, following the impairment, number of events occurred that caused us to re-assess the consolidation of the joint venture. Spccifically, due to the actions of our joint venture partner, we entered into arbitration for the termination and proposed liquidation of the joint venture. This resulted in a loss of our ability to exercise legal or operational control over the joint venture in accordance with the terms of the joint venture agreement. As a result, we deconsolidated the joint venture during the third quarter of 2012. Upon deconsolidation, the fair value of the remaining investment was a liability of $5.4 million representing our share of the joint venture's liabilities at termination of the joint venture, resulting in an impairment loss of $27.6 million recorded as a special item in the third quarter of 2012 6. Other Income and Expense The table below summarizes other income and expense: For the years ended December 31, 2013 December 29, 2012 December 31, 2011 In milions) 5.2 $ Gain on sale of non-oprating assets(1) Bridge facility fees(2) Eura currency purchase less(3) Gain from Foster's swap and related financial instruments(4) 23.5 1.0 ri (13.0) (57,9) 0.8 (25.2) (6,9) (6.7) 0.8 Gain (loss) from other foreign exchange and derivative activity(5) Loss related to the change in designation of cross currency swaps(6) (7.8) 0.6 (90.3) $ Other, net 3.2 $ $ Other income (expense), net 18.9 (11.0) In 1991, Effective November 8, 2013, we sold our 14.6% interest in the Partnership and recognized a gain of $22.3 million. We did not make any cash contributions in 2013, 2012 or 2011, and cash distributions, recognized within other income, from the Partnership were immaterial in 2013, 2012 and 2011 (I) we became a limited partner in the Colorado Rockies Baseball Club, Ltd. ("the Partnership"), treated as a cost method investment. Additionally, during the first quarter of 2013, we realized a $1.2 million gain for proceeds received related to a non-income-rclated tax settlement resulting from historical activity within our former investment in the Montreal Canadiens. Included in this amount is a $5.2 million gain related to the sale ofwater rights in 2012. This also includes a related party gain of $1.0 million in 2011 related to sales of non-core real estate in Golden, Colorado to MillerCoors for $1.0 million. The selling price was based on a market appraisal by an independent third party 95 We incurred costs in connection with the issuance and subsequent termination of the bridge loan agreement entered into concurrent with the announcement of the Acquisition during the sccond quarter of 2012. See Note 13, "Debt" for further discussion, In connection with the Acquisition, wo used the proceeds from our issuance of the $1.9 billion senior notes to parchase Euros in the second quarter of 2012. As a result of a negative foroign exchange movement between the Euro and USD prior to using these procccds to fund the Acquisition, realized a foreign exchange loss on our Euro cash holdings (3) we During 2010, we settled the majority of our Foster's Group Limited's ("Foster's") (ASX:FGL) total retum swaps, which we used to gain interest exposure to Foster's stock, and rolated option contracts, which we used to limit our exposure to future changes in Foster's stock price. The remaining total return swaps and related options matured in January of 2011 (4) an economic (5) Included in this amount are losses of $2.4 million and $23.8 million for 2013 and 2012, respectively, related to foreign cumrency movements on foreign-denominated financing instruments entered into in conjunction with the financing and the closing of the Acquisition. Additionally, we recorded a net loss of $4.9 million during 2013, related to foreign cash positions and foreign exchange contracts entered into to hedge our risk associated with the payment of this foreign-denominated debt. See Note 13, "Debt" and Note 17, "Derivative Instruments and Hedging Activities" for further discussion of financing and hedging activities ralated to the Acquisition. Additionally, we recorded losses of $0.5 million, $1.4 million and $6.9 million related to ofher foreign exchange and derivative activity during 2013, 2012 and 2011, respectively (6) See Note 17, "Derivative Instruments and Hedging Activities" under "Cross Currency Swaps" sub-heading for further discussion. 7. Income Tax Our income (loss) from continuing operations before income taxes on which the provision for inoome taxes was computed is as follows: For the years ended December 31, 2013 December 29, 2012 December 31, 2011 In millioas) Domestic Foreign 809.7 S (155.2) 712.8 767.2 (120.7) 7.0 Total 654.5 774.2 592.1 Income tax expense (benefit) includes the following current and deferred provisions: For the years ended December 31, 2013 December 29, 2012 December 31, 2011 n miions) Current Federal 39.1 $ 45.5 $ 29.8 State 11.8 8.3 5.7 Foreign Total current tax expense (benefit) 50.7 28.2 25.0 101.6 82.0 60.5 Deferred: Federal 59.6 $ 58.8 47.9 S State 5.1 6.3 2.1 Foreign (82.3) (22.0 18.3 Total deferred tax expense (benefit) $ (17.6) -84,0 S 72,5 38.9 Total income tax expense (benefit) from continuing operations $ 154.5 $ 99.4 96 The decrease in income tax expense in 2013 was resulted from the release of valuation allowances in Canada, as further discussed below, as well as decreases in deferred tax liabilities related to certain intangible assets that were impaired in 2013. primarily driven by the net foreign deferred tax bencfits. These foreign defered tax benefits largely Our income tax expense varies from the amount expected by applying the statutory federal corporate tax rate to income as follows: For the years ended December 31, 2013 Deceimber 29, 2012 December 31, 2011 Statutory Federal income tax rate 35,0% 13% 35,0% 35.0 % State income taxes, net of federal benefits 1.4% 1.6% Bffect of foreign tax rates - (27.4)% (24.5)% 6.8% - (214% (0.4) % Effect