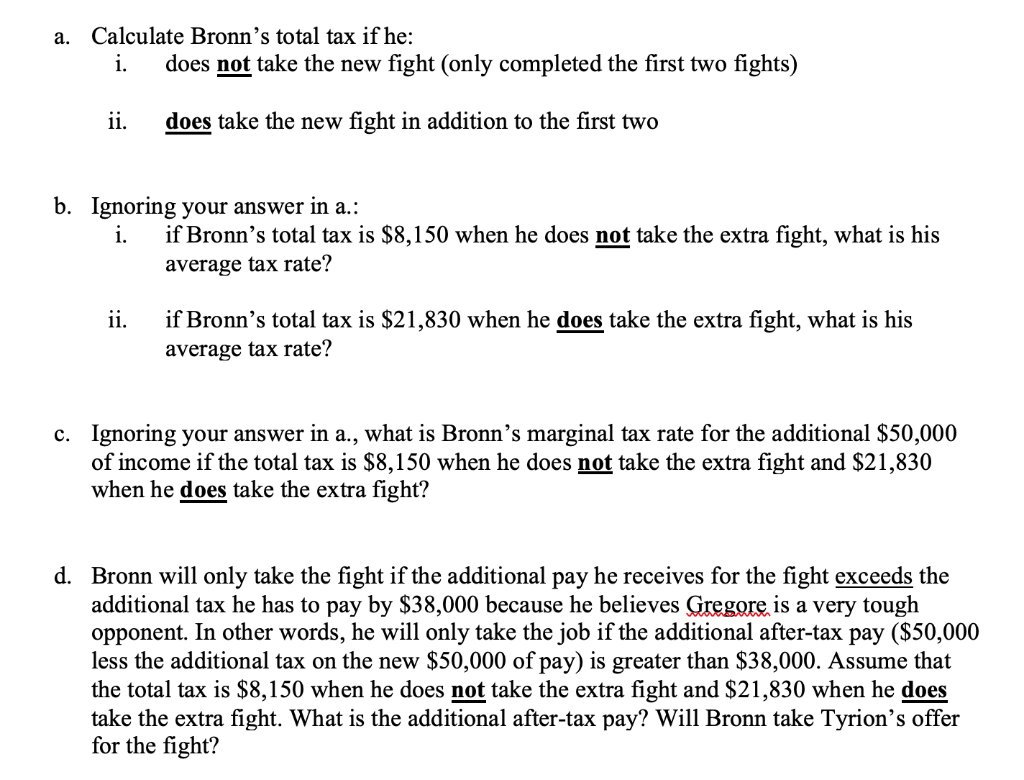

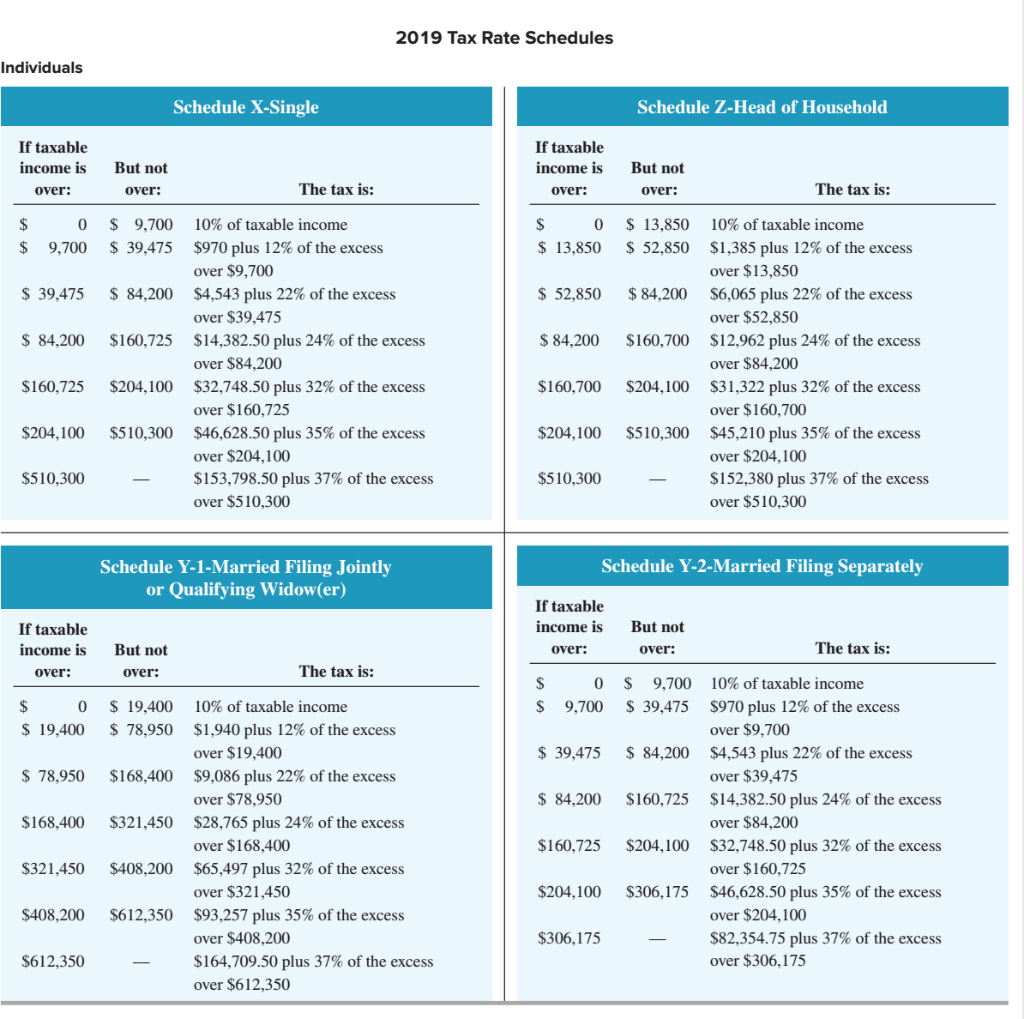

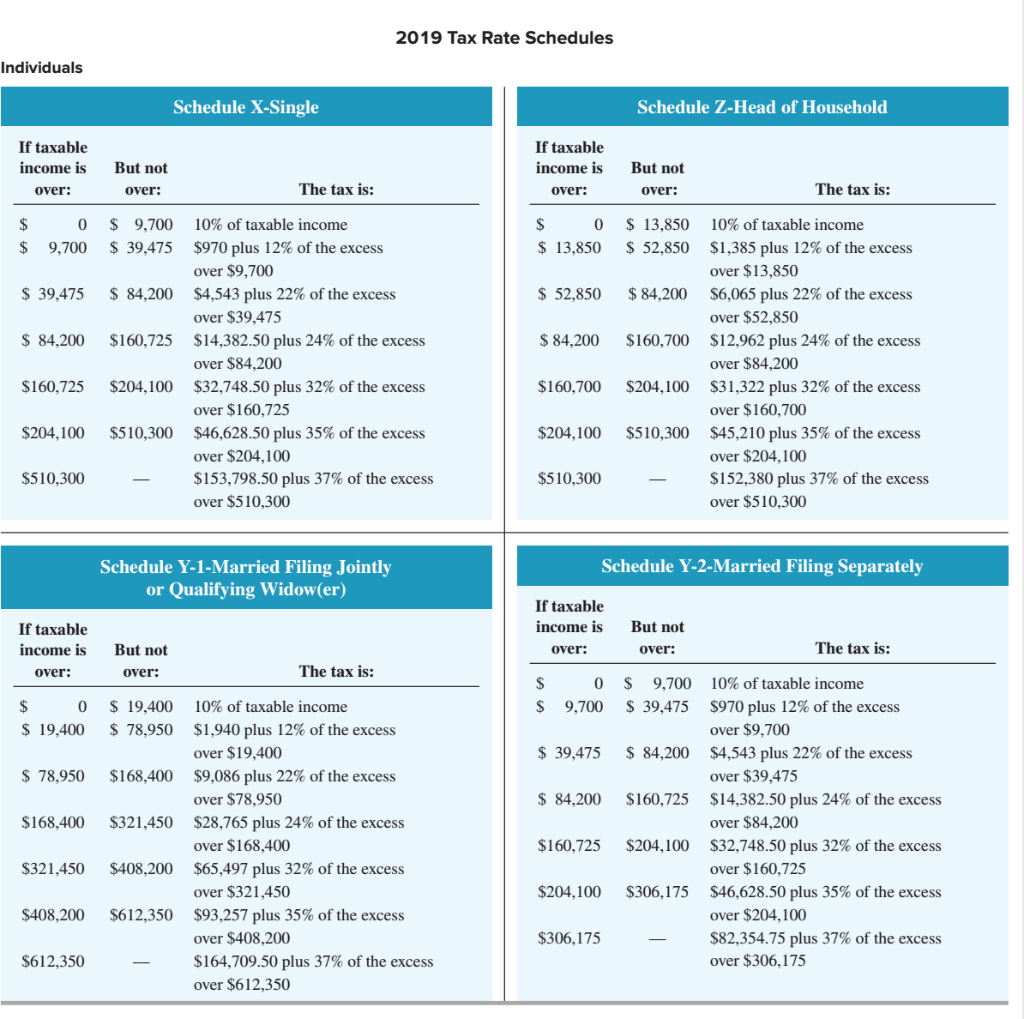

2. In the city of King's Landing, Bronn lives and works as a sell-sword (someone who is willing to fight with his sword for pay). His most recent client, Tyrion Lannister, has been very generous this year (2019) offering $25,000 per fight already for each of his first two fights this year. So, in total, he has earned $50,000 so far. However, Tyrion recently approached Bronn offering an additional $50,000 if he would be willing to fight Gregore Clegane the next day (still in 2019). This would be Bronn's third fight for the year. Assume Bronn files as a single taxpayer and that whatever he receives from Tyrion constitutes his taxable income. Use the appropriate Federal Tax Rate Schedule in Appendix D towards the back of your book to answer the following. Round dollar amounts to the nearest cent ($3,500.0372 $3,500.04). Round percentages to the second decimal place (e.g. 35.027956% 35.03%). a. Calculate Bronn's total tax if he: i. does not take the new fight (only completed the first two fights) 11. does take the new fight in addition to the first two b. Ignoring your answer in a.: i. if Bronn's total