Question

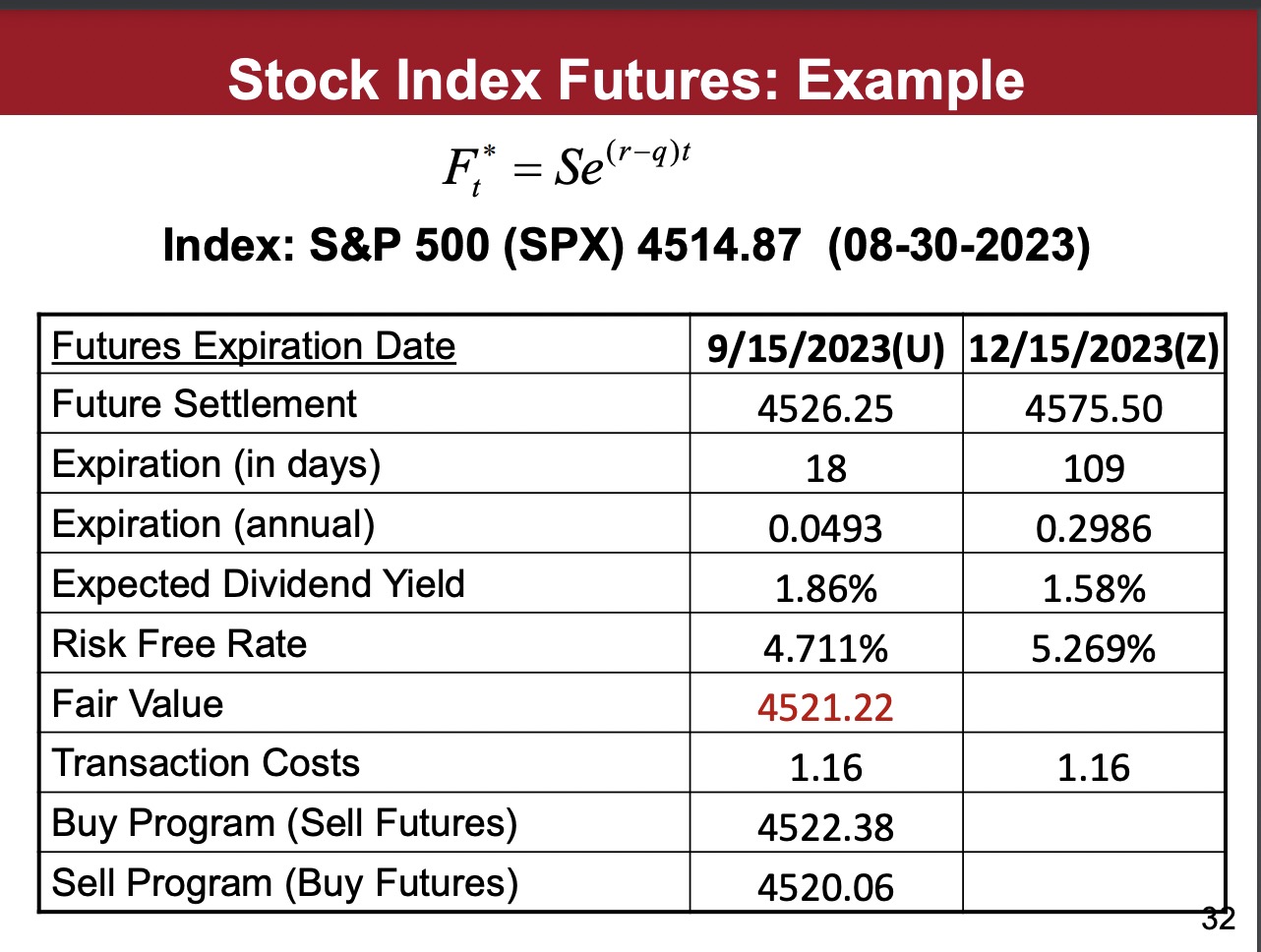

2. For the December 2023 futures contract on the S&P500 Index (SPX) compute Fair Value and answer the following questions (as example, see slide 15

2. For the December 2023 futures contract on the S&P500 Index (SPX) compute Fair Value and answer the following questions (as example, see slide 15 & 17) :

