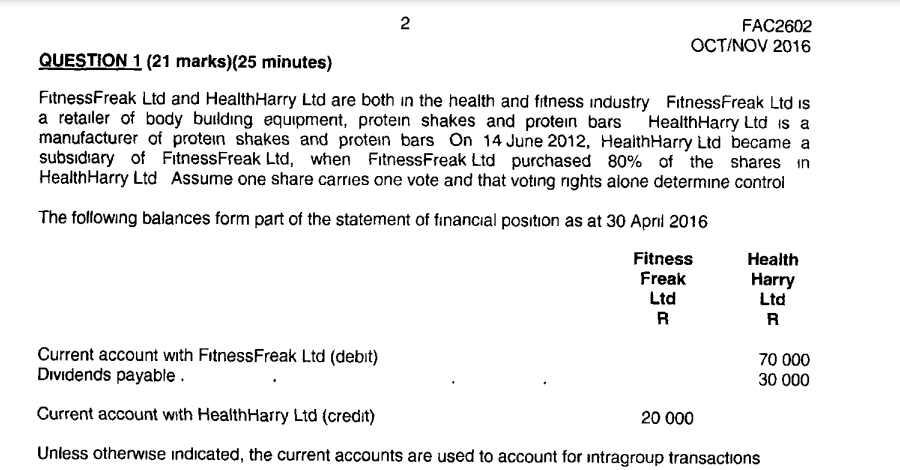

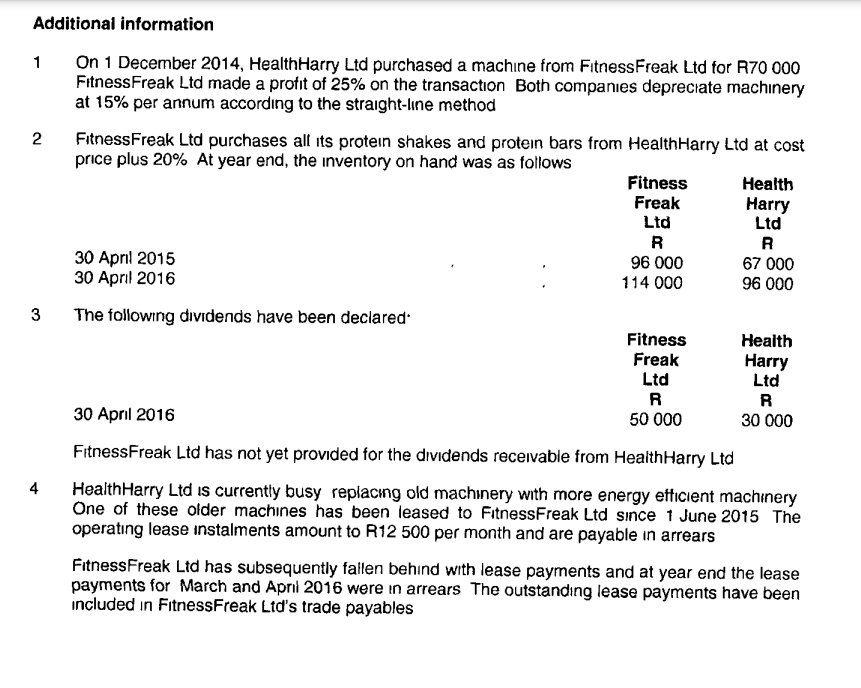

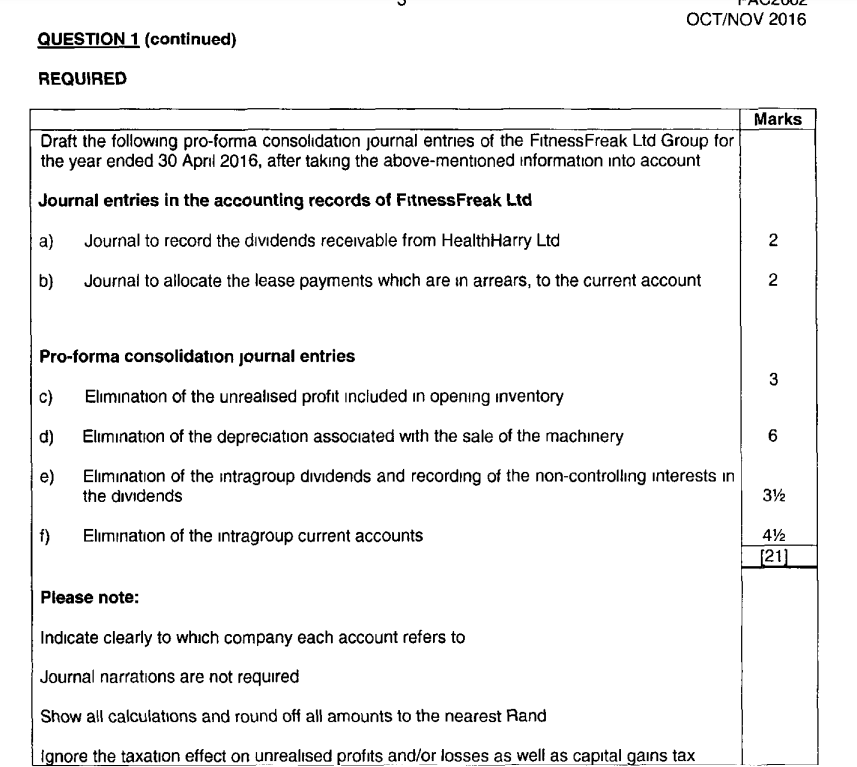

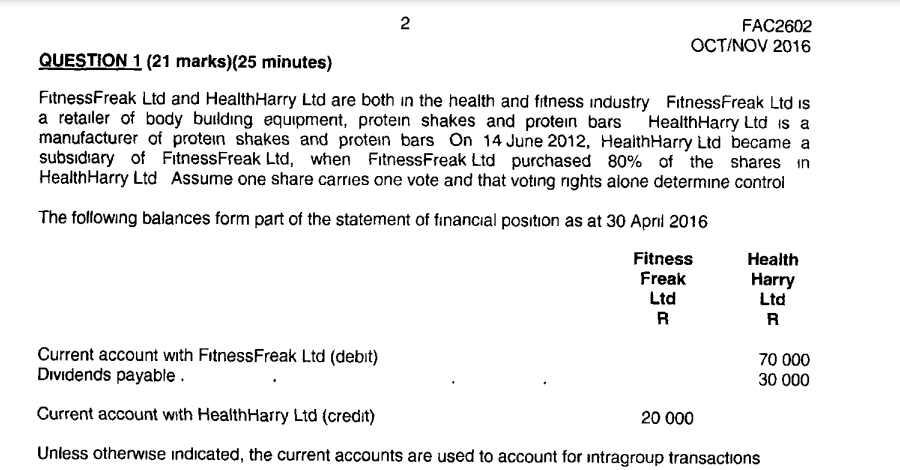

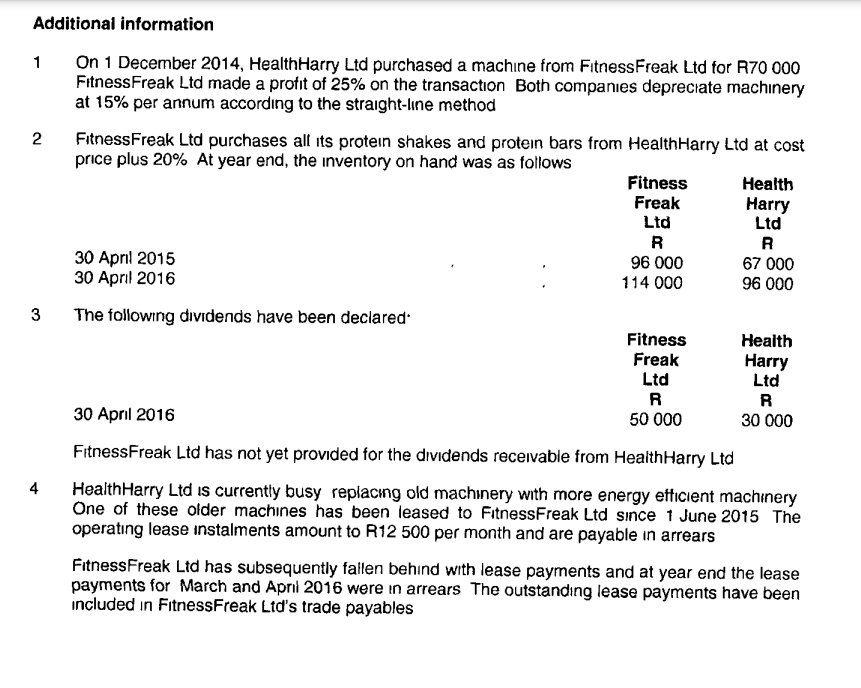

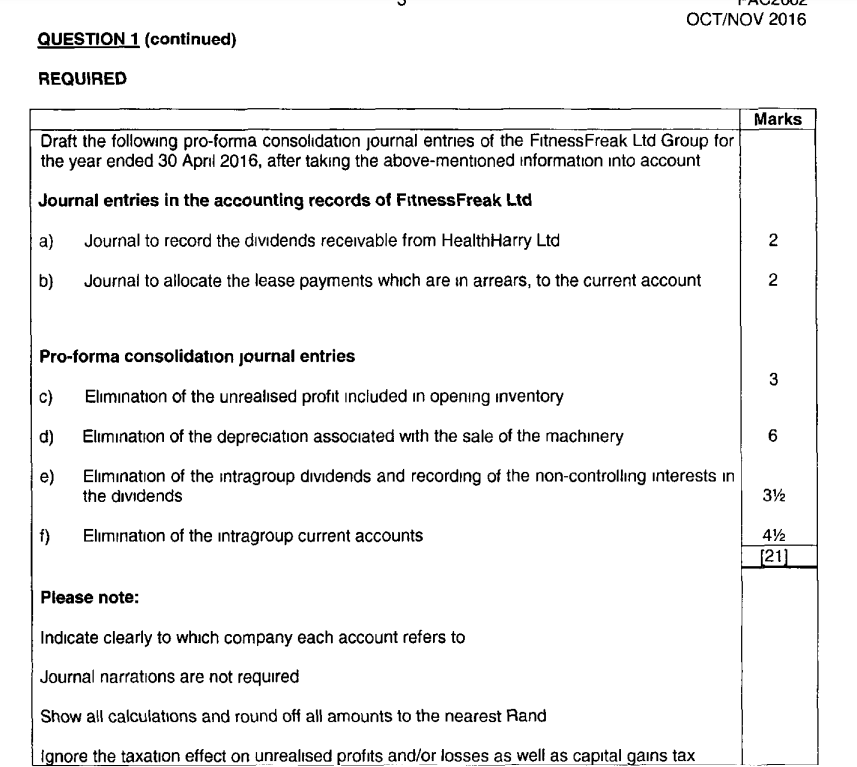

2 FAC2602 OCT/NOV 2016 QUESTION 1 (21 marks) (25 minutes) FitnessFreak Ltd and HealthHarry Ltd are both in the health and fitness industry FitnessFreak Ltd is a retailer of body building equipment, protein shakes and protein bars HealthHarry Ltd is a manufacturer of protein shakes and protein bars On 14 June 2012, HealthHarry Ltd became a subsidiary of FitnessFreak Ltd, when FitnessFreak Ltd purchased 80% of the shares in HealthHarry Ltd Assume one share carries one vote and that voting rights alone determine control The following balances form part of the statement of financial position as at 30 April 2016 Fitness Health Freak Harry Ltd Ltd R R 70 000 Current account with FitnessFreak Ltd (debit) Dividends payable. 30 000 Current account with HealthHarry Ltd (credit) 20 000 Unless otherwise indicated, the current accounts are used to account for intragroup transactions Additional information 1 On 1 December 2014, HealthHarry Ltd purchased a machine from FitnessFreak Ltd for R70 000 FitnessFreak Ltd made a profit of 25% on the transaction Both companies depreciate machinery at 15% per annum according to the straight-line method 2 FitnessFreak Ltd purchases all its protein shakes and protein bars from HealthHarry Ltd at cost price plus 20% At year end, the inventory on hand was as follows Fitness Health Freak Harry Ltd Ltd R R 96 000 67 000 30 April 2015 30 April 2016 114 000 96 