of foreign tax law and rate changes Effect of unrecognized tax bencfits 0.5% (1.1)% 3:3% (0.7)% 6.0% 2.1% Change in valuation allowancee (.5% 1.6% % Other, net (0.IY% ;j{ Effective tax rate 12.8% 26.1% 12.8% Our fiscal year effective tax rate was the federal statutory rate of 35% primarily due to the impact of lower effective income tax rates applicable to our foreign businesses and tax plamning. In addition, as part of the Acquisition, the statutory tax rates in the countries of Central Europe, ranging from 9% to 20 % , in which we began doing business drove the 2013 and 2012 change in the effect of foreign tax rates versus 2011. The 2012 foreign tax law and rate chunge impact, primarily relates to the increased statutory corporate income tax rate in Serbia from 10% to 15 % , effective January 1,2013 (enacted in 2012). As a result of the impact of the rate change on differences between the book basis and tax basis of intangible and other assets purchased in the Acquisition, we increased our deferred tax liability by $38.3 million in the fourth quarter of 2012. We recorded additional tax expense in 2012 due to incresses in our valuation allowance related to capital loss caryforwards and operating losses in several of our jurisdictions. See further discussion below. approximately 13% in 2013, 26% in 2012 and 13% in 2011. Our effective tax rates were significantly lower than The table below summarizes our deferred tax assets and liabilities: As of December 31, 2013 December 29, 2012 (In milliaus) Current deferred tax assets: Compensation related obligations Foreign cxchango 1.2 $ 2,9 Accrued liabilities and other 49.4 53.5 Tax loss carryforwards 6.1 Valuation allowance G.0 (20.2) Balance sheet reserves and accruals Other 0.6 Total current doferred tax assets 79.3 42,9 Current deferrod tax liabilitics: Partnership investments Balance sheet reserves and accruals 151.6 160.9 4.5 Other 6:1 (0.1) Total current deferred tax liabilities 167,0 156.0 Net current deferred tax assets Net current deferred tax liabilities 87.7 113,1 97 8. Special Items We have incurred charges or recognized gains that we do not believe to be indicative of our core operations. As such, we have separately classified these charges (benefits) as special items. The table below summarizes special items recorded by segment For the years ended December 31, 2011 December 31, 2013 December 29, 2012 In millions) Emplovee-related charges Restructuring() 0.6 10.1 10,6 $ Canada 2.1 14.5 19.8 Burope 04 3.0 MCI 2.0 1.3 Corporate Special termination benefits Canada(2) Impairments or asset abandonment charges Canada - Intangible asset impairment(3) Europe- Asset abandonment(4) Europe- Intangible asset impairment(5) MCI-China impairiment and related costse Unusual or infreguent items Canada- Flood loss (insurance reimbursement)(7) Canada - BRI loan guarantee adjustment(8) Canada - Fixed asset adjustment9) 5.2 5,0 2.2 17.9 me 150.9 39.2 (6) 0.2 C14) (2.0) 7.6 (3.5) (2.3) (4.2) (2.0) Europe - Release of non-income-related tax reservo(10) Burope-Flood loss (insurance reimbursement)(11) Europe Costs associated with strategic initiatives MCI-Costs associated with outsourcing and other strategic initiatives (0.1) 1,0 Termination fees and other (gainsVlosses Europe- Tradeteam transactions(12) MCI Sale of China joint venture(6) Total Special items, net 13.2 (4.8) S 81.4 12,3 200.0 During 2013, 2012 and 2011, we recognized expenses associated with restructuring programs related to severance and other employee related charges. Sce further discussion of restructuring activitics below. (1) During 2013, 2012 and 2011, we recognized charges for pension curtailment and special termination benefits related to certain defined benefit pension plans in Canada. Sce Note 16, "Employee Retirement Plans and Postretirement Benefits" for impact to our defined benefit pension plans (2) During the fourth quarter of 2013, we recognized an agreement with Miller in Canada. See Note 19, "Commitments and Contingencies" for further discussion. our definite-lived intangible asset associated with our licensing impairment charge related to (3) an asset abandonment charge related to the discontinuation of primary packaging in the U.K. We- During the second quarter of 2012, we recognized determined that our Home Draft package was not meeting expectations driven by a lack of demand in the U.K. market and as a result, we recognized a loss related to the write-off of the Home Draft packaging line, tooling equipment and packaging materials inventory (4) During the third quarter of 2013, we recognized impairment charges related to indefinite-lived intangible assets in Europe. See Note 12, "Goodwill and Intangible Assets" for further discussion (5) 101 In December of 2013, we sold our interest in the MC Sihai joint venture in China and recognized a gain of $6.0 million. The gain consists of the non-cash release of the $5.4 million liability representing the fair value of our remaining investment upon deconsolidation of the joint venture in 2012, as well as $0.6 million of proceeds received for our interest in the joint venturo. We also recognized legal and related fees in relation to the sale of $1.2 million during 2013. In the second quarter of 2012, we recognized impairment charges of $10.4 million related to goodwill snd definite-lived intangible assets in our MC Si'hai joint venture in China, and in the third quarter of 2012, we deconsolidated the joint venture and recognized an impairment loss of $27.6 million upon deconsolidation. See Note 5, "Investments" for further discussion of the deconsolidation and subsequent sale of the joint venture. During 2012, we reccived insurance procoeds in excess of expenses incured related to flood damages at our Toronto offices, During 2011, we incurred expenses in excess of insurance procceds related to these damages. During the second quarter of 2011, wee recognized a $2.0 million gain resulting