tax is $8,150 when he does not take the extra fight, what is his average tax rate? ii. if Bronn's total tax is $21,830 when he does take the extra fight, what is his average tax rate? c. Ignoring your answer in a., what is Bronn's marginal tax rate for the additional $50,000 of income if the total tax is $8,150 when he does not take the extra fight and $21,830 when he does take the extra fight? d. Bronn will only take the fight if the additional pay he receives for the fight exceeds the additional tax he has to pay by $38,000 because he believes Gregore, is a very tough opponent. In other words, he will only take the job if the additional after-tax pay ($50,000 less the additional tax on the new $50,000 of pay) is greater than $38,000. Assume that the total tax is $8,150 when he does not take the extra fight and $21,830 when he does take the extra fight. What is the additional after-tax pay? Will Bronn take Tyrion's offer for the fight? 2019 Tax Rate Schedules Individuals Schedule X-Single Schedule Z-Head of Household If taxable income is over: But not over: If taxable income is over: But not over: The tax is: The tax is: $ $ 0 9,700 $ 9,700 $ 39,475 $ 0 $ 13,850 $ 13,850 $ 52,850 $ 39,475 $ 84,200 $ 52,850 $ 84,200 $ 84,200 $160,725 $ 84,200 $160,700 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84.200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $153,798.50 plus 37% of the excess over $510,300 10% of taxable income $1,385 plus 12% of the excess over $13,850 $6,065 plus 22% of the excess over $52,850 $12,962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 $160,725 $204,100 $160,700 $204,100 $204,100 $510,300 $204,100 $510,300 $510,300 - $510,300 Schedule Y-2-Married Filing Separately Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: If taxable income is over: But not over: The tax is: But not over: The tax is: $ $ 0 9,700 $ 9,700 $ 39,475 $ 0 $ 19,400 $ 19,400 $ 78,950 $ 39,475 $ 84,200 $ 78,950 $168,400 $ 84,200 $160,725 $168,400 $321,450 10% of taxable income $1,940 plus 12% of the excess over $19,400 $9,086 plus 22% of the excess over $78,950 $28,765 plus 24% of the excess over $168,400 $65,497 plus 32% of the excess over $321,450 $93,257 plus 35% of the excess over $408,200 $164,709.50 plus 37% of the excess over $612,350 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $82,354.75 plus 37% of the excess over $306,175 $160,725 $204,100 $321,450 $408,200 $204,100 $306,175 $408,200 $612,350 $306,175 $612,350