000 The following dividends have been declared Fitness Health Freak Harry Ltd Ltd R R 30 April 2016 50 000 30 000 FitnessFreak Ltd has not yet provided for the dividends receivable from Health Harry Ltd 4 HealthHarry Ltd is currently busy replacing old machinery with more energy efficient machinery One of these older machines has been leased to FitnessFreak Ltd since 1 June 2015 The operating lease instalments amount to R12 500 per month and are payable in arrears FitnessFreak Ltd has subsequently fallen behind with lease payments and at year end the lease payments for March and April 2016 were in arrears The outstanding lease payments have been included in FitnessFreak Ltd's trade payables 3 2 OCT/NOV 2016 QUESTION 1 (continued) REQUIRED Marks Draft the following pro-forma consolidation journal entries of the FitnessFreak Ltd Group for the year ended 30 April 2016, after taking the above-mentioned information into account Journal entries in the accounting records of FitnessFreak Ltd a) Journal to record the dividends receivable from HealthHarry Ltd 2 b) Journal to allocate the lease payments which are in arrears, to the current account 2 Pro-forma consolidation journal entries 3 c) Elimination of the unrealised profit included in opening inventory d) Elimination of the depreciation associated with the sale of the machinery 6 e) Elimination of the intragroup dividends and recording of the non-controlling interests in the dividends 3 f) 4 Elimination of the intragroup current accounts [21] Please note: Indicate clearly to which company each account refers to Journal narrations are not required Show all calculations and round