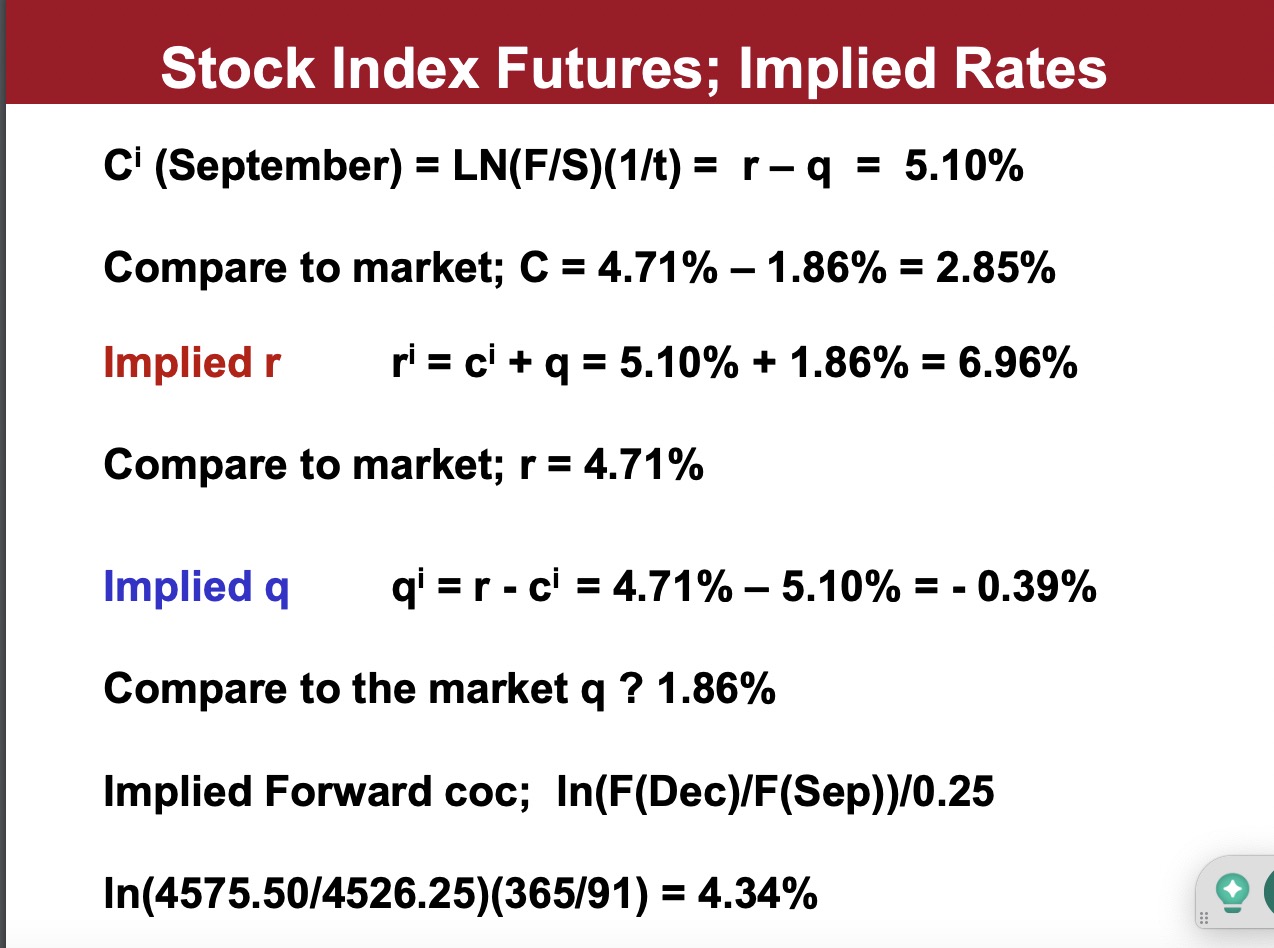

a.Did the Dec 2023 futures contracts settle above or below Fair Value? b.Use the transaction costs (TC) for index arbitrage (1.16) to compute the TC band. c. Was there an arbitrage opportunity? Compute profit, if any. d.What is the implied interest rate using the Dec 23 settlement price? Compare to it the market rate. Is there an arbitrage opportunity, if there are no TC? e. What is the implied forward COC (Sep 23 Dec 23)? f. What is the implied forward interest rate (Sep-Dec)? g. Compute the market forward interest rate (Sep-Dec), is there an arbitrage opportunity? What is the arbitrage strategy? (in borrowing and lending terms)

The Dec Fair value and the TC band are the missing numbers in the table on page 15.

Stock Index Futures: Example Ft=Se(rq)t Index: S\&P 500 (SPX) 4514.87 (08-30-2023) Stock Index Futures; Implied Rates Ci( September )=LN(F/S)(1/t)=rq=5.10% Compare to market; C=4.71%1.86%=2.85% Implied rri=ci+q=5.10%+1.86%=6.96% Compare to market; r=4.71% Implied qqi=rci=4.71%5.10%=0.39% Compare to the market q?1.86% Implied Forward coc; In(F(Dec)/F(Sep))/0.25 ln(4575.50/4526.25)(365/91)=4.34% Stock Index Futures: Example Ft=Se(rq)t Index: S\&P 500 (SPX) 4514.87 (08-30-2023) Stock Index Futures; Implied Rates Ci( September )=LN(F/S)(1/t)=rq=5.10% Compare to market; C=4.71%1.86%=2.85% Implied rri=ci+q=5.10%+1.86%=6.96% Compare to market; r=4.71% Implied qqi=rci=4.71%5.10%=0.39% Compare to the market q?1.86% Implied Forward coc; In(F(Dec)/F(Sep))/0.25 ln(4575.50/4526.25)(365/91)=4.34%

Stock Index Futures: Example Ft=Se(rq)t Index: S\&P 500 (SPX) 4514.87 (08-30-2023) Stock Index Futures; Implied Rates Ci( September )=LN(F/S)(1/t)=rq=5.10% Compare to market; C=4.71%1.86%=2.85% Implied rri=ci+q=5.10%+1.86%=6.96% Compare to market; r=4.71% Implied qqi=rci=4.71%5.10%=0.39% Compare to the market q?1.86% Implied Forward coc; In(F(Dec)/F(Sep))/0.25 ln(4575.50/4526.25)(365/91)=4.34% Stock Index Futures: Example Ft=Se(rq)t Index: S\&P 500 (SPX) 4514.87 (08-30-2023) Stock Index Futures; Implied Rates Ci( September )=LN(F/S)(1/t)=rq=5.10% Compare to market; C=4.71%1.86%=2.85% Implied rri=ci+q=5.10%+1.86%=6.96% Compare to market; r=4.71% Implied qqi=rci=4.71%5.10%=0.39% Compare to the market q?1.86% Implied Forward coc; In(F(Dec)/F(Sep))/0.25 ln(4575.50/4526.25)(365/91)=4.34% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started