Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 FERGS Plc has export orders from a company in Singapore for 300,000 widgets and from a company in Indonesia for 150,000 widgets. The

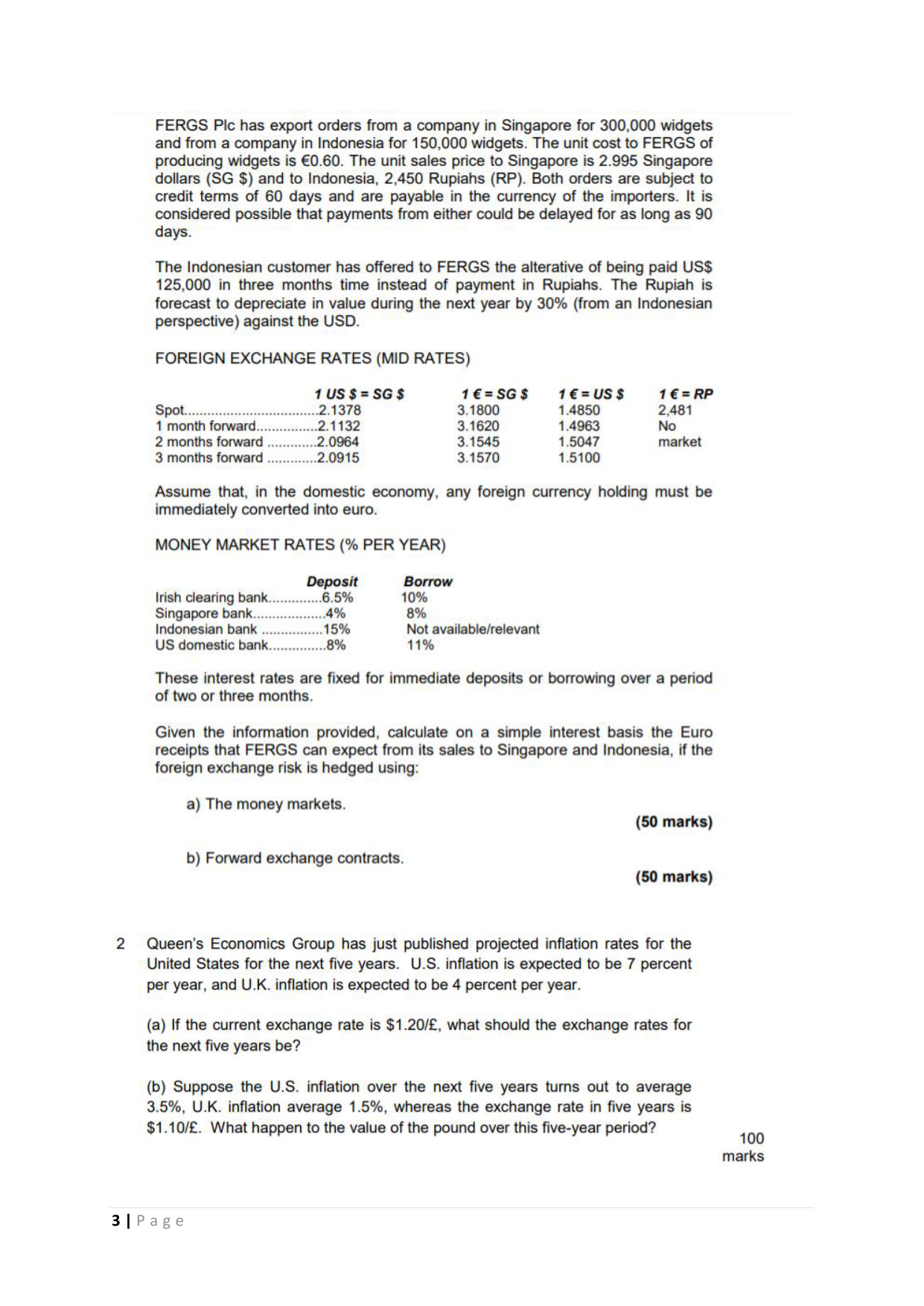

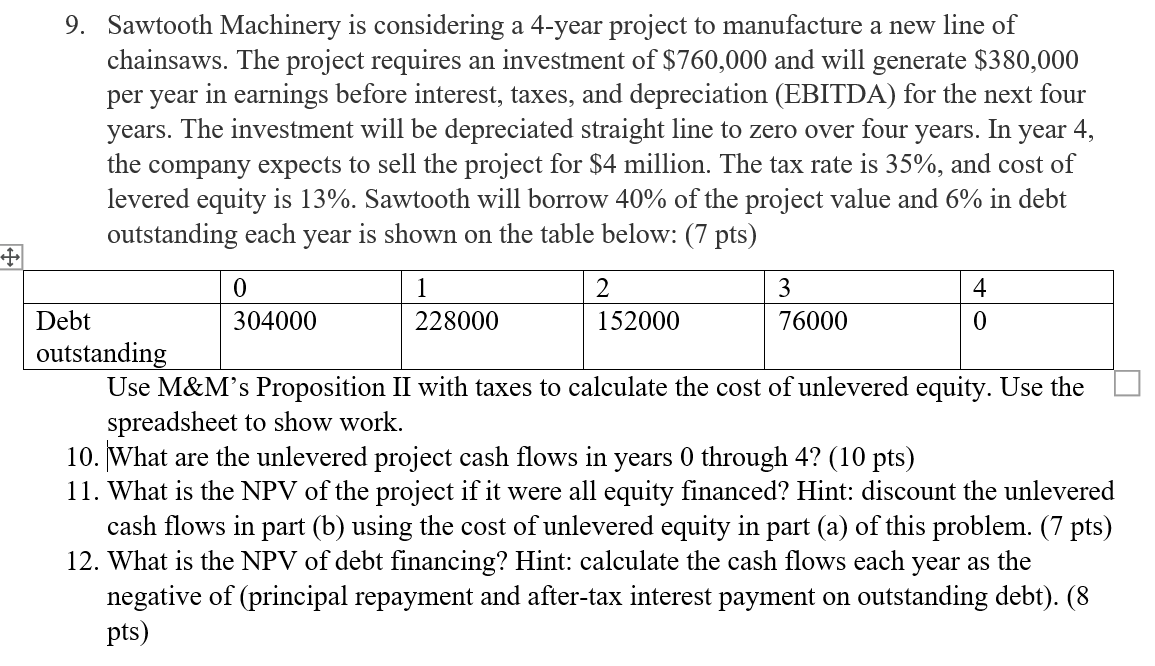

2 FERGS Plc has export orders from a company in Singapore for 300,000 widgets and from a company in Indonesia for 150,000 widgets. The unit cost to FERGS of producing widgets is 0.60. The unit sales price to Singapore is 2.995 Singapore dollars (SG $) and to Indonesia, 2,450 Rupiahs (RP). Both orders are subject to credit terms of 60 days and are payable in the currency of the importers. It is considered possible that payments from either could be delayed for as long as 90 days. The Indonesian customer has offered to FERGS the alterative of being paid US$ 125,000 in three months time instead of payment in Rupiahs. The Rupiah is forecast to depreciate in value during the next year by 30% (from an Indonesian perspective) against the USD. FOREIGN EXCHANGE RATES (MID RATES) 1 US $ = SG $ Spot......... .2.1378 1 month forward.... ..2.1132 2 months forward 2.0964 3 months forward ..2.0915 1 = SG $ 1 = US $ 3.1800 1.4850 1= RP 2,481 3.1620 1.4963 No 3.1545 1.5047 market 3.1570 1.5100 Assume that, in the domestic economy, any foreign currency holding must be immediately converted into euro. MONEY MARKET RATES (% PER YEAR) Deposit Borrow Irish clearing bank.. .6.5% 10% Singapore bank. .4% 8% Indonesian bank .15% US domestic bank.. .8% Not available/relevant 11% These interest rates are fixed for immediate deposits or borrowing over a period of two or three months. Given the information provided, calculate on a simple interest basis the Euro receipts that FERGS can expect from its sales to Singapore and Indonesia, if the foreign exchange risk is hedged using: a) The money markets. b) Forward exchange contracts. (50 marks) (50 marks) Queen's Economics Group has just published projected inflation rates for the