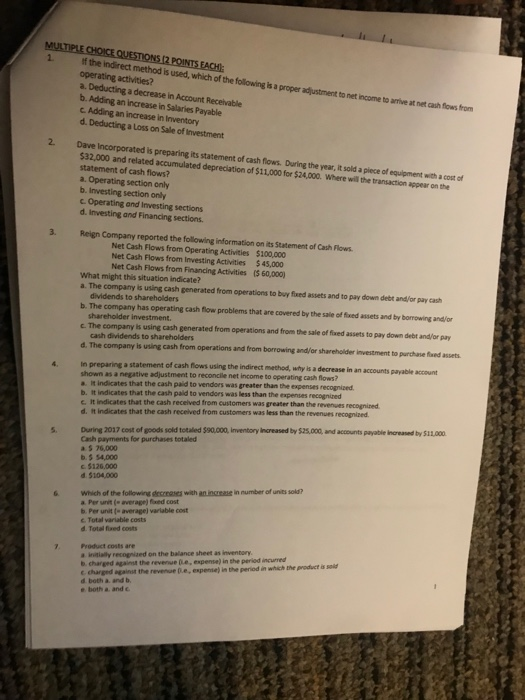

2. If the indirect method is used, which of the following is a proper adjustment to operating activities? a. Deducting a decrease in Account Recelvable b. Adding an increase in Salaries Payable c. Adding an increase in Inventory d. Deducting a Loss on Sale of Investment i net income to arrive at net cash flows from 2. Dave Incorporated is preparing its statement of cash flows. During the year, it sold a piece of equipment with a cost of $32,000 and related accumulated depreciation of $11,000 for $24,000. Where will the transaction appear on the statement of cash flows? a. Operating section only b. Investing section only c. Operating and investing sections d. Investing and Financing sections 3. Reign Company reported the following information on its Statement of Cash Flows Net Cash Flows from Operating Activities $100,000 Net Cash Flows from Investing Activities $45,000 Net Cash Flows from Financing Activities CS 60.001 What might this situation indicate? a. The company is using cash generated from operations to buy fixed assets and to pay down debt and/or pay cash dividends to shareholders b. The company has operating cash flow problems that are covered by the sale of fixed assets and by borrowing and/or shareholder investment. c. The company is using cash generated from operations and from the sale of fixed assets to pay down debt and/or pay cash dividends to shareholders d. The company is using cash from operations and from borrowing and/or shareholder investment to purchase fxed assets a statement of cash flows using the indirect method, why is a decrease in an accounts payable account net income to operating cash flows? n preparing shown as a negative adjustment to reconcile a. It indicates that the cash paid to vendors was greater than the expenses b. It indicates that the cash paid to vendors was less than the expenses recognined c. It indicates that the cash received from customers was greater than the d. it indicates that the cash received from customers was less than the revenues recognized 4, recognized revenues recognined 5. During 2017 cost of goods sold totaled $90,0oo, Inventory increased by $25,000, and accounts payable increased by $11,000 Cash payments for purchases totaled a 3 76,000 b.$ 54,000 c. 5126,000 d $104,000 6 Which of the following deceases with an increase in number of units sols a Per urit (e average) fixed cost b Per ur-average) variable cost c. Total variable costs d. Total fued costs Product costs are a initially recognized on the balance sheet as inventory b charged a charged against the revenue Be, expense) in the period in which the product is soi d both a and b gainst the revenue ie, expense) in the period incurred e both a and c