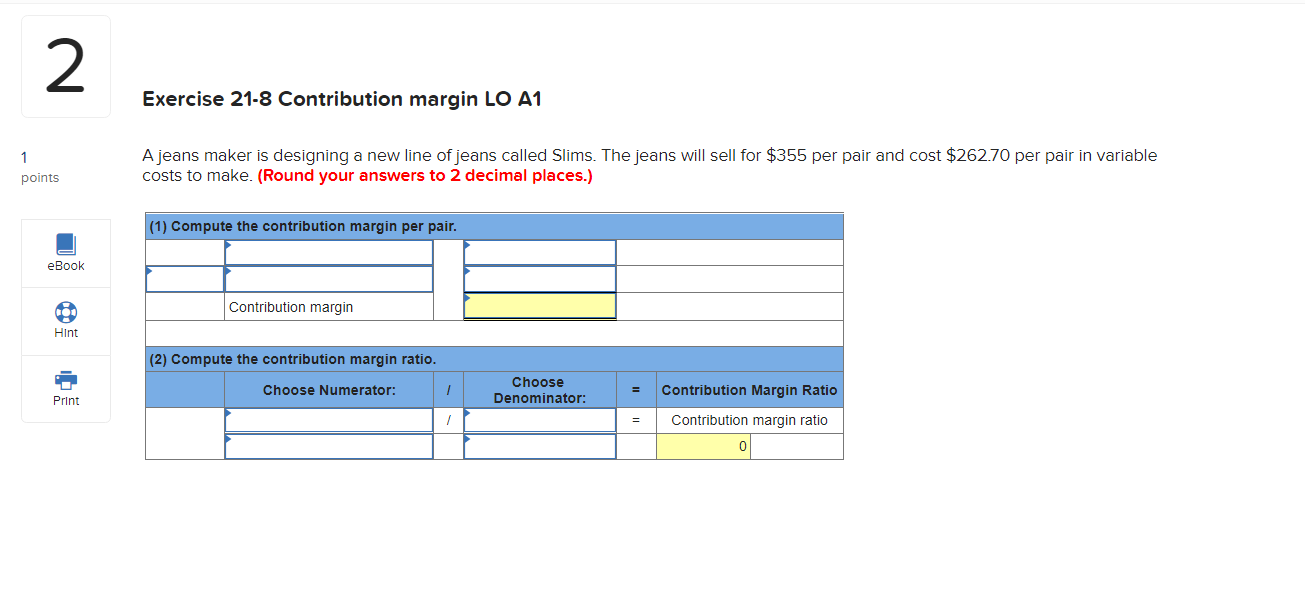

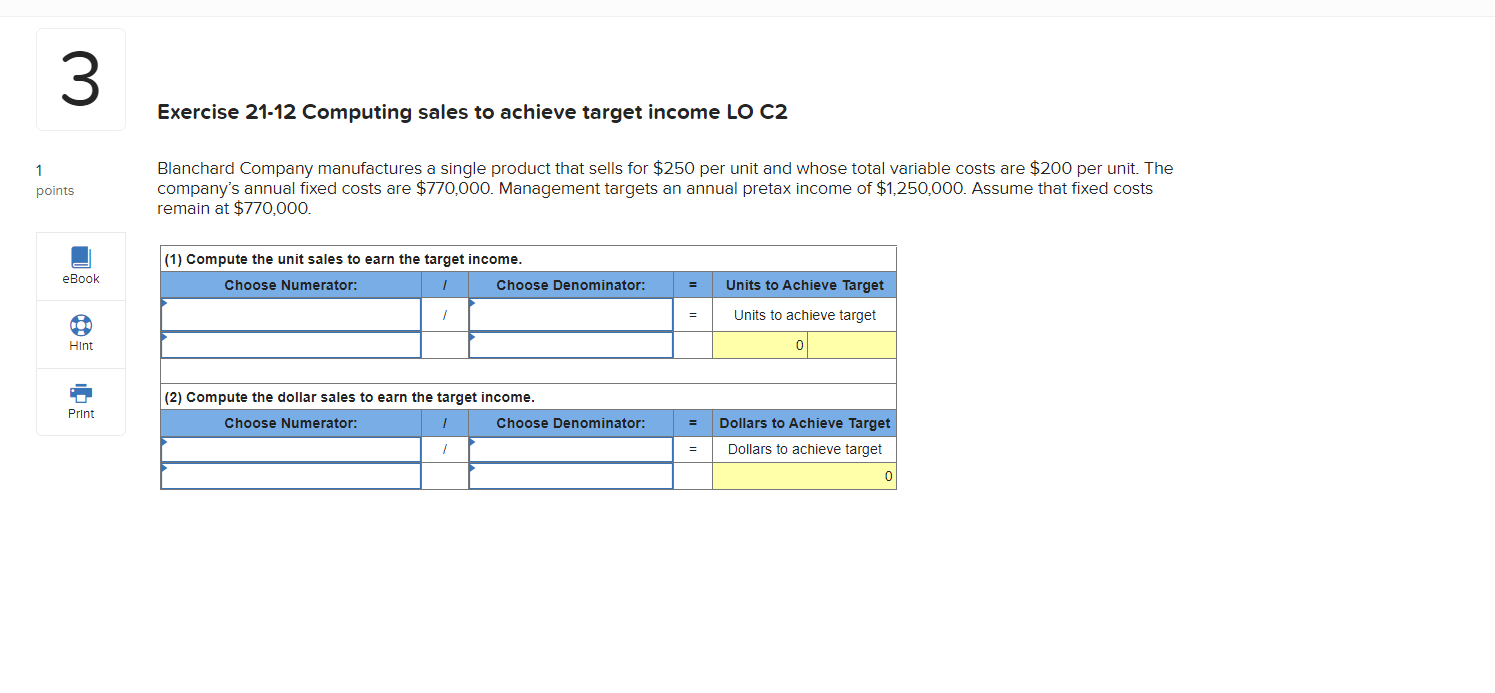

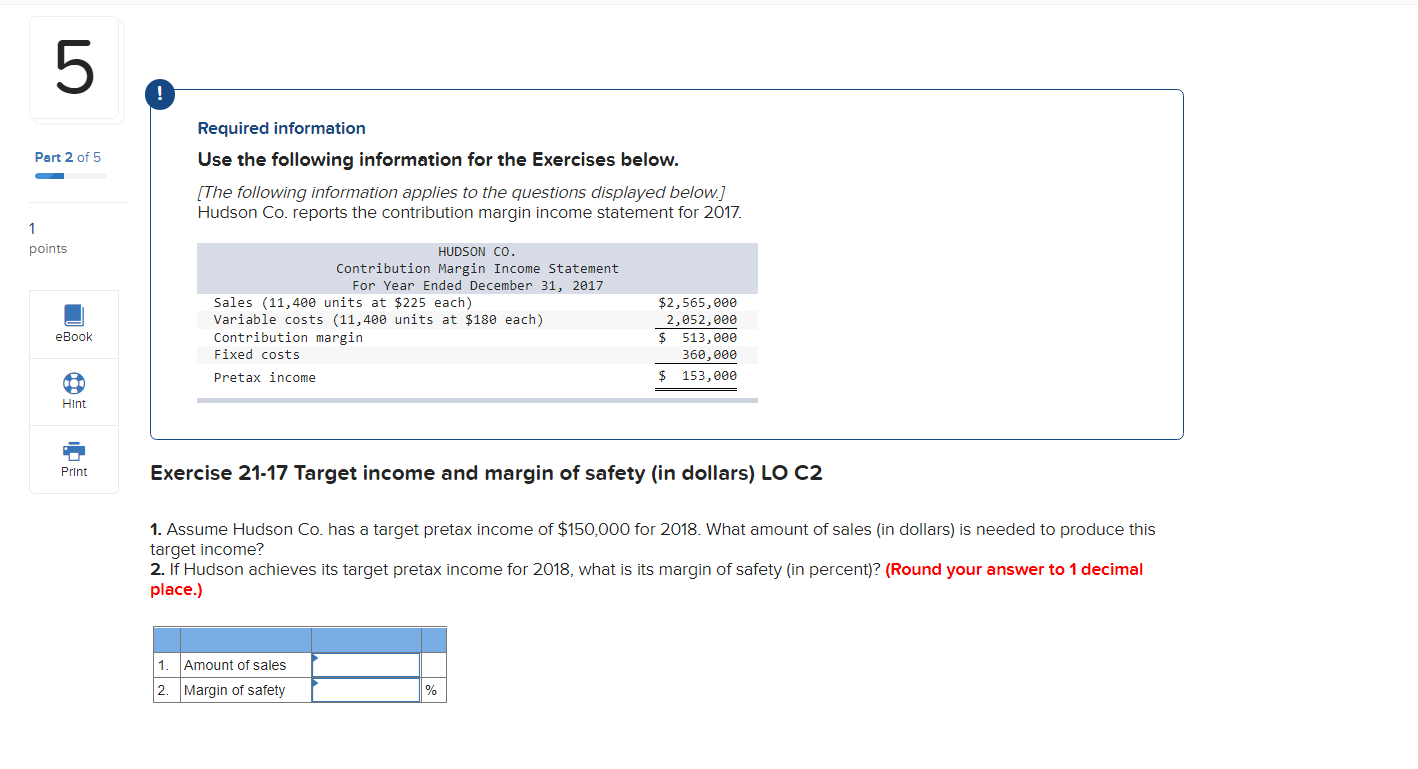

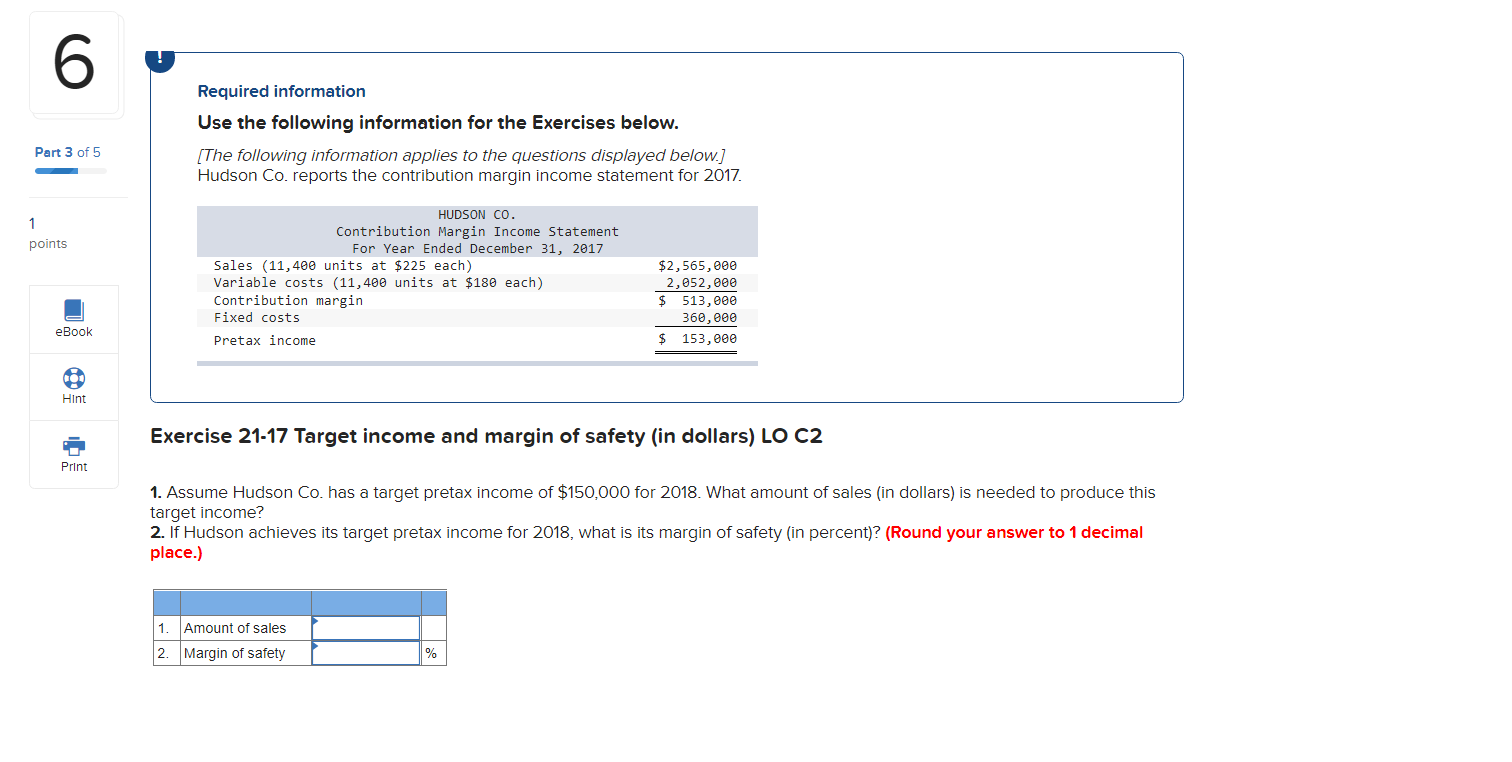

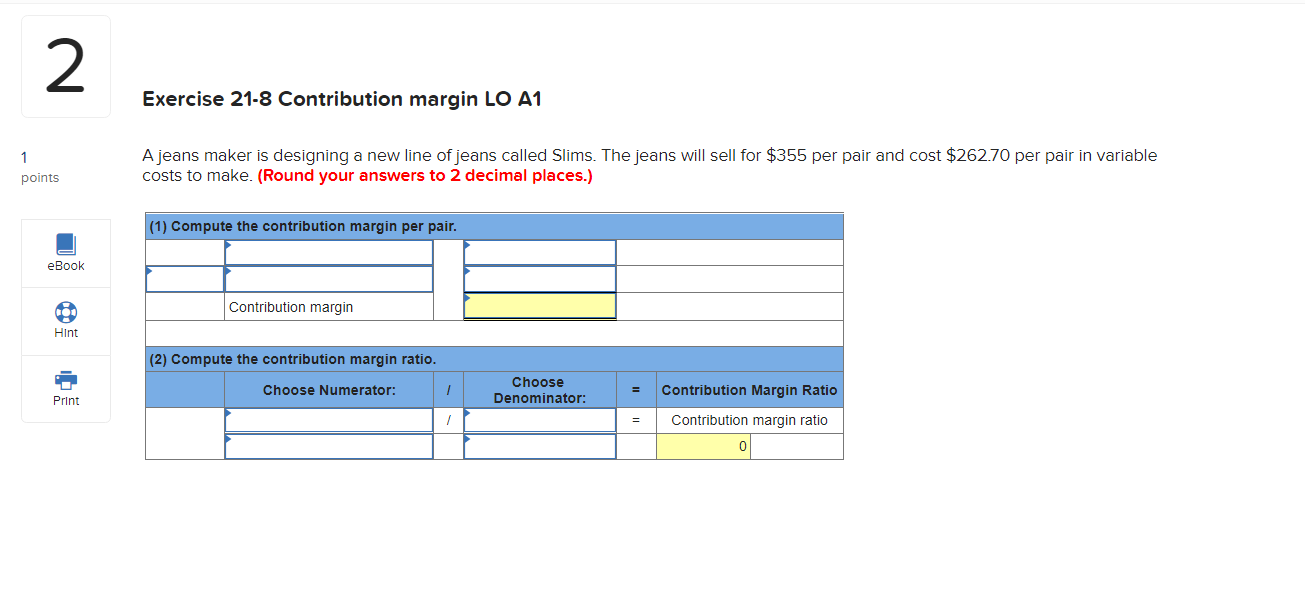

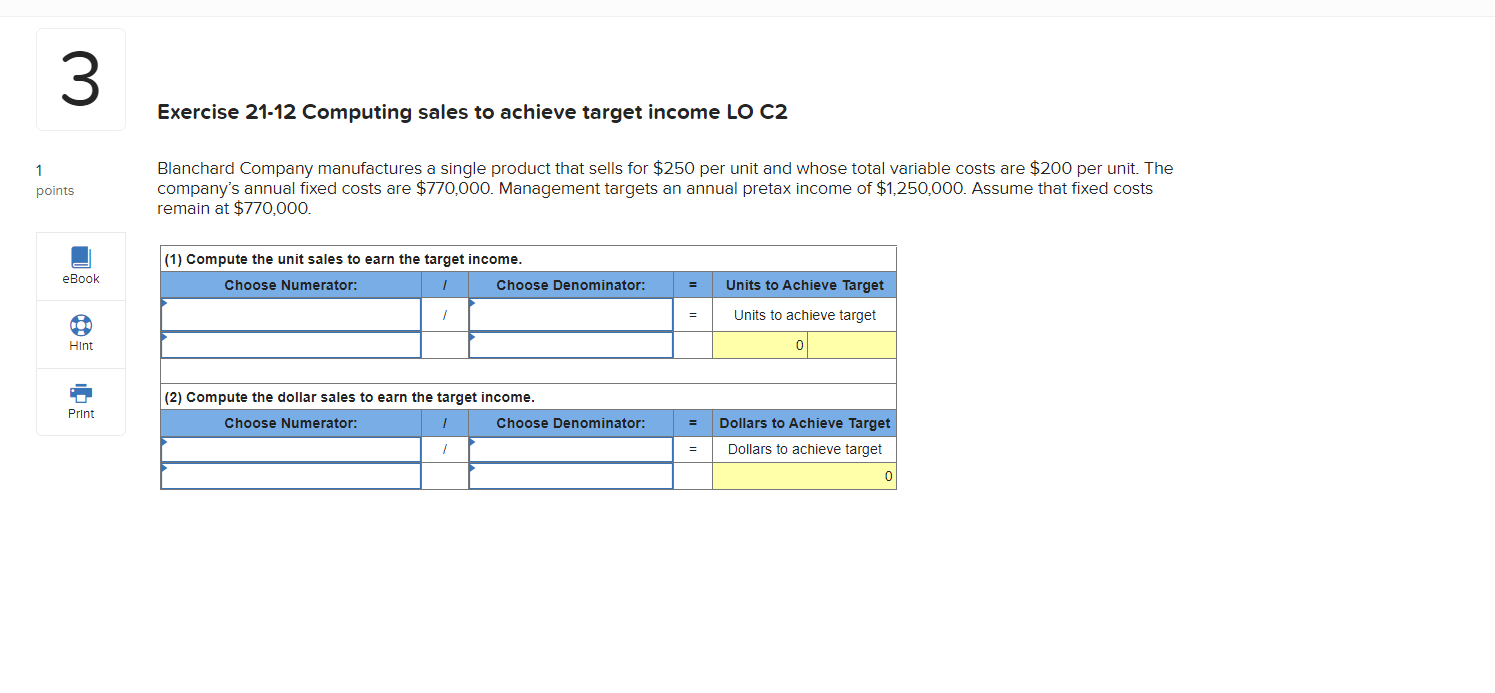

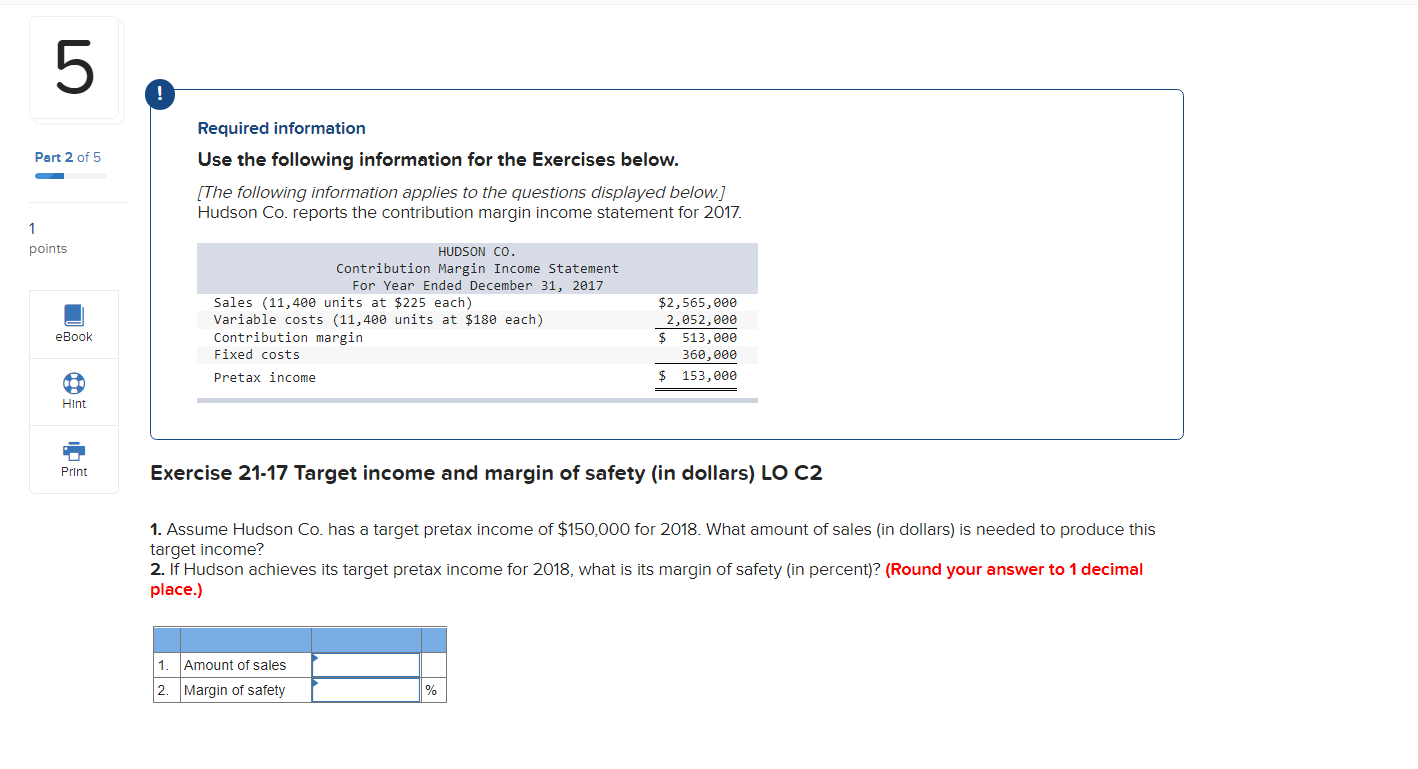

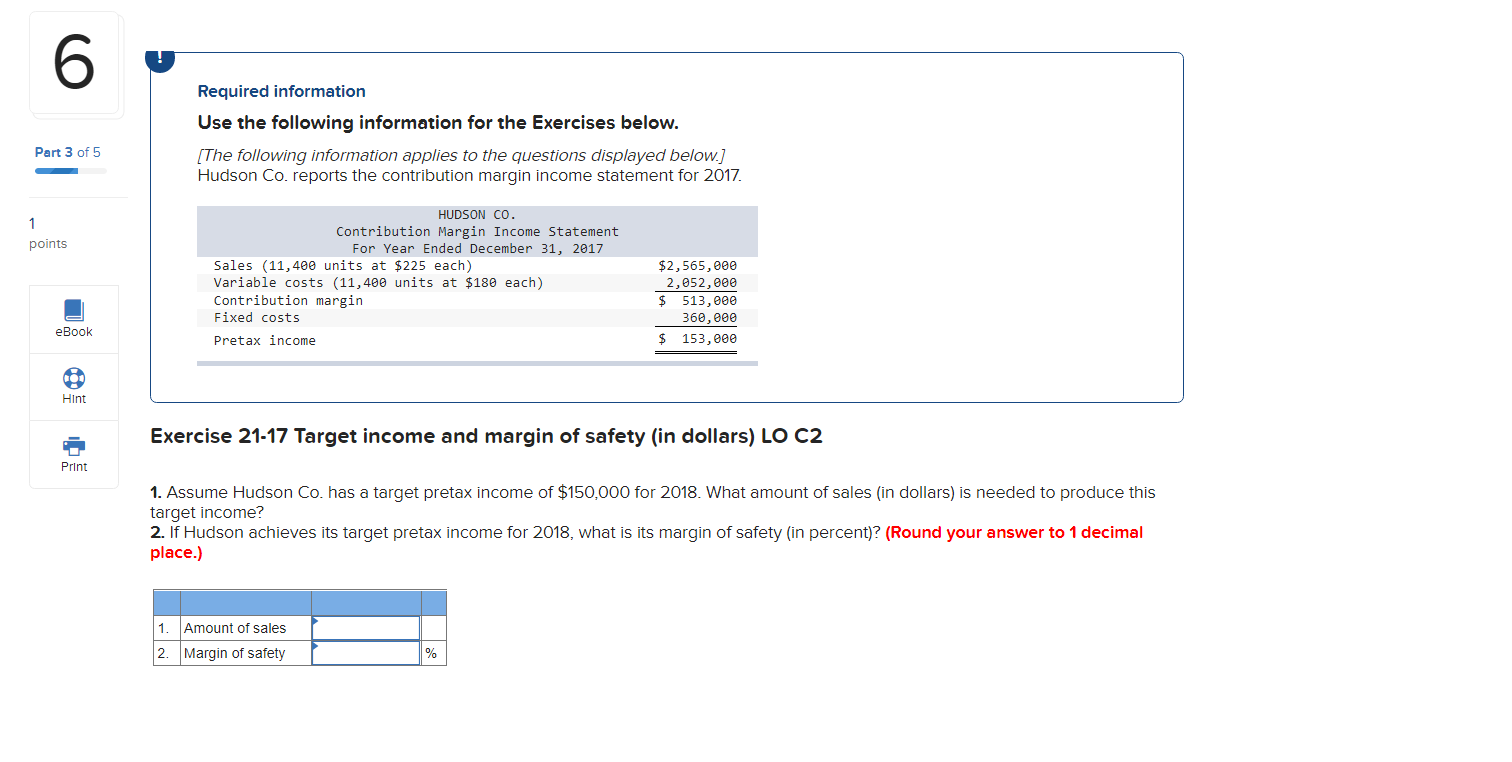

2 Exercise 21-8 Contribution margin LO A1 1 points A jeans maker is designing a new line