from a roduction of our guarantee of BRI debt obligations. During the second quarter of 2011, we recognized a $7.6 million loss related to the corection of an immaterial error in prior periods in the Canada segment, resulting from the performance ofa fixed asset count that reduced properties by $13.9 million in 2011. The adjustment also resulted in an increase to goodwill of $6.3 million for the assets identificd as not present as of the Merger date. The impact of the error and the related correction in 2011 was not material to any prior annual or interim financial statements and was not material to the fiscal year results for 2011 During 2009, we established a non-income-related tax reserve of $10.4 million that was recorded as a special item. Our estimates indicated a range of possible loss relative to this reserve of zero to $22.3 million, inclusive of potential penalties and interest. The amounts recorded in 2013, 2012 and (10) 2011 represent the release of this rescrve as a result of a change in estimate. As a result, the remaining amount of this non-income-related tax reserve fully released in 2013. was During 2013, we rocorded lossos and related net costs of $5.4 million in our Europe business related to significant flooding in Czcch Republic in the (11) second quarter of 2013. These losses were offset by $7.4 million insurance proceeds received in 2013. Upon termination of our Tradeteam distribution agreements and subsequent termination of the joint venture and sale of our 49.9 % interest in Tradeteam to DHL, we recognizeda loss of $13.2 million in December 2013. See Note 5, "Investments" for further discussion. (12) In addition to the previously mentioned termination-related items recorded in special items, in the fourth quarter of 2013 we recaived termination notifications from Modelo and Heineken related to our MMI joint venture agreement and contract-brewing agreement, respectively. Upon termination of the MMI joint venture, which is expected to occur at the end of the day on February 28, 2014, we expect to recognize termination fce income of CAD 70.0 million, net of the remaining carrying value of the definite-lived intangible asset, within special items. See Note 5, "Investments" for further discussion. Additionally, we have a contract brewing and kegging agreement with Heincken whereby we produce and package the Foster's and Kronenbourg brands in the U.K. In December 2013, we entered into an agreement with Heineken to early terminate this arrangement. As a result of the termination, Heineken has agreed to pay us an aggregate early termination payment of GBP 13.0 million during and through the end of the transition period, concluding on April 30, 2015, which will bo recognized within special items Restructuring Activities In 2012, we introduced several initiatives focused on increusing our efficiencies and reducing costs across all fanctions of the business in order to develop a more competitive supply chain and global cost structure. Included in these initiatives is a long-term focus on reducing labor and general overhead costs through restructuring activities. We view these restructuring activities as actions to allow us to meet our long-term growth targets by generating future cost savings within cost of goods sold and general and administrative expenses and include organizational changes that strengthen our business and accelerate cfficiencies within our operational structure. As a result of theso restructuring activitics, we have reduced headcount by approximately 910 employees, of which 310 and 600 relate to 2013 and 2012 activities, respectively. Consequently, we recognized severance and other employce related charges during 2013 and 2012, which we have recorded as special items within our consolidated statements of operations. As we continually evaluate our cost structure and seek opportunities for further efficiencies and cost savings, we may incur additional restructuring related charges in the future, however, are unable to estimate the amount of charges at this time. 102 10 2. Examine Molson Coors balance sheets 2013 and 2012. Footnotes to the financial statements (not included with the case) reveal that the notes receivable (and the current portion thereof) relate to loans made to customers. b. Identify liabilities that you consider "nonoperating," abd then compute nonoperating liabilities in total 2013 2012 Nonoperating liabilities (in millions) Nonopeating liabilities in total MOLSON COORS BREWING COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (IN MILLIONS) As of December 31, 2013 December 29, 2012 Assets Current assots Cash and cash equivalents 442.3 624.0 Accounts and notes receivable: taetet Trade, less allowance for doubtful accounts of $13.6 and S13.4, respectively 572.8 608.3 Affiliates Current notes feceivablo and other receivables, less allowance for doubtful accounts of $1.1 and $1.6, respectively 52.2 30.8 124.4 92.9 Inventories: ry1 Finished 133.2 139.9 In process 23.3 20.3 36.9 Raw materials 43.5 Packaging materials Total inventories Maintenance and operating supplies, less allowance for obsolete supplies of $6.8 and $7.2, respectively 11.9 10.2 213.9 205.3 29,6 28.3 Ofher current assets 82.1 89.2 S Deferred tax assets 50.4 39.2 Total current assets 1,537.7 1,970.1 2,418.7 6,825.1 1,748,0 Properties, less accumulated depreciation of $1,458.7 and $1,224.6, respectively 1,995.9 2,453.1 7,234.8 2,431.8 Goodwill Other intangibles, less accumulated amortization of $513.7 and $497.2, respectively tur- investment in MillerCoors 2,506.5 A ALIE Deferred tax assets 125.4 38.3 Notes reoeivable, less allowance for doubtful accounts of $2.8 and $4.0, respeotively 23,6 26.3 Other assets 260.1 196.9 15,5801 $ Total assets 16,212.2 71 MOLSON COORS BREWING COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Continued) IN MILLIONS, EXCEPT PAR VALUE) As of December 31, 2013 December 29, 2012 Liabilities and equity Current liabilities: tAccounts payable and other current liabilities (includes affiliate payable amounts of $22.8 and $34.1. respectively) Derivative hedging instruments 1,186.9 1,336.4 $ 73.9 6.0 138.1. 