Answered step by step

Verified Expert Solution

Question

1 Approved Answer

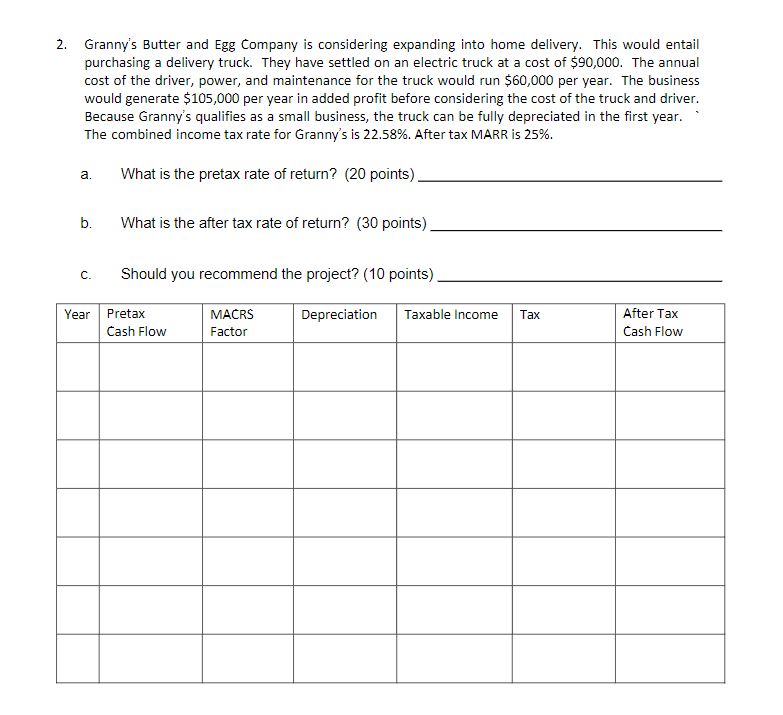

2. Granny's Butter and Egg Company is considering expanding into home delivery. This would entail purchasing a delivery truck. They have settled on an

2. Granny's Butter and Egg Company is considering expanding into home delivery. This would entail purchasing a delivery truck. They have settled on an electric truck at a cost of $90,000. The annual cost of the driver, power, and maintenance for the truck would run $60,000 per year. The business would generate $105,000 per year in added profit before considering the cost of the truck and driver. Because Granny's qualifies as a small business, the truck can be fully depreciated in the first year. The combined income tax rate for Granny's is 22.58%. After tax MARR is 25%. What is the pretax rate of return? (20 points). a. b. C. Year What is the after tax rate of return? (30 points). Should you recommend the project? (10 points) Depreciation MACRS Factor Pretax Cash Flow Taxable Income Tax After Tax Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Grannys Butter and Egg Delivery Truck Analysis a Pretax Rate of Return 20 points To calculate the pretax rate of return we need to consider the initia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started