United States for the next five years. U.S. inflation is expected to be 7 percent per year, and U.K. inflation is expected to be 4 percent per year. (a) If the current exchange rate is $1.20/, what should the exchange rates for the next five years be? (b) Suppose the U.S. inflation over the next five years turns out to average 3.5%, U.K. inflation average 1.5%, whereas the exchange rate in five years is $1.10/. What happen to the value of the pound over this five-year period? 3| Page 100 marks + 9. Sawtooth Machinery is considering a 4-year project to manufacture a new line of chainsaws. The project requires an investment of $760,000 and will generate $380,000 per year in earnings before interest, taxes, and depreciation (EBITDA) for the next four years. The investment will be depreciated straight line to zero over four years. In year 4, the company expects to sell the project for $4 million. The tax rate is 35%, and cost of levered equity is 13%. Sawtooth will borrow 40% of the project value and 6% in debt outstanding each year is shown on the table below: (7 pts) Debt outstanding 0 304000 1 228000 2 152000 3 4 76000 0 Use M&M's Proposition II with taxes to calculate the cost of unlevered equity. Use the spreadsheet to show work. 10. What are the unlevered project cash flows in years 0 through 4? (10 pts) 11. What is the NPV of the project if it were all equity financed? Hint: discount the unlevered cash flows in part (b) using the cost of unlevered equity in part (a) of this problem. (7 pts) 12. What is the NPV of debt financing? Hint: calculate the cash flows each year as the negative of (principal repayment and after-tax interest payment on outstanding debt). (8 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculating Euro Receipts for FERGS a Using Money Markets Singapore Unit Sales Price SG 2995 Conversion Rate 1 SG 31800 Euro Receipts per Widget SG 2995 31800 09427673 Total Euro Receipts for 300000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started