152.3 Deferred tax liabilities 586.9 1,245.6 Current portion of long-term debt and short-term borrowings : Discontifued operations 6.8 7.9 2,142.1 2,5 Total current liabilities Long 3,213.0 3,422.5 term debt 462.6 833.0 Pension and p0stretirement benefits Derivative hedging instruments 3.0 222.2 911.4 948.5 Deferred tax liabilitics 92.7 81.8 Unrecognized tax benefits 74.2 93.9 Other liabilities 173 a -20.0 Discontinued operations 6,916.3 8,220.6 Total liabilities Commitments and contingencies (Noto 19) Molson Coors Brewing Company stockholdens' equity Capital stock: Preferred stock, no par value (authorized: 25.0 shares; none Class A common stock, $0.01 par value (authorized: 500.0 shares; issued and outstanding: 2,6 shares and 2.6 shares, respectively) Class B common stock, $0.01 par value (authorized: 500.0 shares; issued: 167.2 shares and 164.2 shares, respectively) Class A exchangeable shares, no par value (issued and outstanding: 2.9. shares and 2.9 shares, respectively) Class B exchangeable shares, respectively) Paid-in capital issued) 1.7 1.6 110.2 108.5 no par value (issued and outstanding: 19.0 shares and 19.3 shares, 724.4 714.1 3,623.6 3,900.5 3,747.6 4,233.2 154.9 Retained earnings Accumulated other comprehensive income (loss) Class B common stock held in treasury at cost (7.5 shares and 7.5 shares, respectively) (72.3) (321.1) 7,966.9 (321.1) 8,638.9 Total Molson Coors Brewing Company stockholders' equity 24.9 24.7 Noncontrolling interests Total equity 8,663.8 7,991.6 15,580.1 16,212.2 Total liabilities and equity See notes to consolidated financial statements. 72 MOLSON COORS BREWING COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (EXCERPTS) Basis of Presentation and Summary of Significant Accounting Policies 1. Revenue Recognition Our net sales represent the sale ofbeer and other malt beverages (including adjacencies, such as cider) net of excise taxes, the vast majority of which arc brands that we own and brew ourselves. We import or brew and sell certain non-owned partner brands under licensing and related arrangements. In addition, we contract manufacture for other brewers in some of our markets. Rovenue is recognized when the significant risks and rewards of ownership, including the risk of loss, are transferred to the customer or distributor depending upon the method of distribution and shipping terms. The cost of various programs, such as price promotions, rebates and coupon programs are treated as a reduction of sales. In certain of our markets, slotting products are for cash or otherwise agreed upon credit terms. Sales are stated net of incentives, discounts and returns listing fees are paid to customers and are also treated as a reduction of sales, Sales of or We do not have standard terms that permit retum of product; however, in certain markets where returns occur we estimate the amount ofreturns based an historical return experience and adjust our revenue accordingly. Products that do not meet our high quality standards are retumed by the customer or recalled and destroycd and are recorded as a reduction of revenue. The reversal of revenue is recorded upon determination that the product will be recalled and destroyed. We estimate the costs required to fiacilitate product retums and record them in cost of goods sold as required. In addition to supplying our own brands, the U.K. business (within our Europe segment) sells other beverage companies' products to on-premise Customers to provide them with a full range of products for their retail outlets. We refer to this as the "factored brand business." Sales from this business are included in our net sales and cost of goods sold when ultimately sold, but the related vohume is not included in our reported sales volumes. In the factored brand business, we normally purchase inventory, which includes excise taxes charged by the vendor, take orders from customers for such brands, and invoice customers for the product and related costs of delivery. In accordance with guidance pertaining to reporting revenue gross as a principal versus net as an agent, sales under the factored brands are reported on a gross income basis. Payments made to customers are conditional on the achievement of volume targets, marketing commitments, or both. If paid in advance, we record such payments as prepayments and amortizee them in the consolidated statements of operations over the relevant period to which the customer commitment is made (up to five years). Where there is no sufficiently separate identifiable benefit, and the payment is linked to volumes, or fair value cannot be established, the amortization of the prepayment or the cost as incurred is included in sales discounts as a reduction to sales and where there are specific marketing activitics/commitments the cost is included as marketing, general and administrative expenses. The amounts capitalized are reassessed regularly for recoverability over the contract period and are impaired where there is objective evidence that fthe benefits will not be realized or the asset is otherwise not recoverable. In the U.K., loans are extended to a portion of the retail outlets that sell our brands. We reclassify a portion of beer revenue to interest income to reflect a market rate of interest on these loans. In fiscal years 2013, 2012 and 2011, these amounts were $4.9 million, $5.7 million, and $6.3 million, respectively, included in the Europe segment. Excise Taxes Excise taxes collected from customers and remitted to tax authoritics are government-imposed excise taxes on beer shipments. Excise taxes on beer shipments are shown in a separate line item in the consolidated statements of operations as a reduction of sales. Sales taxes collected from