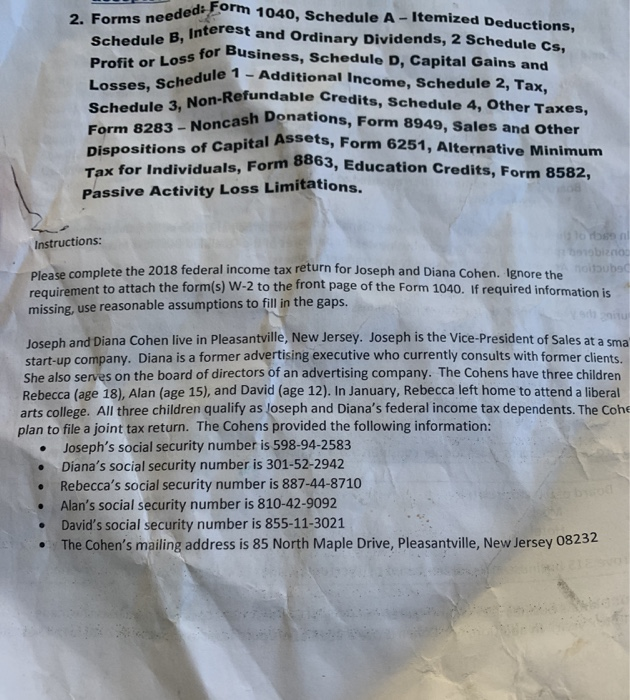

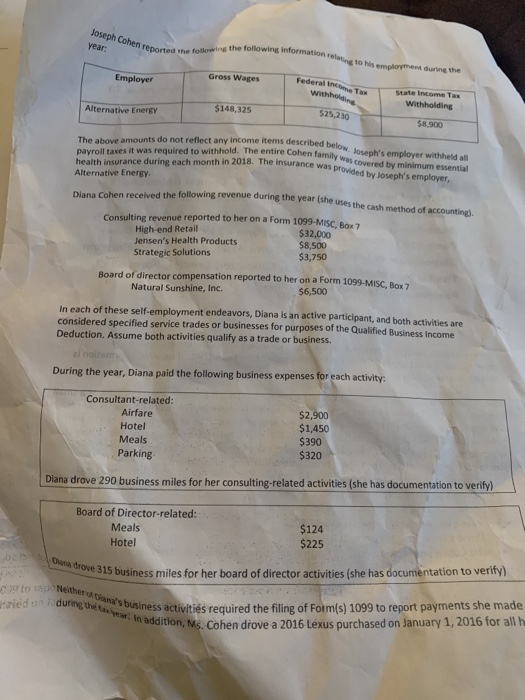

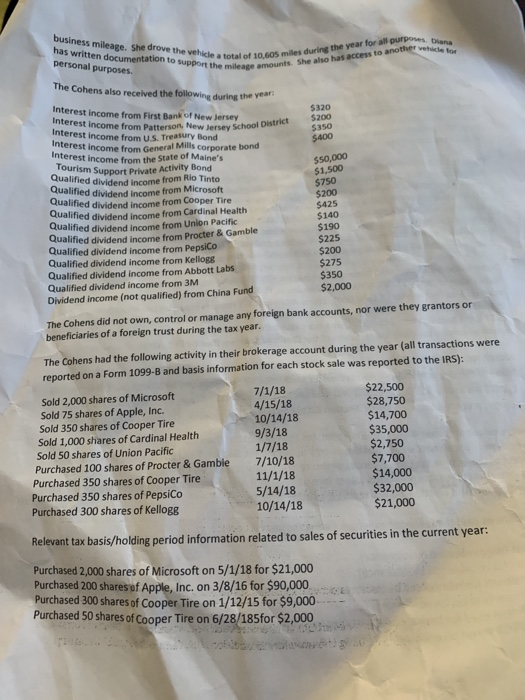

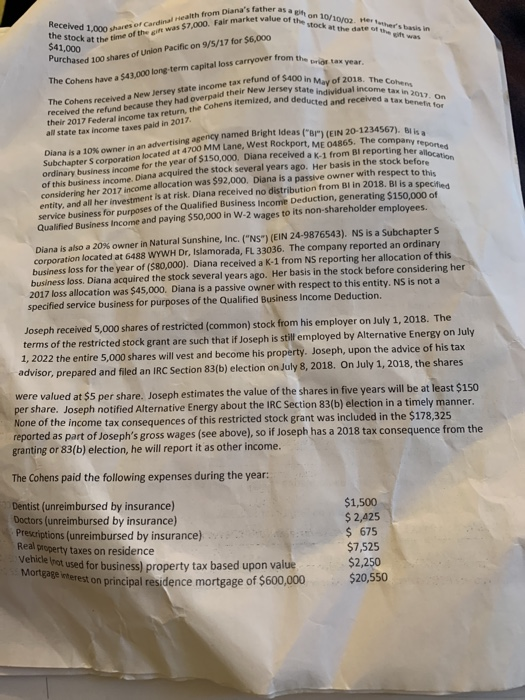

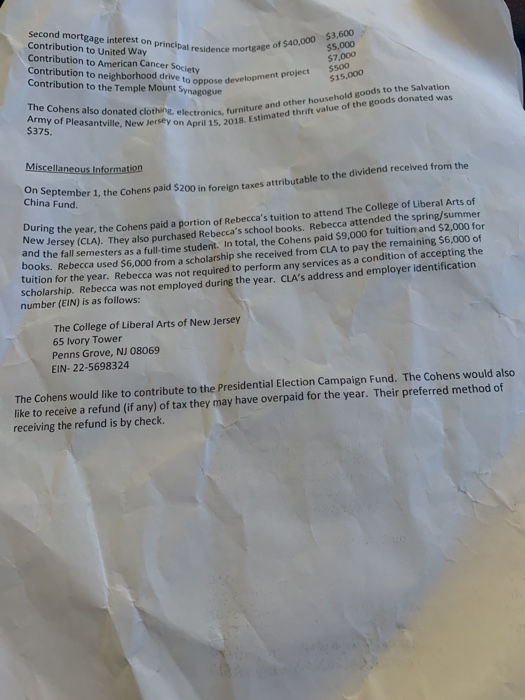

2. Forms needed som 1040, Schedule A. ded: Form 1040, Schedule A -Itemized Deductions, Interest and Ordinary Dividends, 2 Schedule Cs, ss for Business, Schedule D, Capital Gains and edule 1 - Additional Income, Schedule 2, Tax, Profit or Loss for Business, Sche Losses, Schedule - Additional In Schedule 3, Non-Refundable Cred Form 8283 - Noncash Donations, For ons of Capital Ass, Form 6251, Alternative Minimum Tax for Individuals, Form 2003, Education Credits. E Passive Activity Loss Limitations. Instructions: obson otobizno please complete the 2018 federal income tax return for Joseph and Diana Cohen. Ignore the sun sivament to attach the form(s) W-2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps. Joseph and Diana Cohen live in Pleasantville, New Jersey. Joseph is the Vice-President of Sales at a so start-up company. Diana is a former advertising executive who currently consults with former clients She also serves on the board of directors of an advertising company. The Cohens have three children Rebecca (age 18), Alan (age 15), and David (age 12). In January, Rebecca left home to attend a liberal arts college. All three children qualify as Joseph and Diana's federal income tax dependents. The Cohe plan to file a joint tax return. The Cohens provided the following information: Joseph's social security number is 598-94-2583 Diana's social security number is 301-52-2942 Rebecca's social security number is 887-44-8710 Alan's social security number is 810-42-9092 David's social security number is 855-11-3021 The Cohen's mailing address is 85 North Maple Drive, Pleasantville, New Jersey 08232 Joseph Cohen reporte year: en reported the following the following information employment during the Employer Gross Wages Federal com withhold $25,230 State Income Ta Withholding Alternative Energy $148,325 $8.900 The above amounts do not reflect any income items described hot w. Joseph's employer withheld all payroll taxes it was required to withhold. The entire Cohen familie was covered by minimum essential health insurance during each month in 2018. The insurance was as provided by Joseph's employer, Alternative Energy Diana Cohen received the following revenue during the year dhe following revenue during the year the uses the cash method of accounting) Consulting revenue reported to her on a Form 1099-MISC Bez High-end Retail $32,000 Jensen's Health Products $8,500 Strategic Solutions $3,750 Board of director compensation reported to her on a Form 1099-MISC.Box7 Natural Sunshine, Inc. $6,500 In each of these self-employment endeavors, Diana is an active participant, and both activities are considered specified service trades or businesses for purposes of the Qualified Business Income Deduction. Assume both activities qualify as a trade or business. During the year, Diana paid the following business expenses for each activity: Consultant-related: Airfare Hotel Meals Parking $2,900 $1,450 $390 $320 Diana drove 290 business miles for her consulting-related activities (she has documentation to verify) Board of Director-related: Meals Hotel $124 $225 02 Den drove 315 business miles for e315 business miles for her board of director activities (she has documentation to verify) Neither medan during the siness activities required the filing of Form(s) 1099 to report payments she made ddition, Ms. Cohen drove a 2016 