Answered step by step

Verified Expert Solution

Question

1 Approved Answer

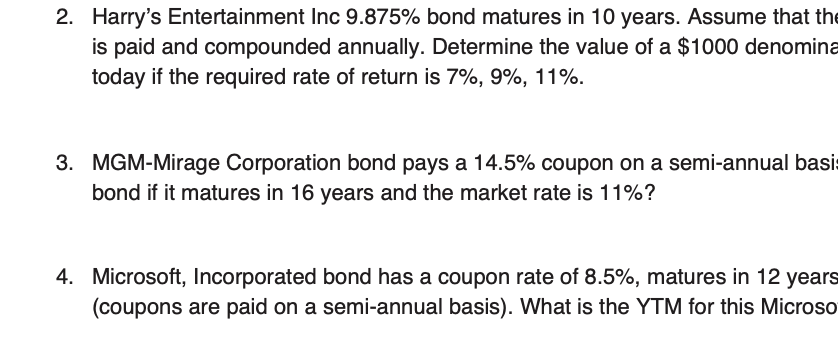

2. Harry's Entertainment Inc 9.875% bond matures in 10 years. Assume that the is paid and compounded annually. Determine the value of a $1000

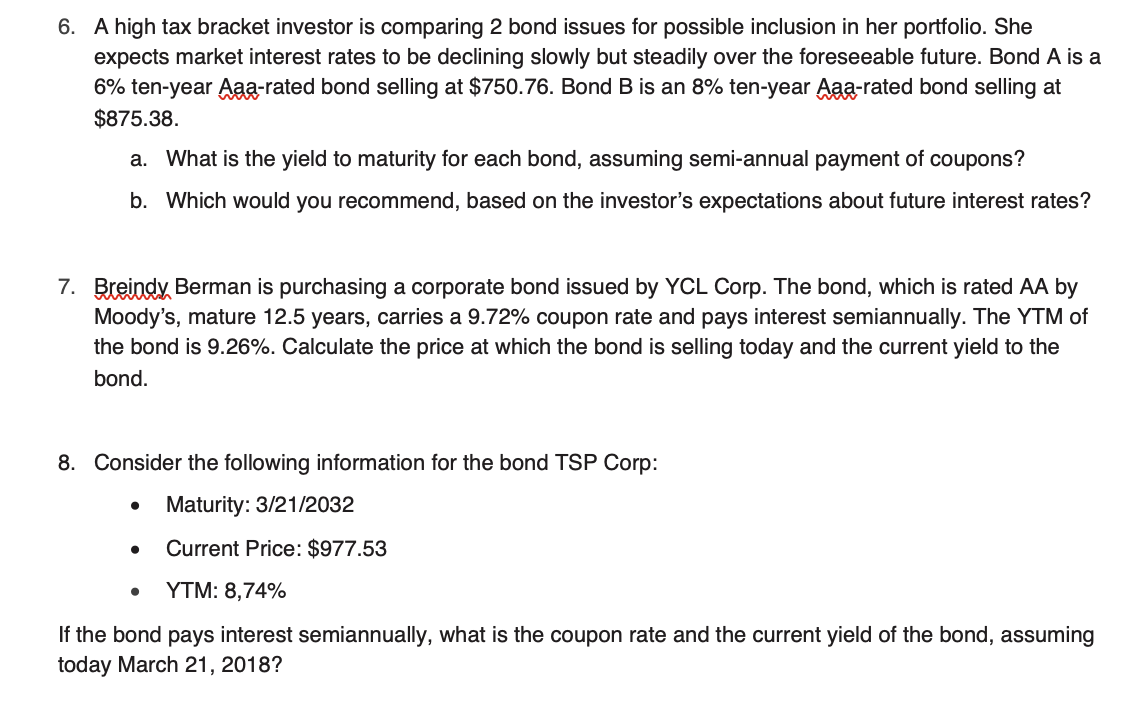

2. Harry's Entertainment Inc 9.875% bond matures in 10 years. Assume that the is paid and compounded annually. Determine the value of a $1000 denomina today if the required rate of return is 7%, 9%, 11%. 3. MGM-Mirage Corporation bond pays a 14.5% coupon on a semi-annual basis bond if it matures in 16 years and the market rate is 11%? 4. Microsoft, Incorporated bond has a coupon rate of 8.5%, matures in 12 years (coupons are paid on a semi-annual basis). What is the YTM for this Microso 6. A high tax bracket investor is comparing 2 bond issues for possible inclusion in her portfolio. She expects market interest rates to be declining slowly but steadily over the foreseeable future. Bond A is a 6% ten-year Aaa-rated bond selling at $750.76. Bond B is an 8% ten-year Aaa-rated bond selling at $875.38. a. What is the yield to maturity for each bond, assuming semi-annual payment of coupons? b. Which would you recommend, based on the investor's expectations about future interest rates? 7. Breindy Berman is purchasing a corporate bond issued by YCL Corp. The bond, which is rated AA by Moody's, mature 12.5 years, carries a 9.72% coupon rate and pays interest semiannually. The YTM of the bond is 9.26%. Calculate the price at which the bond is selling today and the current yield to the bond. 8. Consider the following information for the bond TSP Corp: Maturity: 3/21/2032 Current Price: $977.53 YTM: 8,74% If the bond pays interest semiannually, what is the coupon rate and the current yield of the bond, assuming today March 21, 2018?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started