customers are recognized as a liability, with the liability subsequently reduced when the taxes are remitted to the tax authority Cost of Goods Sold Our cost of goods sold includes costs we incur to make and ship beer. These costs include brewing materials, such as barley, hops and various grains. Packaging materials, including glass botties, aluminum and steel cans, cardboard and paperboard are also inchuded in our cost of goads sold. Additionally, our cost of goods sold include both direct and indirect labor, shipping and handling including freight costs, utilities, maintenance costs, depreciation, promotional packaging, other manufacturing overheads and costs to purchase factored brands from suppliers, as well as the estimated cost to facilitate product returns. Marketing, General and Administrative Expenses Our marketing, general and administrative expenses include media advertising (television, radio, print), tactical advertising (signs, banners, point-of- sale materials) and promotion costs on both local and national levels within our operating segments. The creative portion of our advertising activities is expensed as incurred. Production costs of advertising and promotional materials are expensed when the advertising is first run. Advertising expense was $458.5 million, $423.5 million and $398.8 million for fiscal years 2013, 2012 and 2011, respectively. Prepaid advertising costs of $13.8 million and $23.9 million, current assets in the consolidated balance sheets at December 31, 2013, and December 29, 2012, respectively. were included in other This classification includes general and administrative costs for functions such as finance, legal, human resources and information technology, which consist primarily of labor and outside services, as well as bad debt expense related to our allowance for doubtful accounts. Unless capitalization is allowed or required by U.S. GAAP, legal costs are expensed when incurred. These costs also include our marketing and sales organizations, including labor and other overheads. This line item additionally includes amortization costs associated with intangible assets, as well as certain depreciation costs related to non- production cquipment and share-based compensation. Share-based compensation is recognized using a straight-line method over the vesting period of the awards. Certain share-based compensation plans contain provisions that accelcrate vesting of awards upn change in control, retirement, disability or death of eligible employees and directors. Our share-based awards are considered vested when the employee's retention of the award is no longer contingent on providing service, which for certain awards can result in immediate recognition for awards granted to retirement-eligible individuals or accelerated recognition for awards granted to individuals that will become retirement eligible within fhe stated vesting period. Also, if less than the stated vesting period, we recognize these costs over the period from the grant date to the date retirement eligibility is achieved. We report the benefits of tax deductions in excess of recognized compensation cost as a financing cash flow, thereby reducing net operating cash flows and increasing net financing cash flows. Special Items Our special items represent charges incurred or benefits realized that we do not believe to be indicative of our core operations; specifically, such items are considered to be one of the following infrequent or unusual items, impairment or asset abandonment-related losses, restructuring charges and other atypical employee-related costs, or fes on termination of significant operating agreements and gains (losses) on disposal of investments. Although we believe these iterns are not indicative of our core operations, the items classified as special items are not necessarily non-recurring Equity Income in MillerCoors Our equity income in MillerCoors represents our proportionate share for the period of the net income of our investment in MillerCoors accounted for under the equity method. Such amount typically reflects adjustments to eliminate intercompany gains and losses, and to amortize, if appropriate, any difference between cost and underlying equity in net assets upon the fomation of MillerCoors. Interest Expense, net Our interest costs are associatod with borrowings to finance our operations. In addition to interest eamed on our cash and cash equivalents across our business, interest income in the Europe segment is associated with trade loans receivable from customers, primarily in the U.K. As noted above, this includes a portion of beer revenue which is reclassified to interest income to reflect a market rate of interest on these loans. We capitalize interest cost as a part of the original cost of acquiring certain fixed assots if the cost of the capital expenditure and the expocted time to complete the project are considered significant Other Income (Expense) Our other income (expense) classification primarily includes gains and losses associated For instance, certain gains or losses on foreign exchange and on sales of non-operating assets are classified in this line item. th activities not directly related to brewing and selling beer. Income Taxes Deferred income taxes are provided for the temporary differences between the financial reporting basis and the tax basis of our assets, liabilities, and certain unrecognized gains and losses recorded in accumulated other comprehensive income (loss). We provide for taxes that may be payable if undistributed carnings of overseas subsidiaries were to be remitted to the U.S., except for those earnings that we consider to be permanently reinvested. Interest, penalties and offsctting positions related to unrecognized tax benefits are recognized as a component of income tax expenso. Our deferred tax valuation allowances are primarily the result of uncertainties regarding the future realization