Lexus purchased on January 1, 2016 for all h business mileage. She drove the vehicle a total of 10,6 has written documentation to support the mileage amoun personal purposes. for all purposes. Diana le a total of 10 COSmiles during the year to e mileage amounts. She also has access to anon The Cohens also received the following during the year $320 $200 $350 $400 $50,000 $1,500 Interest Income from First Bank of New Jersey interest income from Patterson, New Jersey School Dish Interest income from US Treasury Bond interest income from General Mills Corporate bond Interest income from the State of Maine's Tourism Sunport Debate Activity Bond Qualified dividend income from Rio Tinto Qualified dividend income from Microsoft Qualified dividend income from Cooper Tire Qualified dividend income from Cardinal Health Qualified dividend income from Union Pacific Qualified dividend income from Procter & Gamble Qualified dividend income from PepsiCo Qualified dividend income from Kellogg Qualified dividend income from Abbott Labs Qualified dividend income from 3M Dividend income (not qualified) from China Fund $750 $200 $425 $140 $190 $225 $200 $275 $350 $2,000 The Cohens did not own, control or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year. The Cohens had the following activity in their brokerage account during the year (all transactions were reported on a Form 1099-B and basis information for each stock sale was reported to the IRS): Sold 2,000 shares of Microsoft Sold 75 shares of Apple, Inc. Sold 350 shares of Cooper Tire Sold 1,000 shares of Cardinal Health Sold 50 shares of Union Pacific Purchased 100 shares of Procter & Gamble Purchased 350 shares of Cooper Tire Purchased 350 shares of PepsiCo Purchased 300 shares of Kellogg 7/1/18 4/15/18 10/14/18 9/3/18 1/7/18 7/10/18 11/1/18 5/14/18 10/14/18 $22,500 $28,750 $14,700 $35,000 $2,750 $7,700 $14,000 $32,000 $21,000 Relevant tax basis/holding period information related to sales of securities in the current year: Purchased 2,000 shares of Microsoft on 5/1/18 for $21,000 Purchased 200 shares of Apple, Inc. on 3/8/16 for $90,000 Purchased 300 shares of Cooper Tire on 1/12/15 for $9,000 Purchased 50 shares of Cooper Tire on 6/28/185for $2,000 on Received 1,000 Fair market value of the 10/10/02. Her stock at the date other's basis in ed lo c al reath from Diana's father Stock at the time of the gift was $7,000. Fair market value $41,000 Purchased 100 shares of Union Pacific on 9/5/17 for $6,000 loss carryover from the tax year $43.000 long-term capital loss carryover from th The Cohens have sax refund of $400 in May of 2018. The Cohen New Jersey state individual income tax in 2012 emired, and deducted and received a tax benen te The Cohens received a New Jersey state income tax refund of 5.400 in received the refund because they had overpaid their New Jersey star their 2017 Federal income tax return, the cohens itemized, and dedi all state tax income taxes paid in 2017. 1234567). Bisa uring her location Diana is a 10% owner in an advertising a deas(" EIN 20-1234567 + 4700 MM Lane, West Rockport, ME 04865. The company repon Subchapter Scorporation located atom Lane, West Rockport ME ordinary business income for the year of 150,000. Dina received a K-1 from Bl reporting her of this business income. Diana pana acquired the stock several years ago. Her basis in the stock before considering her 2017 income allocation was $4,000. Diana is a passive owner with respect to this entity, and all her investment is at risk. Diana received no distribution from Bl in 2018. Bl is