Answered step by step

Verified Expert Solution

Question

1 Approved Answer

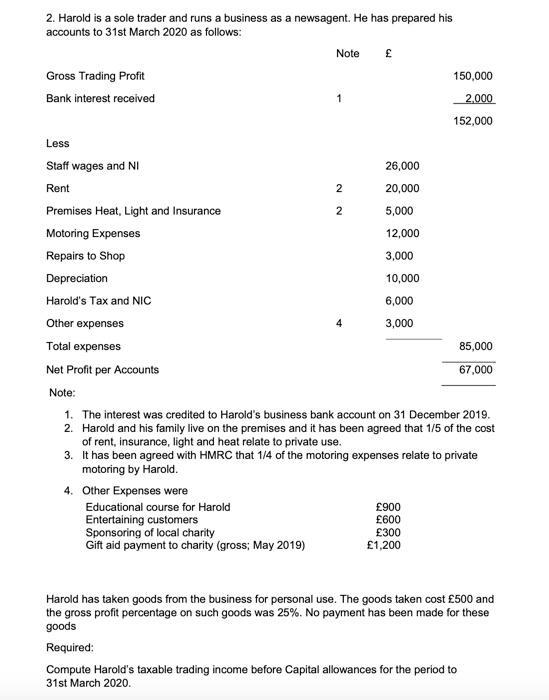

2. Harold is a sole trader and runs a business as a newsagent. He has prepared his accounts to 31st March 2020 as follows:

2. Harold is a sole trader and runs a business as a newsagent. He has prepared his accounts to 31st March 2020 as follows: Gross Trading Profit Bank interest received Less Staff wages and NI Rent 4. Other Expenses were Note Educational course for Harold Entertaining customers Sponsoring of local charity Gift aid payment to charity (gross; May 2019) 1 2 2 26,000 20,000 5,000 12,000 3,000 10,000 6,000 3,000 Premises Heat, Light and Insurance Motoring Expenses Repairs to Shop Depreciation Harold's Tax and NIC Other expenses Total expenses Net Profit per Accounts Note: 1. The interest was credited to Harold's business bank account on 31 December 2019. 2. Harold and his family live on the premises and it has been agreed that 1/5 of the cost of rent, insurance, light and heat relate to private use. 3. It has been agreed with HMRC that 1/4 of the motoring expenses relate to private motoring by Harold. 150,000 2,000 152,000 900 600 300 1,200 85,000 67,000 Harold has taken goods from the business for personal use. The goods taken cost 500 and the gross profit percentage on such goods was 25%. No payment has been made for these goods Required: Compute Harold's taxable trading income before Capital allowances for the period to 31st March 2020.

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

According to the data Ang Harold is a sole trader and rung ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started