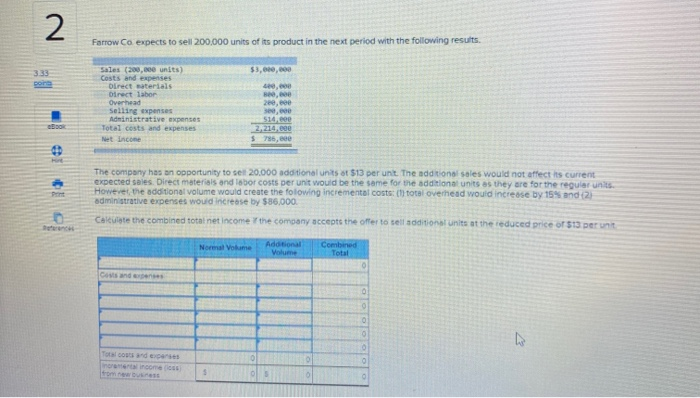

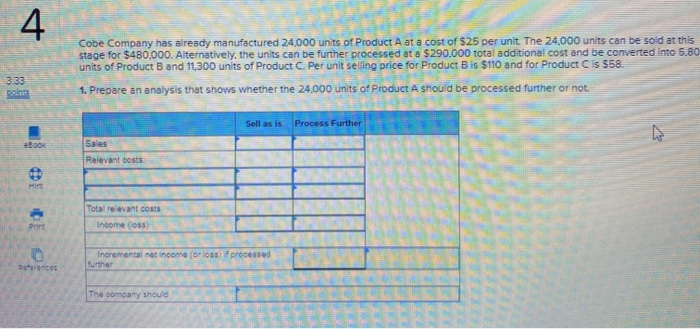

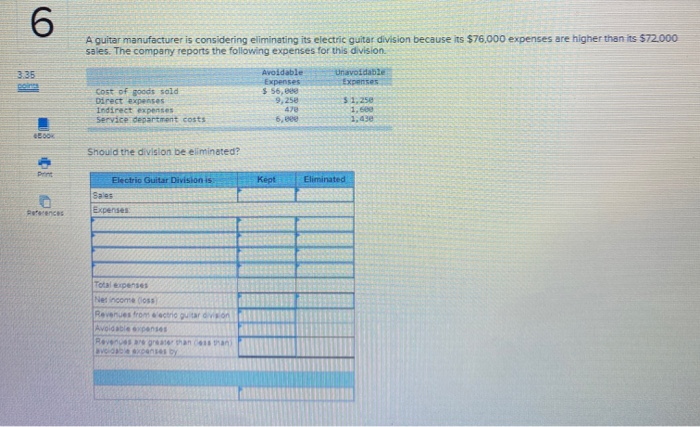

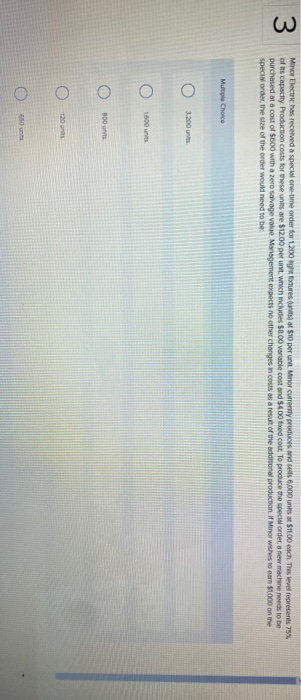

2 Farrow Co expects to sell 200,000 units of its product in the next period with the following results $3,000,00 3.33 port Sales (200,000 units) Costs and expenses Direct materials Direct labor Overhead Selling expenses Administrative expenses Total costs and expenses Net Income 80, 200, 300,000 514.ee 21210.000 $ 78,000 The company has an opportunity to set 20,000 additional units of $13 per unit. The additional sales would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units However, the additional volume would create the folowing incremental costs: (total overhead would increase by 15% and 2) administrative expenses would increase by $86,000 Calculate the combined total net income the company accept the offer to tell additional units at the reduced price of 513 perunt Normal Volume Additional Volume Combined Total 0 O To out and conses re 4 Cobe Company has already manufactured 24,000 units of Product A at a cost of $25 per unit. The 24.000 units can be sold at this stage for $480,000. Alternatively, the units can be further processed at a $290,000 total additional cost and be converted into 5.80 units of Product B and 11,300 units of Product C. Per unit selling price for Product B is $110 and for Product is $58. 1. Prepare an analysis that shows whether the 24.000 units of Product A should be processed further or not. 333 Sell as is Process Further Boos Sales Relevant costs Hint Total relevant costs Income (0) Print o Incrementai net income (or loss processed References The company should 6 A guitar manufacturer is considering eliminating its electric guitar division because its $76,000 expenses are higher than its $72.000 sales. The company reports the following expenses for this division 335 Unavoidable Expenses Cost of goods sold Direct expenses Indirect expenses Service department costs Avoidable Expenses $ 56, de 9,250 51,250 1.se 6. Should the division be eliminated? Print Kept Eliminated Electric Guitar Division is Sales Expenses References Total expenses Net income oss Revenues from a trio outro Avoidable expenses Rovena 15 ve energy 3 Minor Electric has received a special one-time order for 200 stures units) at $10 per unit Minor currently produces and sells 6,000 units of $11.00 each. This level represents 75% of its capacity Production costs for these units are $12.00 per unnt which includes $8.00 variable cost and $400 fred code to produce the special order a new machine needs to be purchased at a cost of $600 with a zero salvage Value Management expects no other changes in costs as a result of the adamsonal production of Minor wishes to earn $1000 on the special order, the size of the order would need to be Multiple Choice 3.200 units 00 300 units 120