a specie service business for purposes of the Qualified Business Income Deduction, generating $150.000 of Qualified Business Income and paying $50,000 in W-2 wages to its non-shareholder employees. Diana is also a 20% owner in Natural Sunshine, Inc. ("NS") (EIN 24-9876543). NS is a Subchapters corporation located at 6488 WYWH Dr, Islamorada, FL 33036. The company reported an ordinary business loss for the year of ($80,000). Diana received a K-1 from NS reporting her allocation of this business loss. Diana acquired the stock several years ago. Her basis in the stock before considering her 2017 loss allocation was $45,000, Diana is a passive owner with respect to this entity. NS is not a specified service business for purposes of the Qualified Business Income Deduction Joseph received 5,000 shares of restricted common) stock from his employer on July 1, 2018. The terms of the restricted stock grant are such that if Joseph is still employed by Alternative Energy on July 1, 2022 the entire 5,000 shares will vest and become his property. Joseph, upon the advice of his tax advisor, prepared and filed an IRC Section 83(b) election on July 8, 2018. On July 1, 2018, the shares were valued at $5 per share. Joseph estimates the value of the shares in five years will be at least $150 per share. Joseph notified Alternative Energy about the IRC Section 83(b) election in a timely manner. None of the income tax consequences of this restricted stock grant was included in the $178,325 reported as part of Joseph's gross wages (see above), so if Joseph has a 2018 tax consequence from the granting or 83(b) election, he will report it as other income. The Cohens paid the following expenses during the year: Dentist (unreimbursed by insurance) Doctors (unreimbursed by insurance) Prescriptions (unreimbursed by insurance) Real property taxes on residence Vehicle Wrot used for business) property tax based upon value Mongagemerest on principal residence mortgage of $600,000 $1,500 $ 2,425 $ 675 $7,525 $2,250 $20,550 $3,600 $5,000 mortgage of $40,000 Second mortgage interest on principal residence mortgas Contribution to United Way Contribution to American Cancer Society Contribution to neighborhood drive to oppose develop Contribution to the Temple Mount Synagogue $7,000 $500 $15.000 to oppose development project The Cohens also donated clothing electronics, fu Army of Pleasantville, New Jersey on April 15, $375. electronics furniture and other household goods to the Salvation on April 15, 2018 Estimated thrift value of the goods donated was Miscellaneous Information On September 1, the cohe China Fund. nber 1, the Cohens paid $200 in foreign taxes attributable to the dividend received from the ing the year, the Cohens paid a portion of Rebecca's tuition to attend The College of Liberal Arts of w Jersey (CLA). They also purchased Rebecca's school books. Rebecca attended the spring/summer nd the fall semesters as a full-time student. In total, the Cohens paid $9,000 for tuition and $2,000 for books. Rebecca used $6.000 from a scholarship she received from CLA to pay the remaining $6,000 of tuition for the year. Rebecca was not required to perform any services as a condition of accepting the scholarship. Rebecca was not employed during the year. CLA's address and employer identification number (EIN) is as follows: The College of Liberal Arts of New Jersey 65 Ivory Tower Penns Grove, NJ 08069 EIN-22-5698324 The Cohens would like to contribute to the Presidential Election Campaign Fund. The Cohens would also like to receive a refund (if any) of tax they may have overpaid for the year. Their preferred method of receiving the refund is by check. 