Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Harry acquires 100% of David on January 1, 2010 by issuing 10,000 shares with par value $1 and fair value $70. In addition,

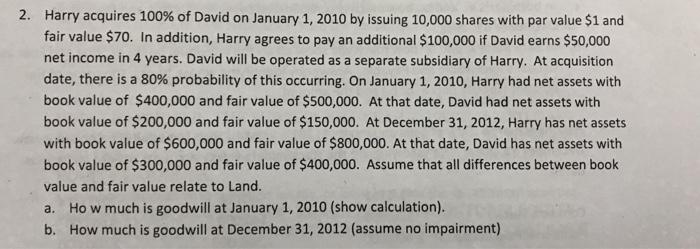

2. Harry acquires 100% of David on January 1, 2010 by issuing 10,000 shares with par value $1 and fair value $70. In addition, Harry agrees to pay an additional $100,000 if David earns $50,000 net income in 4 years. David will be operated as a separate subsidiary of Harry. At acquisition date, there is a 80% probability of this occurring. On January 1, 2010, Harry had net assets with book value of $400,000 and fair value of $500,000. At that date, David had net assets with book value of $200,000 and fair value of $150,000. At December 31, 2012, Harry has net assets with book value of $600,000 and fair value of $800,000. At that date, David has net assets with book value of $300,000 and fair value of $400,000. Assume that all differences between book value and fair value relate to Land. a. How much is goodwill at January 1, 2010 (show calculation). b. How much is goodwill at December 31, 2012 (assume no impairment)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the goodwill at January 1 2010 we need to determine the excess of the consideration t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started