2.

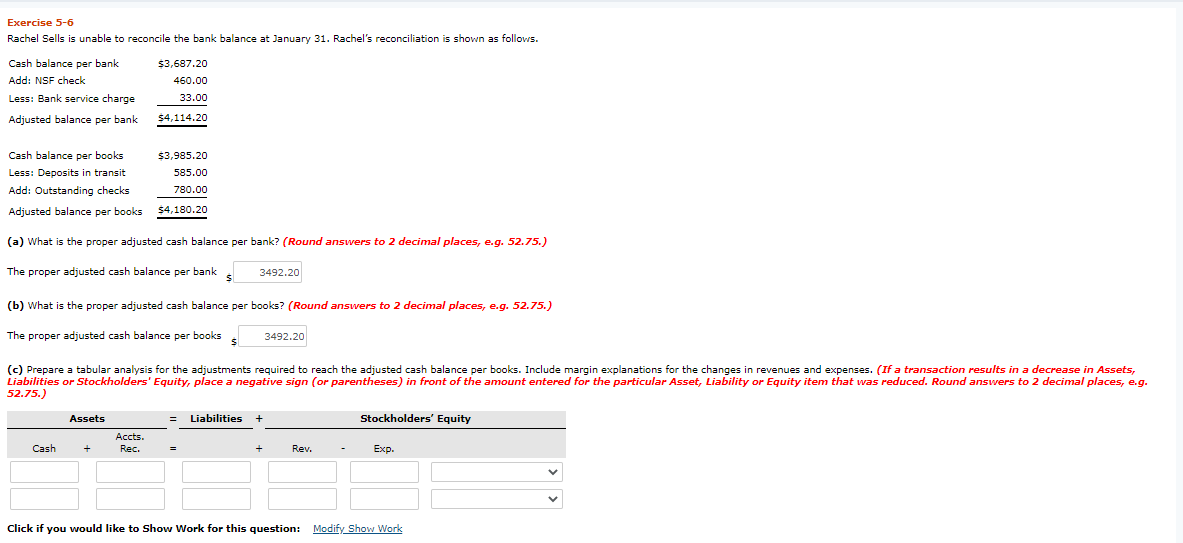

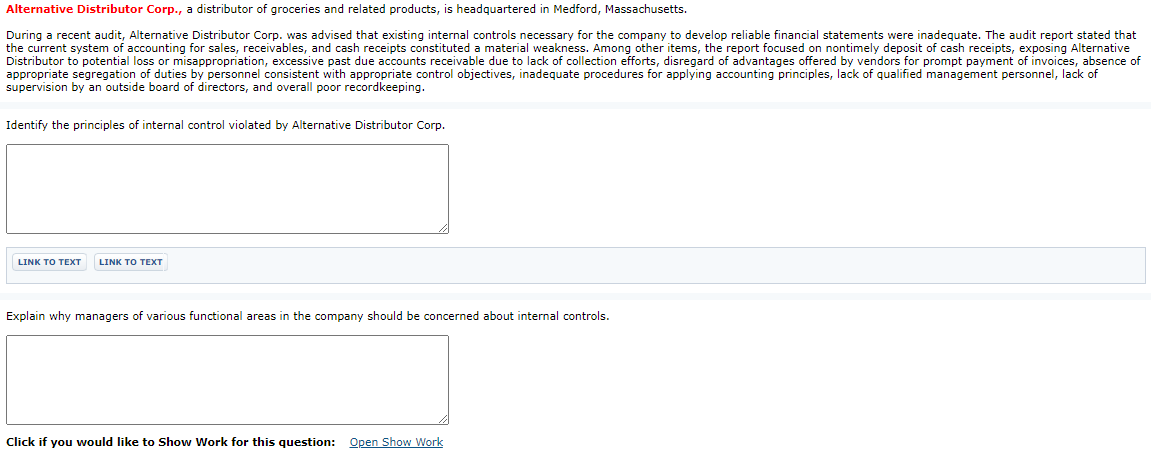

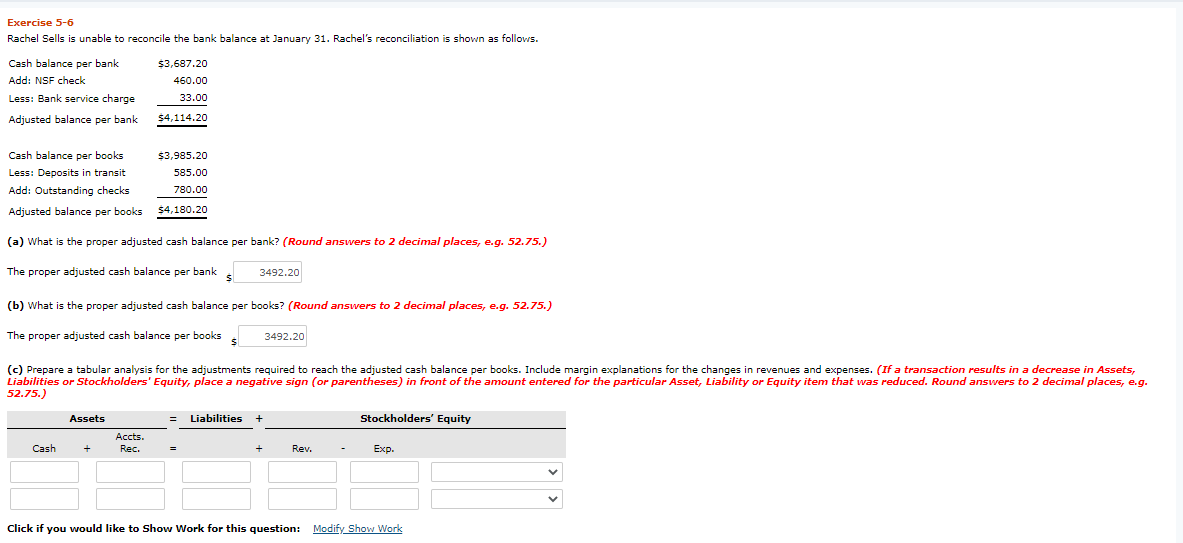

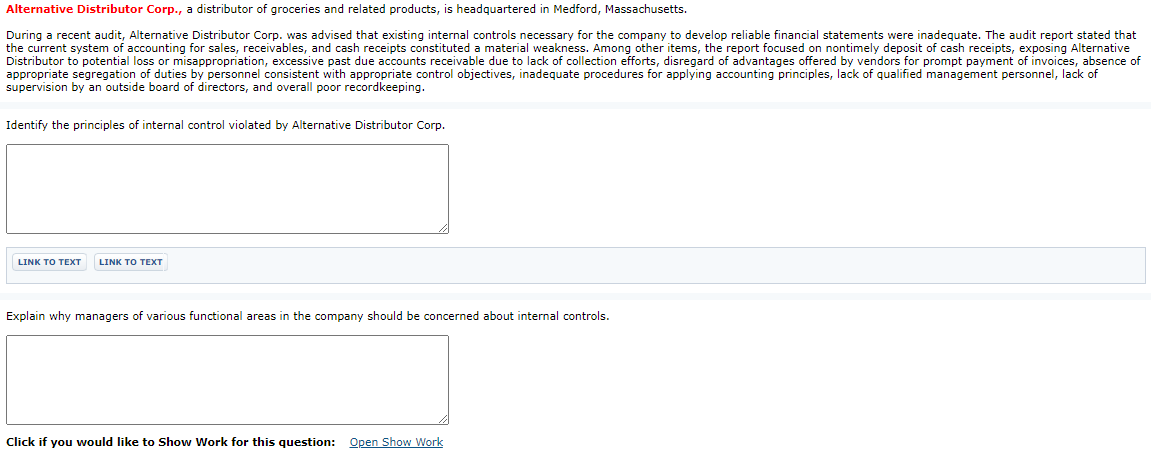

Exercise 5-6 Rachel Sells is unable to reconcile the bank balance at January 31. Rachel's reconciliation is shown as follows. Cash balance per bank Add: NSF check Less: Bank service charge $3,687.20 460.00 33.00 Adjusted balance per bank $4,114.20 Cash balance per books Less: Deposits in transit Add: Outstanding checks Adjusted balance per books $3.985.20 585.00 780.00 $4,180.20 (a) What is the proper adjusted cash balance per bank? (Round answers to 2 decimal places, e.g. 52.75.) The proper adjusted cash balance per bank s 3492.20 (b) What is the proper adjusted cash balance per books? (Round answers to 2 decimal places, e.g. 52.75.) The proper adjusted cash balance per books 3492.20 (c) Prepare a tabular analysis for the adjustments required to reach the adjusted cash balance per books. Include margin explanations for the changes in revenues and expenses. (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to 2 decimal places, e.g. 52.75.) Assets Liabilities Stockholders' Equity Accts. Cash Rec. + Rev. Exp. + + - Click you would like to Show Work for this question: Modify Show Work Alternative Distributor Corp., a distributor of groceries and related products, is headquartered in Medford, Massachusetts. During a recent audit, Alternative Distributor Corp. was advised that existing internal controls necessary for the company to develop reliable financial statements were inadequate. The audit report stated that the current system of accounting for sales, receivables, and cash receipts constituted a material weakness. Among other items, the report focused on nontimely deposit of cash receipts, exposing Alternative Distributor to potential loss or misappropriation, excessive past due accounts receivable due to lack of collection efforts, disregard of advantages offered by vendors for prompt payment of invoices, absence of appropriate segregation of duties by personnel consistent with appropriate control objectives, inadequate procedures for applying accounting principles, lack of qualified management personnel, lack of supervision by an outside board of directors, and overall poor recordkeeping. Identify the principles of internal control violated by Alternative Distributor Corp. LINK TO TEXT LINK TO TEXT Explain why managers of various functional areas in the company should be concerned about internal controls. Click if you would like to Show Work for this question: Open Show Work