2. Forms needed som 1040, Schedule A. ded: Form 1040, Schedule A -Itemized Deductions, Interest and Ordinary Dividends, 2 Schedule Cs, ss for Business, Schedule D, Capital Gains and edule 1 - Additional Income, Schedule 2, Tax, Profit or Loss for Business, Sche Losses, Schedule - Additional In Schedule 3, Non-Refundable Cred Form 8283 - Noncash Donations, For ons of Capital Ass, Form 6251, Alternative Minimum Tax for Individuals, Form 2003, Education Credits. E Passive Activity Loss Limitations. Instructions: obson otobizno please complete the 2018 federal income tax return for Joseph and Diana Cohen. Ignore the sun sivament to attach the form(s) W-2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps. Joseph and Diana Cohen live in Pleasantville, New Jersey. Joseph is the Vice-President of Sales at a so start-up company. Diana is a former advertising executive who currently consults with former clients She also serves on the board of directors of an advertising company. The Cohens have three children Rebecca (age 18), Alan (age 15), and David (age 12). In January, Rebecca left home to attend a liberal arts college. All three children qualify as Joseph and Diana's federal income tax dependents. The Cohe plan to file a joint tax return. The Cohens provided the following information: Joseph's social security number is 598-94-2583 Diana's social security number is 301-52-2942 Rebecca's social security number is 887-44-8710 Alan's social security number is 810-42-9092 David's social security number is 855-11-3021 The Cohen's mailing address is 85 North Maple Drive, Pleasantville, New Jersey 08232 Joseph Cohen reporte year: en reported the following the following information employment during the Employer Gross Wages Federal com withhold $25,230 State Income Ta Withholding Alternative Energy $148,325 $8.900 The above amounts do not reflect any income items described hot w. Joseph's employer withheld all payroll taxes it was required to withhold. The entire Cohen familie was covered by minimum essential health insurance during each month in 2018. The insurance was as provided by Joseph's employer, Alternative Energy Diana Cohen received the following revenue during the year dhe following revenue during the year the uses the cash method of accounting) Consulting revenue reported to her on a Form 1099-MISC Bez High-end Retail $32,000 Jensen's Health Products $8,500 Strategic Solutions $3,750 Board of director compensation reported to her on a Form 1099-MISC.Box7 Natural Sunshine, Inc. $6,500 In each of these self-employment endeavors, Diana is an active participant, and both activities are considered specified service trades or businesses for purposes of the Qualified Business Income Deduction. Assume both activities qualify as a trade or business. During the year, Diana paid the following business expenses for each activity: Consultant-related: Airfare Hotel Meals Parking $2,900 $1,450 $390 $320 Diana drove 290 business miles for her consulting-related activities (she has documentation to verify) Board of Director-related: Meals Hotel $124 $225 02 Den drove 315 business miles for e315 business miles for her board of director activities (she has documentation to verify) Neither medan during the siness activities required the filing of Form(s) 1099 to report payments she made ddition, Ms. Cohen drove a 2016 Lexus purchased on January 1, 2016 for all h business mileage. She drove the vehicle a total of 10,6 has