of recarded tax benefits on tax loss carryforwards from our consolidated balance sheet includes our investment in Tradeteam of $17.7 million. During the fiscal years ended 2013, 2012 and 2011, we recognized equity carnings from our Tradetcam investment of $4.6 million, $6.0 million and $6.4 million, respectively, which are recorded within cost of goods sold MC Si'hai Since its inception, the performance of the MC Sihai joint venture did not meet our expectations due to delays in executing its business plans as well as significant difficulties in working with our business partner. Through the on-going arbitration process, which began in 2012 as discussed below, we began discussions with the joint venture partner and concluded upon a price that we would accept to exit the relationship through the sale of our interest in the joint venture. As a result, in December 2013, we sold our interest in the joint venture and, upon finalizing the sale, we recognized a gain of $6.0 million, recorded as a special item. The gain consists of the non-cash release of the $4 milion liability remaining upon deconsolidation in 2012, as further discussed below, as well as $0.6 million of proceeds received upon closing of the sale. Wo also recognized legal and related fees in relation to the sale of $1.2 million during 2013. In 2012, we recorded impairment charges related to the goodwill and definite-lived intangible assets in the joimt venture, as well as concluded that we had lost our ability to exercise control of the joint venture which led to fhe deconsolidation of the joint venture. Specifically, duie to the ongoing operational challenges of the joint venture, coupled with the impact of increased competitive pressures in China, we evaluated and subsequently impaired the fll amount of the goodwill and definite-lived brand and distribution rights intangible assets recorded in relation to the joint venture. As a result, we recognized charges recorded as special items of $9.5 million and $0.9 million related to the goodwill and intangible asset impairments, respectively. Further, following the impairment, number of events occurred that caused us to re-assess the consolidation of the joint venture. Spccifically, due to the actions of our joint venture partner, we entered into arbitration for the termination and proposed liquidation of the joint venture. This resulted in a loss of our ability to exercise legal or operational control over the joint venture in accordance with the terms of the joint venture agreement. As a result, we deconsolidated the joint venture during the third quarter of 2012. Upon deconsolidation, the fair value of the remaining investment was a liability of $5.4 million representing our share of the joint venture's liabilities at termination of the joint venture, resulting in an impairment loss of $27.6 million recorded as a special item in the third quarter of 2012 6. Other Income and Expense The table below summarizes other income and expense: For the years ended December 31, 2013 December 29, 2012 December 31, 2011 In milions) 5.2 $ Gain on sale of non-oprating assets(1) Bridge facility fees(2) Eura currency purchase less(3) Gain from Foster's swap and related financial instruments(4) 23.5 1.0 ri (13.0) (57,9) 0.8 (25.2) (6,9) (6.7) 0.8 Gain (loss) from other foreign exchange and derivative activity(5) Loss related to the change in designation of cross currency swaps(6) (7.8) 0.6 (90.3) $ Other, net 3.2 $ $ Other income (expense), net 18.9 (11.0) In 1991, Effective November 8, 2013, we sold our 14.6% interest in the Partnership and recognized a gain of $22.3 million. We did not make any cash contributions in 2013, 2012 or 2011, and cash distributions, recognized within other income, from the Partnership were immaterial in 2013, 2012 and 2011 (I) we became a limited partner in the Colorado Rockies Baseball Club, Ltd. ("the Partnership"), treated as a cost method investment. Additionally, during the first quarter of 2013, we realized a $1.2 million gain for proceeds received related to a non-income-rclated tax settlement resulting from historical activity within our former investment in the Montreal Canadiens. Included in this amount is a $5.2 million gain related to the sale ofwater rights in 2012. This also includes a related party gain of $1.0 million in 2011 related to sales of non-core real estate in Golden, Colorado to MillerCoors for $1.0 million. The selling price was based on a market appraisal by an independent third party 95 We incurred costs in connection with the issuance and subsequent termination of the bridge loan agreement entered into concurrent with the announcement of the Acquisition during the sccond quarter of 2012. See Note 13, "Debt" for further discussion, In connection with the Acquisition, wo used the proceeds from our issuance of the $1.9 billion senior notes to parchase Euros in the second quarter of 2012. As a result of a negative foroign exchange movement between the Euro and USD prior to using these procccds to fund the Acquisition, realized a foreign exchange loss on our Euro cash holdings (3) we During 2010, we settled the majority of our Foster's Group Limited's ("Foster's") (ASX:FGL) total retum swaps, which we used to gain interest exposure to Foster's stock, and rolated option contracts, which we used to limit our exposure to future changes in Foster's stock price. The remaining total return swaps and related options matured in January of 2011 (4) an economic (5) Included in this amount are losses of $2.4 million and $23.8 million for 2013 and 2012, respectively, related to foreign cumrency movements on foreign-denominated financing instruments entered into in conjunction with the financing and the closing of the Acquisition. Additionally, we recorded a net loss of $4.9 million during 2013, related to foreign cash positions and foreign exchange contracts entered into to hedge our risk associated with the payment of this foreign-denominated debt. See Note 13, "Debt" and Note 17, "Derivative Instruments and Hedging Activities" for further discussion of financing and hedging activities ralated to the Acquisition. Additionally, we recorded losses of $0.5 million, $1.4 million and $6.9 million related to ofher foreign exchange and derivative activity during 2013, 2012 and 2011, respectively (6) See Note 17, "Derivative Instruments and Hedging Activities" under "Cross Currency Swaps" sub-heading for further discussion. 