of jeans called Slims. The jeans will sell for $355 per pair and cost $262.70 per pair in variable costs to make. (Round your answers to 2 decimal places.) (1) Compute the contribution margin per pair. eBook Contribution margin Hint (2) Compute the contribution margin ratio. Choose Numerator: 1 Choose Denominator: Contribution Margin Ratio Print 1 Contribution margin ratio 0 3 Exercise 21-12 Computing sales to achieve target income LO C2 1 points Blanchard Company manufactures a single product that sells for $250 per unit and whose total variable costs are $200 per unit. The company's annual fixed costs are $770,000. Management targets an annual pretax income of $1,250,000. Assume that fixed costs remain at $770,000. (1) Compute the unit sales to earn the target income. Choose Numerator: 1 Choose Denominator: eBook Units to Achieve Target / Units to achieve target op Hint Print (2) Compute the dollar sales to earn the target income. Choose Numerator: Choose Denominator: Dollars to Achieve Target Dollars to achieve target UT 5 Part 2 of 5 Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Hudson Co. reports the contribution margin income statement for 2017. 1 points HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2017 Sales (11,400 units at $225 each) Variable costs (11,400 units at $180 each) Contribution margin Fixed costs Pretax income eBook $2,565,000 2,052,000 $ 513,000 360,000 $ 153,000 Hint Print Exercise 21-17 Target income and margin of safety (in dollars) LO C2 1. Assume Hudson Co. has a target pretax income of $150,000 for 2018. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target pretax income for 2018, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) 1. Amount of sales 2. Margin of safety % 6 Required information Use the following information for the Exercises below. (The following information applies to the questions displayed below.] Hudson Co. reports the contribution margin income statement for 2017. Part 3 of 5 1 points HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2017 Sales (11,400 units at $225 each) Variable costs (11,400 units at $180 each) Contribution margin Fixed costs Pretax income $2,565,000 2,052,000 $ 513,000 360,000 $ 153,000 eBook 101 Hint Exercise 21-17 Target income and margin of safety (in dollars) LO C2 Print 1. Assume Hudson Co. has a target pretax income of $150,000 for 2018. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target pretax income for 2018, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) 1. Amount of sales 2. Margin of safety %