Question

2. Here are some addtional information. The companys beta is 1.5, risk free rate is 2% and market risk premium is 6%, what is WACC

2. Here are some addtional information. The companys beta is 1.5, risk free rate is 2% and market risk premium is 6%, what is WACC under market value based capital structure? (Hint, only long-term debt is interst bearing, and is considered as debt capital). 3. Bigquiz Inc. is considering whether to introduce a new machine. The projected unit sales are 150, 225, and 175 units per year for the next three years, respectively. Price is $1 million per unit, variable cost is $0.5 million per unit, and fixed costs are 15 million per year. The equipment costs 150 million today and can be sold three years later at a market value of 10 million. The machine will be depreciated on a three-year MACRS schedule (33.3%, 44.44%, 14.8%, 7.4%). The machine also requires an initial working capital of 10 million, and in each year working capital is estimated as 10% of the total sales. All working capital will be recovered by the end of the projects life. Tax rate is 20%. (Use WACC in Problem 2 as discount rate).

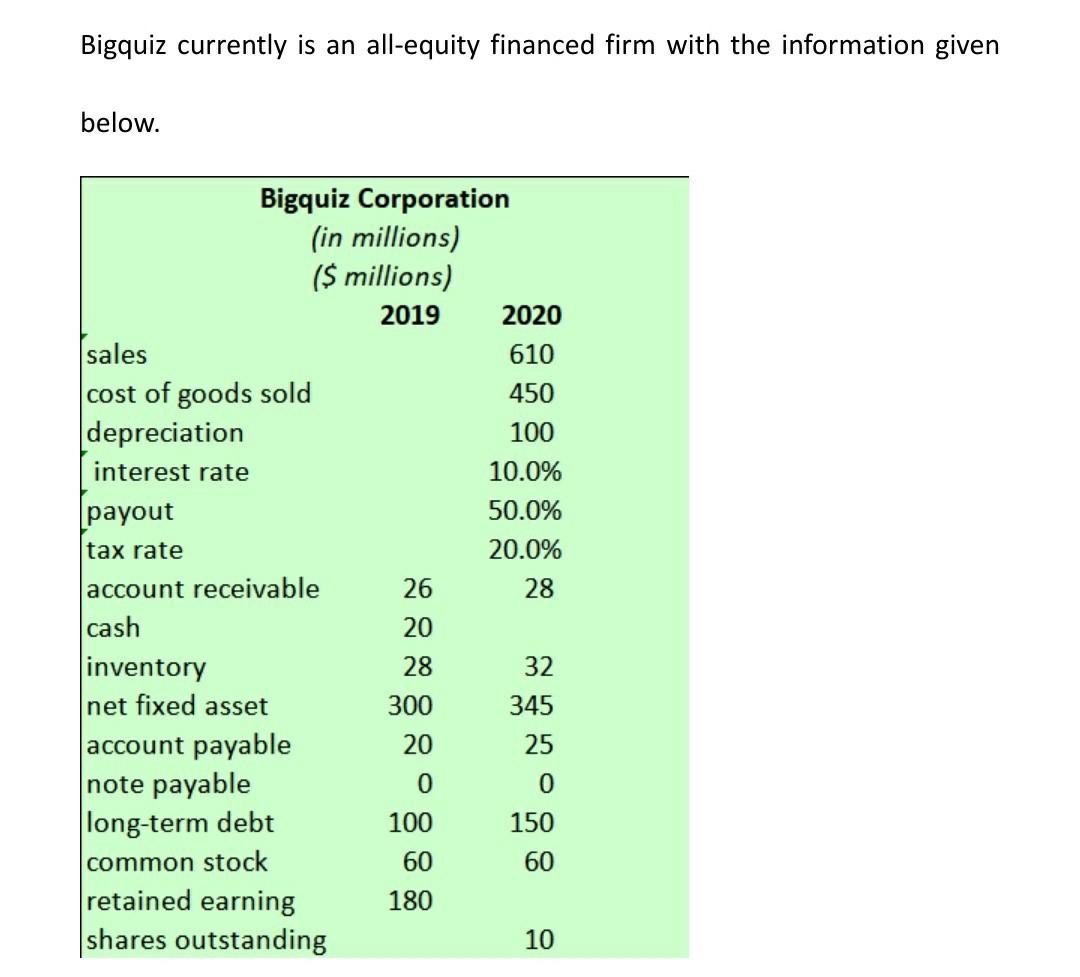

Bigquiz currently is an all-equity financed firm with the information given below. Bigquiz Corporation (in millions) ($ millions) 2019 2020 sales 610 cost of goods sold 450 depreciation 100 interest rate 10.0% payout 50.0% tax rate 20.0% account receivable 26 28 cash 20 inventory 28 32 net fixed asset 300 345 account payable 20 25 note payable 0 0 long-term debt 100 150 common stock 60 60 retained earning 180 shares outstanding 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started