Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. If a stock has a beta coefficient, equal to 1.20, the risk premium associated with the market is 9%, and the risk-free rate

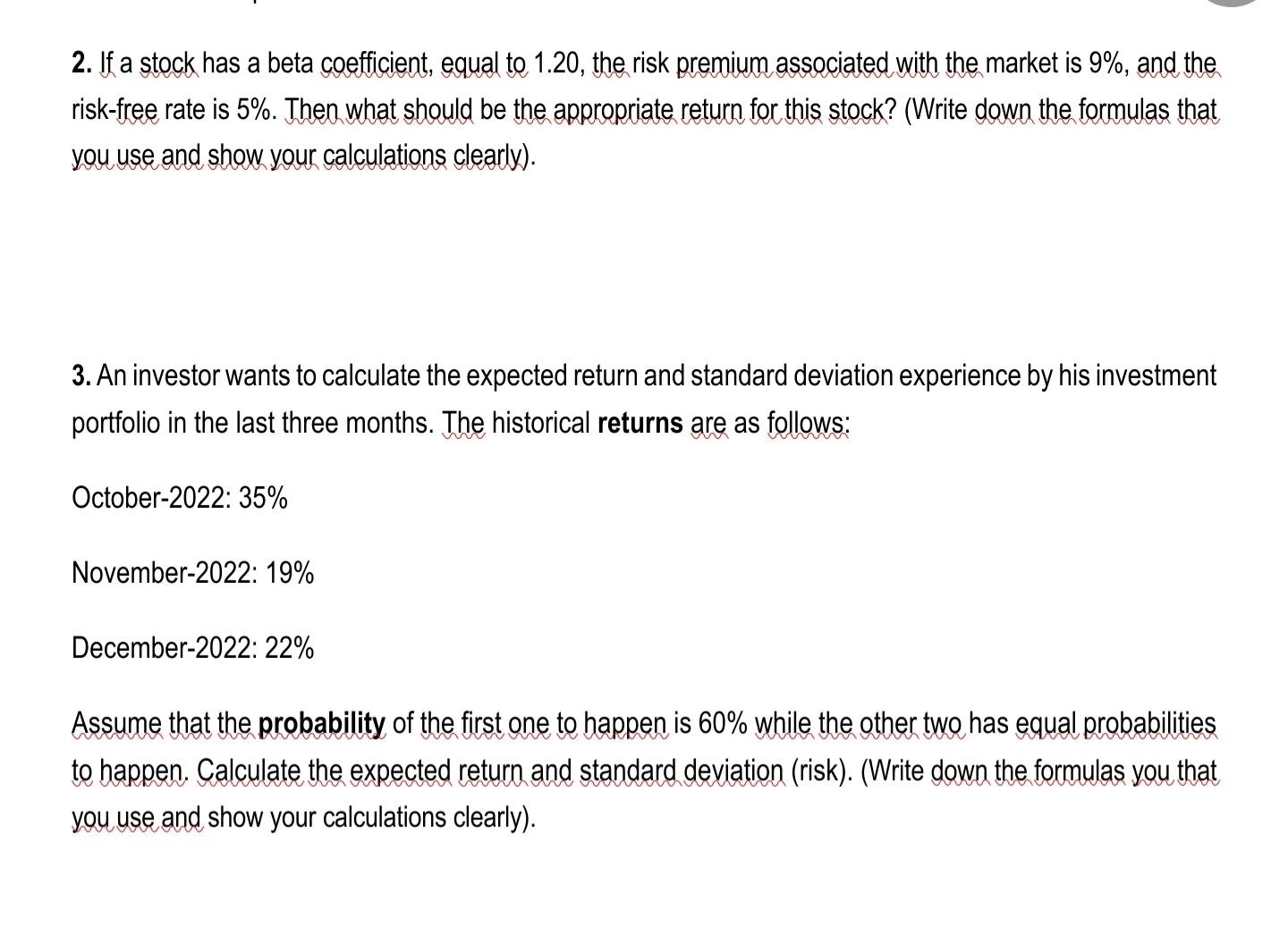

2. If a stock has a beta coefficient, equal to 1.20, the risk premium associated with the market is 9%, and the risk-free rate is 5%. Then what should be the appropriate return for this stock? (Write down the formulas that you use and show your calculations clearly). 3. An investor wants to calculate the expected return and standard deviation experience by his investment portfolio in the last three months. The historical returns are as follows: October-2022: 35% November-2022: 19% December-2022: 22% Assume that the probability of the first one to happen is 60% while the other two has equal probabilities to happen. Calculate the expected return and standard deviation (risk). (Write down the formulas you that you use and show your calculations clearly).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the image you are presented with two separate questions related to finance and investment calculations Lets address each question one by one Question 2 Calculating the Expected Return of a St...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started