7. Income Tax Our income (loss) from continuing operations before income taxes on which the provision for inoome taxes was computed is as follows: For the years ended December 31, 2013 December 29, 2012 December 31, 2011 In millioas) Domestic Foreign 809.7 S (155.2) 712.8 767.2 (120.7) 7.0 Total 654.5 774.2 592.1 Income tax expense (benefit) includes the following current and deferred provisions: For the years ended December 31, 2013 December 29, 2012 December 31, 2011 n miions) Current Federal 39.1 $ 45.5 $ 29.8 State 11.8 8.3 5.7 Foreign Total current tax expense (benefit) 50.7 28.2 25.0 101.6 82.0 60.5 Deferred: Federal 59.6 $ 58.8 47.9 S State 5.1 6.3 2.1 Foreign (82.3) (22.0 18.3 Total deferred tax expense (benefit) $ (17.6) -84,0 S 72,5 38.9 Total income tax expense (benefit) from continuing operations $ 154.5 $ 99.4 96 The decrease in income tax expense in 2013 was resulted from the release of valuation allowances in Canada, as further discussed below, as well as decreases in deferred tax liabilities related to certain intangible assets that were impaired in 2013. primarily driven by the net foreign deferred tax bencfits. These foreign defered tax benefits largely Our income tax expense varies from the amount expected by applying the statutory federal corporate tax rate to income as follows: For the years ended December 31, 2013 Deceimber 29, 2012 December 31, 2011 Statutory Federal income tax rate 35,0% 13% 35,0% 35.0 % State income taxes, net of federal benefits 1.4% 1.6% Bffect of foreign tax rates - (27.4)% (24.5)% 6.8% - (214% (0.4) % Effect of foreign tax law and rate changes Effect of unrecognized tax bencfits 0.5% (1.1)% 3:3% (0.7)% 6.0% 2.1% Change in valuation allowancee (.5% 1.6% % Other, net (0.IY% ;j{ Effective tax rate 12.8% 26.1% 12.8% Our fiscal year effective tax rate was the federal statutory rate of 35% primarily due to the impact of lower effective income tax rates applicable to our foreign businesses and tax plamning. In addition, as part of the Acquisition, the statutory tax rates in the countries of Central Europe, ranging from 9% to 20 % , in which we began doing business drove the 2013 and 2012 change in the effect of foreign tax rates versus 2011. The 2012 foreign tax law and rate chunge impact, primarily relates to the increased statutory corporate income tax rate in Serbia from 10% to 15 % , effective January 1,2013 (enacted in 2012). As a result of the impact of the rate change on differences between the book basis and tax basis of intangible and other assets purchased in the Acquisition, we increased our deferred tax liability by $38.3 million in the fourth quarter of 2012. We recorded additional tax expense in 2012 due to incresses in our valuation allowance related to capital loss caryforwards and operating losses in several of our jurisdictions. See further discussion below. approximately 13% in 2013, 26% in 2012 and 13% in 2011. Our effective tax rates were significantly lower than The table below summarizes our deferred tax assets and liabilities: As of December 31, 2013 December 29, 2012 (In milliaus) Current deferred tax assets: Compensation related obligations Foreign cxchango 1.2 $ 2,9 Accrued liabilities and other 49.4 53.5 Tax loss carryforwards 6.1 Valuation allowance G.0 (20.2) Balance sheet reserves and accruals Other 0.6 Total current doferred tax assets 79.3 42,9 Current deferrod tax liabilitics: Partnership investments Balance sheet reserves and accruals 151.6 160.9 4.5 Other 6:1 (0.1) Total current deferred tax liabilities 167,0 156.0 Net current deferred tax assets Net current deferred tax liabilities 87.7 113,1 97 8. Special Items We have incurred charges or recognized gains that we do not believe to be indicative of our core operations. As such, we have separately classified these charges (benefits) as special items. The table below summarizes special items recorded by segment For the years ended December 31, 2011 December 31, 2013 December 29, 2012 In millions) Emplovee-related charges Restructuring() 0.6 10.1 10,6 $ Canada 2.1 14.5 19.8 Burope 04 3.0 MCI 2.0 1.3 Corporate Special termination benefits Canada(2) Impairments or asset abandonment charges Canada - Intangible asset impairment(3) Europe- Asset abandonment(4) Europe- Intangible asset impairment(5) MCI-China impairiment and related costse Unusual or infreguent items Canada- Flood loss (insurance reimbursement)(7) Canada - BRI loan guarantee adjustment(8) Canada - Fixed asset adjustment9) 5.2 5,0 2.2 17.9 me 150.9 39.2 (6) 0.2 C14) (2.0) 7.6 (3.5) (2.3) (4.2) (2.0) Europe - Release of non-income-related tax reservo(10) Burope-Flood loss (insurance reimbursement)(11) Europe Costs associated with strategic initiatives MCI-Costs associated with outsourcing and other strategic initiatives (0.1) 1,0 Termination fees and other (gainsVlosses Europe- Tradeteam transactions(12) MCI Sale of China joint venture(6) Total Special items, net 13.2 (4.8) S 81.4 12,3 200.0 During 2013, 2012 and 2011, we recognized expenses associated with restructuring programs related to severance and other employee related charges. Sce further discussion of restructuring activitics below. (1) During 2013, 2012 and 2011, we recognized charges for pension curtailment and special termination benefits related to certain defined benefit pension plans in Canada. Sce Note 16, "Employee Retirement Plans and Postretirement Benefits" for impact to our defined benefit