off all amounts to the nearest Rand Ignore the taxation effect on unrealised profits and/or losses as well as capital gains tax 2 FAC2602 OCT/NOV 2016 QUESTION 1 (21 marks) (25 minutes) FitnessFreak Ltd and HealthHarry Ltd are both in the health and fitness industry FitnessFreak Ltd is a retailer of body building equipment, protein shakes and protein bars HealthHarry Ltd is a manufacturer of protein shakes and protein bars On 14 June 2012, HealthHarry Ltd became a subsidiary of FitnessFreak Ltd, when FitnessFreak Ltd purchased 80% of the shares in HealthHarry Ltd Assume one share carries one vote and that voting rights alone determine control The following balances form part of the statement of financial position as at 30 April 2016 Fitness Health Freak Harry Ltd Ltd R R 70 000 Current account with FitnessFreak Ltd (debit) Dividends payable. 30 000 Current account with HealthHarry Ltd (credit) 20 000 Unless otherwise indicated, the current accounts are used to account for intragroup transactions Additional information 1 On 1 December 2014, HealthHarry Ltd purchased a machine from FitnessFreak Ltd for R70 000 FitnessFreak Ltd made a profit of 25% on the transaction Both companies depreciate machinery at 15% per annum according to the straight-line method 2 FitnessFreak Ltd purchases all its protein shakes and protein bars from HealthHarry Ltd at cost price plus 20% At year end, the inventory on hand was as follows Fitness Health Freak Harry Ltd Ltd R R 96 000 67 000 30 April 2015 30 April 2016 114 000 96 000 The following dividends have been declared Fitness Health Freak Harry Ltd Ltd R R 30 April 2016 50 000 30 000 FitnessFreak