#2

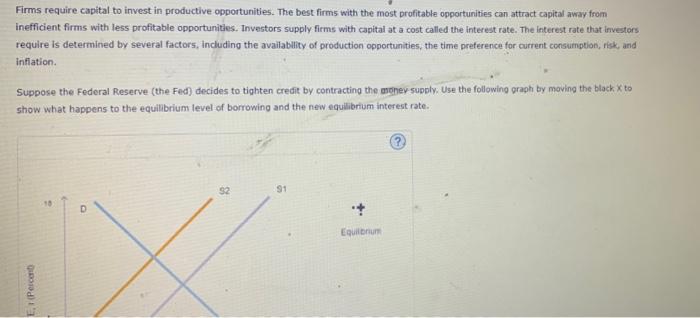

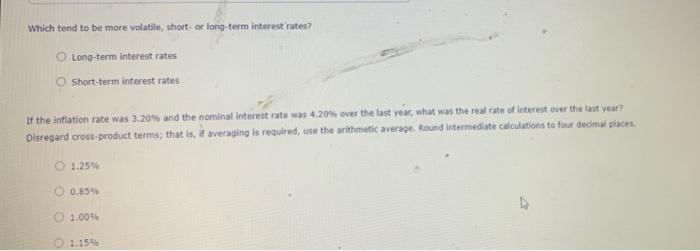

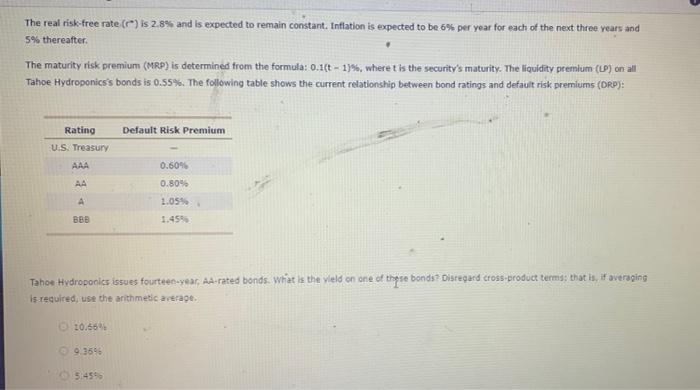

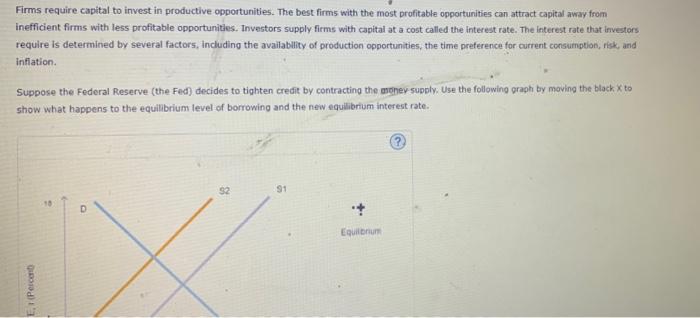

Firms require capital to invest in productive opportunities. The best firms with the most profitable opportunities can attract capital away from inefficient firms with less profitable opportunities. Investors supply firms with capital at a cost called the interest rate. The interest rate that investors require is determined by several factors, including the availability of production opportunities, the time preference for current consumption, risk, and inflation Suppose the Federal Reserve (the Fed) decides to tighten credit by contracting the money supply. Use the following graph by moving the black X to show what happens to the equilibrium level of borrowing and the new equilibrium interest rate 52 91 18 D Equilibrium E. (Percent 10 S2 S1 Equilibrium INTEREST RATE, (Percent) CAPITAL (Bilions of dollars) Which tend to be more volatile, short- or long-term interest rates? Long-term interest rates Short-term interest rates Which tend to be more volatile, short or long-term interest rates? Long-term interest rates Short-term interest rates If the Inflation rate was 3.20% and the nominal Interest rate was 4.20% over the last year, what was the real rate of interest over the last year? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. Round intermediate calculations to four decimal places. 1.25% 0.654 1.00% 1.159 The real risk-free rate () is 2.8% and is expected to remain constant. Inflation is expected to be 6% per year for each of the next three years and 5% thereafter The maturity risk premium (MRP) is determined from the formula: 0.1(t-1)%, where t is the security's maturity. The liquidity premium (L) on all Tahoe Hydroponics's bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (ORP): Default Risk Premium Rating U.S. Treasury AAA 0.60 AA 0.80% A 1.05 BBB 1.45% Tahoe Hydroponics issues fourteen-year, AA-rated bonds. What is the veld on one of those bonds? Distegard cross-product terms; that is, it averaging is required, use the arithmetic a cerage. 10.569 9 3596 5.45 Tahoe Hydroponics issues fourteen-yeat, AA rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 10.66% @ 9.36 @ 5.45% 10.119 Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? The yield on U.S. Treasury securities always remains static In theory, the viold on a bond with a longer maturity will be higher than the vield on a bond with a shorter maturity