pension plans (2) During the fourth quarter of 2013, we recognized an agreement with Miller in Canada. See Note 19, "Commitments and Contingencies" for further discussion. our definite-lived intangible asset associated with our licensing impairment charge related to (3) an asset abandonment charge related to the discontinuation of primary packaging in the U.K. We- During the second quarter of 2012, we recognized determined that our Home Draft package was not meeting expectations driven by a lack of demand in the U.K. market and as a result, we recognized a loss related to the write-off of the Home Draft packaging line, tooling equipment and packaging materials inventory (4) During the third quarter of 2013, we recognized impairment charges related to indefinite-lived intangible assets in Europe. See Note 12, "Goodwill and Intangible Assets" for further discussion (5) 101 In December of 2013, we sold our interest in the MC Sihai joint venture in China and recognized a gain of $6.0 million. The gain consists of the non-cash release of the $5.4 million liability representing the fair value of our remaining investment upon deconsolidation of the joint venture in 2012, as well as $0.6 million of proceeds received for our interest in the joint venturo. We also recognized legal and related fees in relation to the sale of $1.2 million during 2013. In the second quarter of 2012, we recognized impairment charges of $10.4 million related to goodwill snd definite-lived intangible assets in our MC Si'hai joint venture in China, and in the third quarter of 2012, we deconsolidated the joint venture and recognized an impairment loss of $27.6 million upon deconsolidation. See Note 5, "Investments" for further discussion of the deconsolidation and subsequent sale of the joint venture. During 2012, we reccived insurance procoeds in excess of expenses incured related to flood damages at our Toronto offices, During 2011, we incurred expenses in excess of insurance procceds related to these damages. During the second quarter of 2011, wee recognized a $2.0 million gain resulting from a roduction of our guarantee of BRI debt obligations. During the second quarter of 2011, we recognized a $7.6 million loss related to the corection of an immaterial error in prior periods in the Canada segment, resulting from the performance ofa fixed asset count that reduced properties by $13.9 million in 2011. The adjustment also resulted in an increase to goodwill of $6.3 million for the assets identificd as not present as of the Merger date. The impact of the error and the related correction in 2011 was not material to any prior annual or interim financial statements and was not material to the fiscal year results for 2011 During 2009, we established a non-income-related tax reserve of $10.4 million that was recorded as a special item. Our estimates indicated a range of possible loss relative to this reserve of zero to $22.3 million, inclusive of potential penalties and interest. The amounts recorded in 2013, 2012 and (10) 2011 represent the release of this rescrve as a result of a change in estimate. As a result, the remaining amount of this non-income-related tax reserve fully released in 2013. was During 2013, we rocorded lossos and related net costs of $5.4 million in our Europe business related to significant flooding in Czcch Republic in the (11) second quarter of 2013. These losses were offset by $7.4 million insurance proceeds received in 2013. Upon termination of our Tradeteam distribution agreements and subsequent termination of the joint venture and sale of our 49.9 % interest in Tradeteam to DHL, we recognizeda loss of $13.2 million in December 2013. See Note 5, "Investments" for further discussion. (12) In addition to the previously mentioned termination-related items recorded in special items, in the fourth quarter of 2013 we recaived termination notifications from Modelo and Heineken related to our MMI joint venture agreement and contract-brewing agreement, respectively. Upon termination of the MMI joint venture, which is expected to occur at the end of the day on February 28, 2014, we expect to recognize termination fce income of CAD 70.0 million, net of the remaining carrying value of the definite-lived intangible asset, within special items. See Note 5, "Investments" for further discussion. Additionally, we have a contract brewing and kegging agreement with Heincken whereby we produce and package the Foster's and Kronenbourg brands in the U.K. In December 2013, we entered into an agreement with Heineken to early terminate this arrangement. As a result of the termination, Heineken has agreed to pay us an aggregate early termination payment of GBP 13.0 million during and through the end of the transition period, concluding on April 30, 2015, which will bo recognized within special items Restructuring Activities In 2012, we introduced several initiatives focused on increusing our efficiencies and reducing costs across all fanctions of the business in order to develop a more competitive supply chain and global cost structure. Included in these initiatives is a long-term focus on reducing labor and general overhead costs through restructuring activities. We view these restructuring activities as actions to allow us to meet our long-term growth targets by generating future cost savings within cost of goods sold and general and administrative expenses and include organizational changes that strengthen our business and accelerate cfficiencies within our operational structure. As a result of theso restructuring activitics, we have reduced headcount by approximately 910 employees, of which 310 and 600 relate to 2013 and 2012 activities, respectively. Consequently, we recognized severance and other employce related charges during 2013 and 2012, which we have recorded as special items within our consolidated statements of operations. As we continually evaluate our cost structu