written documentation to support the mileage amoun personal purposes. for all purposes. Diana le a total of 10 COSmiles during the year to e mileage amounts. She also has access to anon The Cohens also received the following during the year $320 $200 $350 $400 $50,000 $1,500 Interest Income from First Bank of New Jersey interest income from Patterson, New Jersey School Dish Interest income from US Treasury Bond interest income from General Mills Corporate bond Interest income from the State of Maine's Tourism Sunport Debate Activity Bond Qualified dividend income from Rio Tinto Qualified dividend income from Microsoft Qualified dividend income from Cooper Tire Qualified dividend income from Cardinal Health Qualified dividend income from Union Pacific Qualified dividend income from Procter & Gamble Qualified dividend income from PepsiCo Qualified dividend income from Kellogg Qualified dividend income from Abbott Labs Qualified dividend income from 3M Dividend income (not qualified) from China Fund $750 $200 $425 $140 $190 $225 $200 $275 $350 $2,000 The Cohens did not own, control or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year. The Cohens had the following activity in their brokerage account during the year (all transactions were reported on a Form 1099-B and basis information for each stock sale was reported to the IRS): Sold 2,000 shares of Microsoft Sold 75 shares of Apple, Inc. Sold 350 shares of Cooper Tire Sold 1,000 shares of Cardinal Health Sold 50 shares of Union Pacific Purchased 100 shares of Procter & Gamble Purchased 350 shares of Cooper Tire Purchased 350 shares of PepsiCo Purchased 300 shares of Kellogg 7/1/18 4/15/18 10/14/18 9/3/18 1/7/18 7/10/18 11/1/18 5/14/18 10/14/18 $22,500 $28,750 $14,700 $35,000 $2,750 $7,700 $14,000 $32,000 $21,000 Relevant tax basis/holding period information related to sales of securities in the current year: Purchased 2,000 shares of Microsoft on 5/1/18 for $21,000 Purchased 200 shares of Apple, Inc. on 3/8/16 for $90,000 Purchased 300 shares of Cooper Tire on 1/12/15 for $9,000 Purchased 50 shares of Cooper Tire on 6/28/185for $2,000 on Received 1,000 Fair market value of the 10/10/02. Her stock at the date other's basis in ed lo c al reath from Diana's father Stock at the time of the gift was $7,000. Fair market value $41,000 Purchased 100 shares of Union Pacific on 9/5/17 for $6,000 loss carryover from the tax year $43.000 long-term capital loss carryover from th The Cohens have sax refund of $400 in May of 2018. The Cohen New Jersey state individual income tax in 2012 emired, and deducted and received a tax benen te The Cohens received a New Jersey state income tax refund of 5.400 in received the refund because they had overpaid their New Jersey star their 2017 Federal income tax return, the cohens itemized, and dedi all state tax income taxes paid in 2017. 1234567). Bisa uring her location Diana is a 10% owner in an advertising a deas(" EIN 20-1234567 + 4700 MM Lane, West Rockport, ME 04865. The company repon Subchapter Scorporation located atom Lane, West Rockport ME ordinary business income for the year of 150,000. Dina received a K-1 from Bl reporting her of this business income. Diana pana acquired the stock several years ago. Her basis in the stock before considering her 2017 income allocation was $4,000. Diana is a passive owner with respect to this entity, and all her investment is at risk. Diana received no distribution from Bl in 2018. Bl is a specie service business for purposes of the Qualified Business Income Deduction, generating $150.000 