Answered step by step

Verified Expert Solution

Question

1 Approved Answer

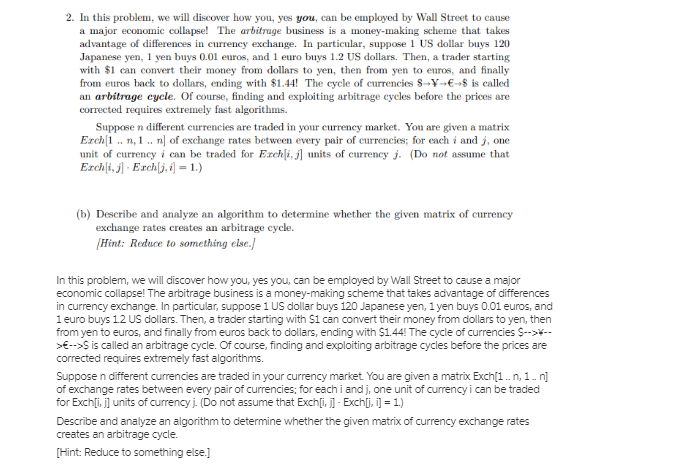

2. In this problem, we will discover how you, yes you, can be employed by Wall Street to cause a major economic collapse! The

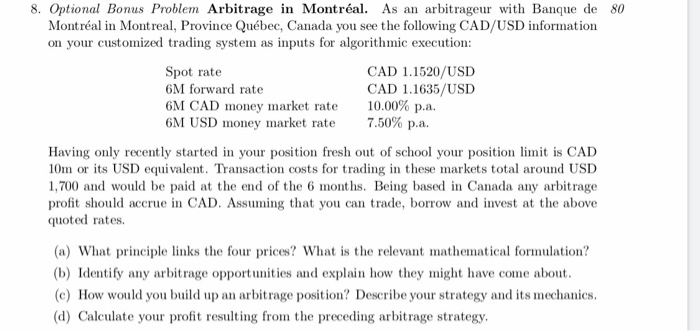

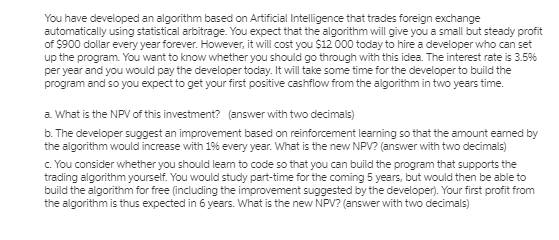

2. In this problem, we will discover how you, yes you, can be employed by Wall Street to cause a major economic collapse! The arbitrage business is a money-making scheme that takes advantage of differences in currency exchange. In particular, suppose 1 US dollar buys 120 Japanese yen, 1 yen buys 0.01 euros, and 1 euro buys 1.2 US dollars. Then, a trader starting with $1 can convert their money from dollars to yen, then from yen to euros, and finally from euros back to dollars, ending with $1.44! The cycle of currencies 8--8 is called an arbitrage cycle. Of course, finding and exploiting arbitrage cycles before the prices are corrected requires extremely fast algorithms. Suppose n different currencies are traded in your currency market. You are given a matrix Exch 1. n, 1..n] of exchange rates between every pair of currencies; for each i and j, one unit of currency i can be traded for Exch[i, j] units of currency j. (Do not assume that Exch[i, j] - Exch[j, i] = 1.) (b) Describe and analyze an algorithm to determine whether the given matrix of currency exchange rates creates an arbitrage cycle. [Hint: Reduce to something else.] In this problem, we will discover how you, yes you, can be employed by Wall Street to cause a major economic collapse! The arbitrage business is a money-making scheme that takes advantage of differences in currency exchange. In particular, suppose 1 US dollar buys 120 Japanese yen, 1 yen buys 0.01 euros, and 1 euro buys 1.2 US dollars. Then, a trader starting with $1 can convert their money from dollars to yen, then from yen to euros, and finally from euros back to dollars, ending with $1.44! The cycle of currencies $-->-- >-->S is called an arbitrage cycle. Of course, finding and exploiting arbitrage cycles before the prices are corrected requires extremely fast algorithms. Suppose n different currencies are traded in your currency market. You are given a matrix Exch[1.. n, 1..n] of exchange rates between every pair of currencies; for each i and j, one unit of currency i can be traded for Exch[i, j] units of currency j. (Do not assume that Exch[i, j] - Exch[j, i] = 1.) Describe and analyze an algorithm to determine whether the given matrix of currency exchange rates creates an arbitrage cycle. [Hint: Reduce to something else.] 8. Optional Bonus Problem Arbitrage in Montral. As an arbitrageur with Banque de 80 Montral in Montreal, Province Qubec, Canada you see the following CAD/USD information on your customized trading system as inputs for algorithmic execution: Spot rate 6M forward rate 6M CAD money market rate 6M USD money market rate CAD 1.1520/USD CAD 1.1635/USD 10.00% p.a. 7.50% p.a. Having only recently started in your position fresh out of school your position limit is CAD 10m or its USD equivalent. Transaction costs for trading in these markets total around USD 1,700 and would be paid at the end of the 6 months. Being based in Canada any arbitrage profit should accrue in CAD. Assuming that you can trade, borrow and invest at the above quoted rates. (a) What principle links the four prices? What is the relevant mathematical formulation? (b) Identify any arbitrage opportunities and explain how they might have come about. (c) How would you build up an arbitrage position? Describe your strategy and its mechanics. (d) Calculate your profit resulting from the preceding arbitrage strategy. You have developed an algorithm based on Artificial Intelligence that trades foreign exchange automatically using statistical arbitrage. You expect that the algorithm will give you a small but steady profit of $900 dollar every year forever. However, it will cost you $12,000 today to hire a developer who can set up the program. You want to know whether you should go through with this idea. The interest rate is 3.5% per year and you would pay the developer today. It will take some time for the developer to build the program and so you expect to get your first positive cashflow from the algorithm in two years time. a. What is the NPV of this investment? (answer with two decimals) b. The developer suggest an improvement based on reinforcement learning so that the amount earned by the algorithm would increase with 1% every year. What is the new NPV? (answer with two decimals) c. You consider whether you should learn to code so that you can build the program that supports the trading algorithm yourself. You would study part-time for the coming 5 years, but would then be able to build the algorithm for free (including the improvement suggested by the developer). Your first profit from the algorithm is thus expected in 6 years. What is the new NPV? (answer with two decimals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started