Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. In this question we will conduct a backtesting exercise for a portfolioof 5 stocks for the 2021 year. For each trading day in 2021

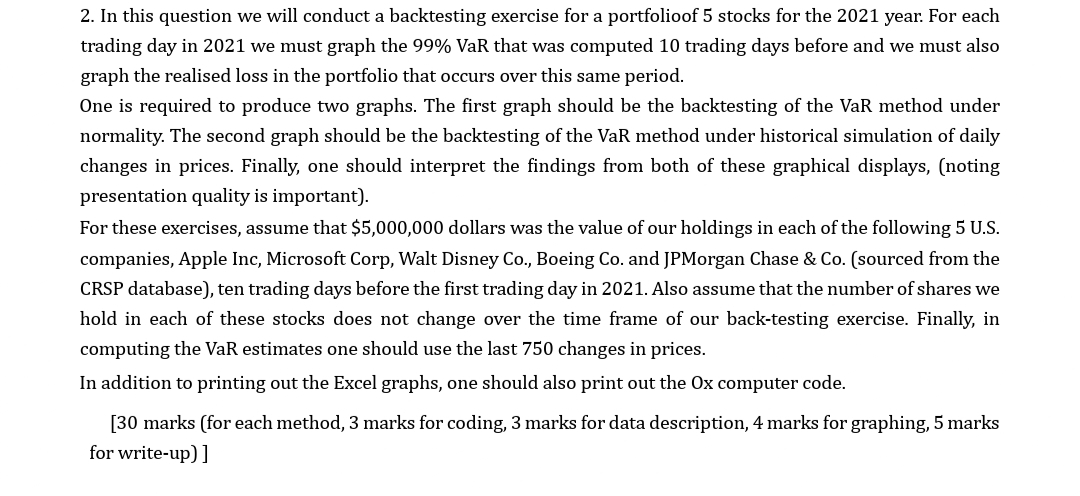

2. In this question we will conduct a backtesting exercise for a portfolioof 5 stocks for the 2021 year. For each trading day in 2021 we must graph the 99% VaR that was computed 10 trading days before and we must also graph the realised loss in the portfolio that occurs over this same period. One is required to produce two graphs. The first graph should be the backtesting of the VaR method under normality. The second graph should be the backtesting of the VaR method under historical simulation of daily changes in prices. Finally, one should interpret the findings from both of these graphical displays, (noting presentation quality is important). For these exercises, assume that $5,000,000 dollars was the value of our holdings in each of the following 5 U.S. companies, Apple Inc, Microsoft Corp, Walt Disney Co., Boeing Co. and JPMorgan Chase \& Co. (sourced from the CRSP database), ten trading days before the first trading day in 2021. Also assume that the number of shares we hold in each of these stocks does not change over the time frame of our back-testing exercise. Finally, in computing the VaR estimates one should use the last 750 changes in prices. In addition to printing out the Excel graphs, one should also print out the Ox computer code. [30 marks (for each method, 3 marks for coding, 3 marks for data description, 4 marks for graphing, 5 marks for write-up) ]

2. In this question we will conduct a backtesting exercise for a portfolioof 5 stocks for the 2021 year. For each trading day in 2021 we must graph the 99% VaR that was computed 10 trading days before and we must also graph the realised loss in the portfolio that occurs over this same period. One is required to produce two graphs. The first graph should be the backtesting of the VaR method under normality. The second graph should be the backtesting of the VaR method under historical simulation of daily changes in prices. Finally, one should interpret the findings from both of these graphical displays, (noting presentation quality is important). For these exercises, assume that $5,000,000 dollars was the value of our holdings in each of the following 5 U.S. companies, Apple Inc, Microsoft Corp, Walt Disney Co., Boeing Co. and JPMorgan Chase \& Co. (sourced from the CRSP database), ten trading days before the first trading day in 2021. Also assume that the number of shares we hold in each of these stocks does not change over the time frame of our back-testing exercise. Finally, in computing the VaR estimates one should use the last 750 changes in prices. In addition to printing out the Excel graphs, one should also print out the Ox computer code. [30 marks (for each method, 3 marks for coding, 3 marks for data description, 4 marks for graphing, 5 marks for write-up) ] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started