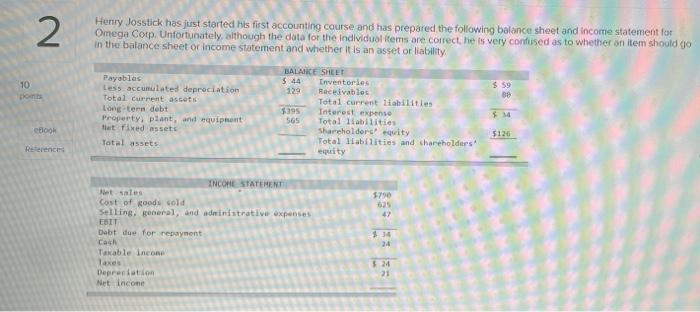

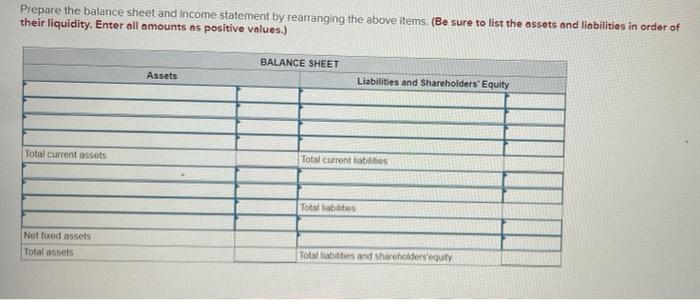

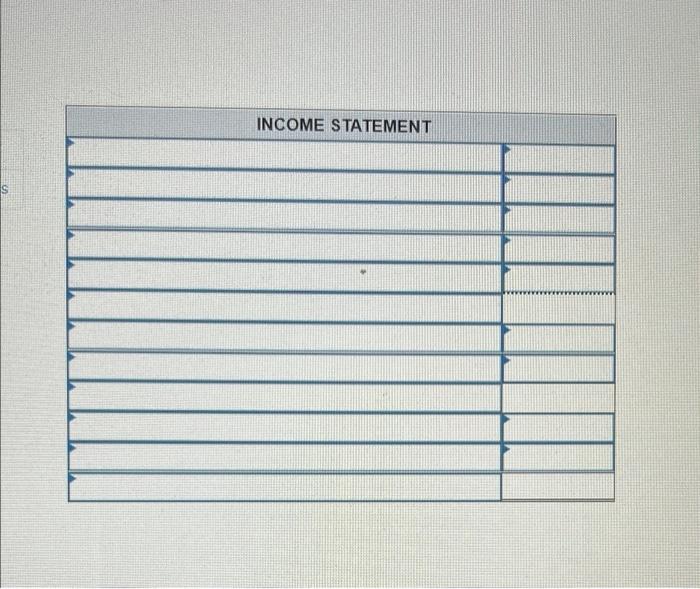

2 . Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for Omega Corp. Unfortunately, although the data for the individual items are correct, he is very confused as to whether on item should go in the balance sheet or income statement and whether it is an asset or liability 10 $ 59 38 Payables Less accumulated depreciation Total current assets Longtern debt Property, plant, and equipent that fixed asset Total assets BALANCE SHEET 5.44 Inventories 129 Raceivables Total current liabilities $395 Interest ex 565 Total liabilities Shareholders equity Total liabilities and shareholders equity 14 BOOK 5126 Reference $790 635 4) INCOME STATEMENT et sales Cost of foods Old Selling general, and administrative expenses EDIT Debt due for repaynent Cash Taxable income $34 24 $ 24 21 Depreciation Net Income Prepare the balance sheet and income statement by tearranging the above items (Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values.) BALANCE SHEET Assets Liabilities and Shareholders' Equity Total current assots Total current abilities Total abilities Not fixed assets Total assets Total liabilities and shareholders equity INCOME STATEMENT 2 . Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for Omega Corp. Unfortunately, although the data for the individual items are correct, he is very confused as to whether on item should go in the balance sheet or income statement and whether it is an asset or liability 10 $ 59 38 Payables Less accumulated depreciation Total current assets Longtern debt Property, plant, and equipent that fixed asset Total assets BALANCE SHEET 5.44 Inventories 129 Raceivables Total current liabilities $395 Interest ex 565 Total liabilities Shareholders equity Total liabilities and shareholders equity 14 BOOK 5126 Reference $790 635 4) INCOME STATEMENT et sales Cost of foods Old Selling general, and administrative expenses EDIT Debt due for repaynent Cash Taxable income $34 24 $ 24 21 Depreciation Net Income Prepare the balance sheet and income statement by tearranging the above items (Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values.) BALANCE SHEET Assets Liabilities and Shareholders' Equity Total current assots Total current abilities Total abilities Not fixed assets Total assets Total liabilities and shareholders equity INCOME STATEMENT