Answered step by step

Verified Expert Solution

Question

1 Approved Answer

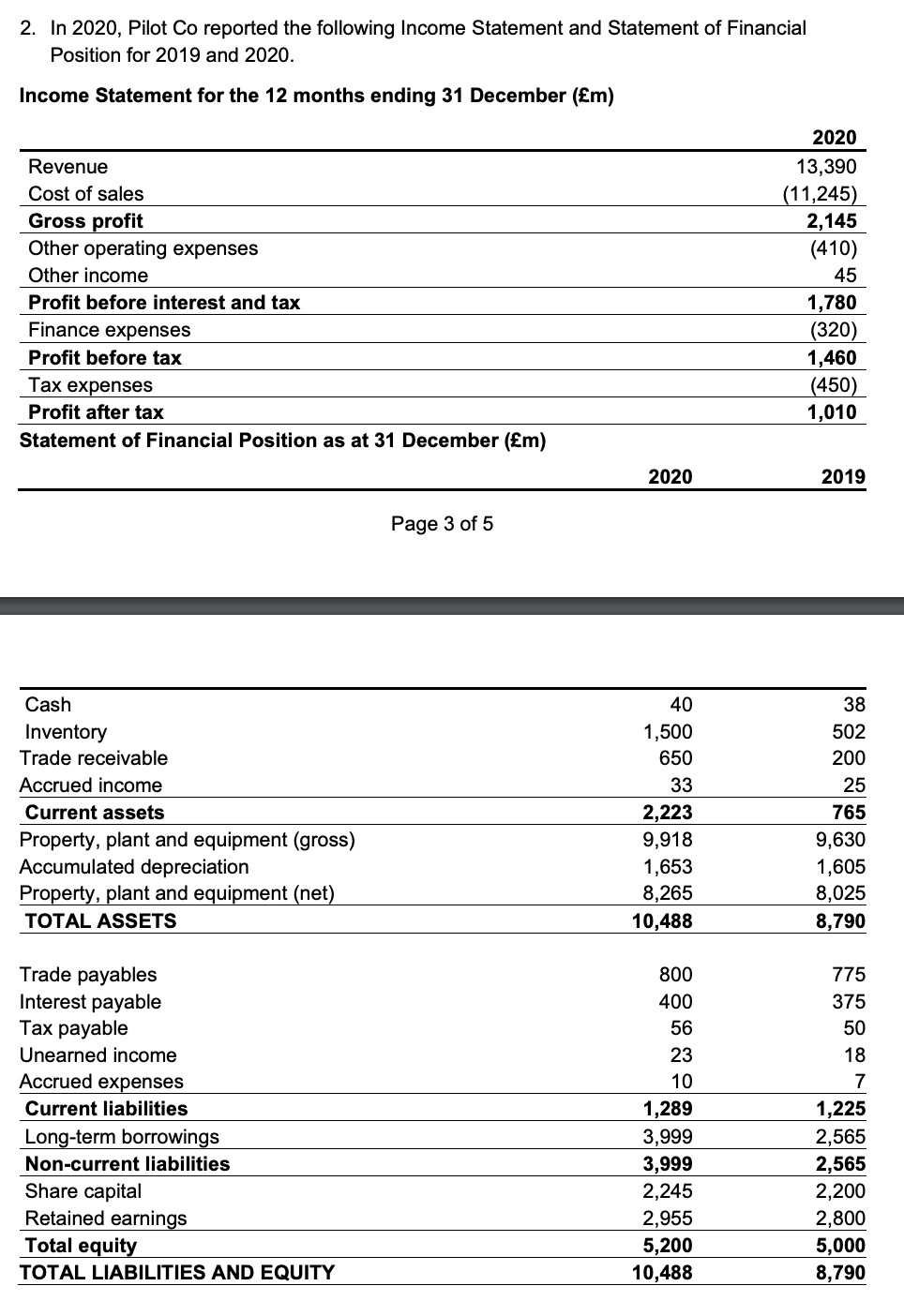

2. In 2020, Pilot Co reported the following Income Statement and Statement of Financial Position for 2019 and 2020. Income Statement for the 12

2. In 2020, Pilot Co reported the following Income Statement and Statement of Financial Position for 2019 and 2020. Income Statement for the 12 months ending 31 December (m) 2020 Revenue 13,390 (11,245) 2,145 Cost of sales Gross profit Other operating expenses (410) Other income 45 1,780 (320) 1,460 (450) 1,010 Profit before interest and tax Finance expenses Profit before tax xpenses Profit after tax Statement of Financial Position as at 31 December (m) 2020 2019 Page 3 of 5 Cash 40 38 Inventory 1,500 502 Trade receivable 650 200 Accrued income 33 25 2,223 9,918 Current assets 765 Property, plant and equipment (gross) Accumulated depreciation Property, plant and equipment (net) 9,630 1,653 8,265 1,605 8,025 TOTAL ASSETS 10,488 8,790 Trade payables Interest payable ayable 800 775 400 375 56 50 Unearned income 23 18 Accrued expenses 10 7 Current liabilities 1,289 1,225 Long-term borrowings 3,999 2,565 3,999 2,245 2,565 2,200 Non-current liabilities Share capital Retained earnings Total equity 2,955 5,200 10,488 2,800 5,000 TOTAL LIABILITIES AND EQUITY 8,790 The firm also disclosed depreciation charges for the year amounting to 640m and the loss of 12m from sale of property, plant and equipment (P,P&E) with net book value (NBV) of 150m. Required: From the information provided: (a) Work out Cash Flows from Operating Activities using the indirect method starting with profit after tax (PAT). (b) Work out the value of additions and disposals of PP&E and hence work out Cash Flows from Investing Activities. (c) Work out Cash Flows from Financing Activities. (d) Show that the Statement of Cash Flows and Net change in cash position at the end of the reporting period reconcile. (25 marks)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 Cash Flow From Operating Activities Net income 1010 Adjustments to reconcile net i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started