Ltd has not yet provided for the dividends receivable from Health Harry Ltd 4 HealthHarry Ltd is currently busy replacing old machinery with more energy efficient machinery One of these older machines has been leased to FitnessFreak Ltd since 1 June 2015 The operating lease instalments amount to R12 500 per month and are payable in arrears FitnessFreak Ltd has subsequently fallen behind with lease payments and at year end the lease payments for March and April 2016 were in arrears The outstanding lease payments have been included in FitnessFreak Ltd's trade payables 3 2 OCT/NOV 2016 QUESTION 1 (continued) REQUIRED Marks Draft the following pro-forma consolidation journal entries of the FitnessFreak Ltd Group for the year ended 30 April 2016, after taking the above-mentioned information into account Journal entries in the accounting records of FitnessFreak Ltd a) Journal to record the dividends receivable from HealthHarry Ltd 2 b) Journal to allocate the lease payments which are in arrears, to the current account 2 Pro-forma consolidation journal entries 3 c) Elimination of the unrealised profit included in opening inventory d) Elimination of the depreciation associated with the sale of the machinery 6 e) Elimination of the intragroup dividends and recording of the non-controlling interests in the dividends 3 f) 4 Elimination of the intragroup current accounts [21] Please note: Indicate clearly to which company each account refers to Journal narrations are not required Show all calculations and round off all amounts to the nearest Rand Ignore the taxation effect on unrealised profits and/or losses as well as capital gains tax