of Qualified Business Income and paying $50,000 in W-2 wages to its non-shareholder employees. Diana is also a 20% owner in Natural Sunshine, Inc. ("NS") (EIN 24-9876543). NS is a Subchapters corporation located at 6488 WYWH Dr, Islamorada, FL 33036. The company reported an ordinary business loss for the year of ($80,000). Diana received a K-1 from NS reporting her allocation of this business loss. Diana acquired the stock several years ago. Her basis in the stock before considering her 2017 loss allocation was $45,000, Diana is a passive owner with respect to this entity. NS is not a specified service business for purposes of the Qualified Business Income Deduction Joseph received 5,000 shares of restricted common) stock from his employer on July 1, 2018. The terms of the restricted stock grant are such that if Joseph is still employed by Alternative Energy on July 1, 2022 the entire 5,000 shares will vest and become his property. Joseph, upon the advice of his tax advisor, prepared and filed an IRC Section 83(b) election on July 8, 2018. On July 1, 2018, the shares were valued at $5 per share. Joseph estimates the value of the shares in five years will be at least $150 per share. Joseph notified Alternative Energy about the IRC Section 83(b) election in a timely manner. None of the income tax consequences of this restricted stock grant was included in the $178,325 reported as part of Joseph's gross wages (see above), so if Joseph has a 2018 tax consequence from the granting or 83(b) election, he will report it as other income. The Cohens paid the following expenses during the year: Dentist (unreimbursed by insurance) Doctors (unreimbursed by insurance) Prescriptions (unreimbursed by insurance) Real property taxes on residence Vehicle Wrot used for business) property tax based upon value Mongagemerest on principal residence mortgage of $600,000 $1,500 $ 2,425 $ 675 $7,525 $2,250 $20,550 $3,600 $5,000 mortgage of $40,000 Second mortgage interest on principal residence mortgas Contribution to United Way Contribution to American Cancer Society Contribution to neighborhood drive to oppose develop Contribution to the Temple Mount Synagogue $7,000 $500 $15.000 to oppose development project The Cohens also donated clothing electronics, fu Army of Pleasantville, New Jersey on April 15, $375. electronics furniture and other household goods to the Salvation on April 15, 2018 Estimated thrift value of the goods donated was Miscellaneous Information On September 1, the cohe China Fund. nber 1, the Cohens paid $200 in foreign taxes attributable to the dividend received from the ing the year, the Cohens paid a portion of Rebecca's tuition to attend The College of Liberal Arts of w Jersey (CLA). They also purchased Rebecca's school books. Rebecca attended the spring/summer nd the fall semesters as a full-time student. In total, the Cohens paid $9,000 for tuition and $2,000 for books. Rebecca used $6.000 from a scholarship she received from CLA to pay the remaining $6,000 of tuition for the year. Rebecca was not required to perform any services as a condition of accepting the scholarship. Rebecca was not employed during the year. CLA's address and employer identification number (EIN) is as follows: The College of Liberal Arts of New Jersey 65 Ivory Tower Penns Grove, NJ 08069 EIN-22-5698324 The Cohens would like to contribute to the Presidential Election Campaign Fund. The Cohens would also like to receive a refund (if any) of tax they may have overpaid for the year. Their preferred method of receiving the refund is by check