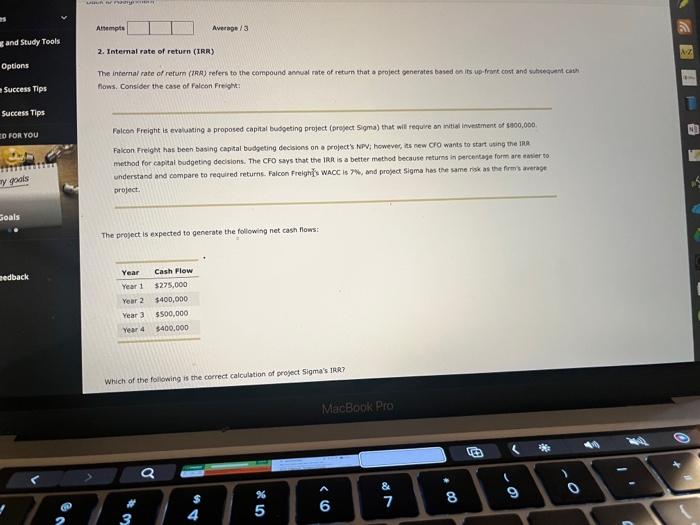

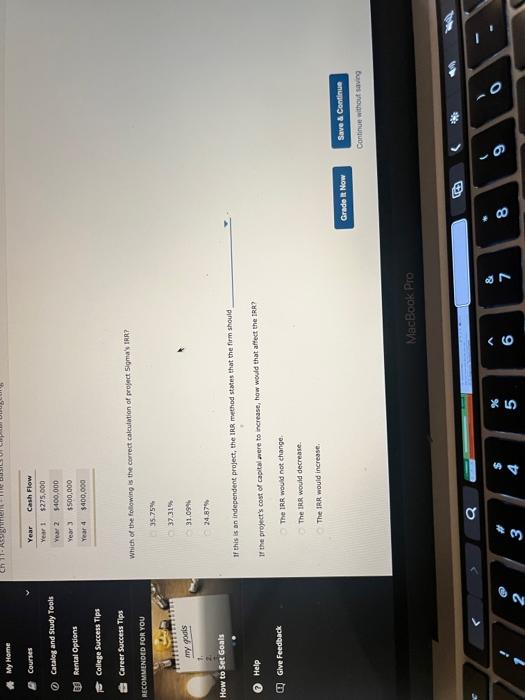

2. Inteinal rate of return (IRR) The internal rate of refum (tEA) fefers to the cempound anmal rate of rebum that a project generates based bs its up-frier cost and satictacent cith fhaw5, Consider the case of faleon Freight: Falcen Freight is evalumung a proposed chpital budgeting project (broject 5 gma) that wit requle an ritial inveutment od sabo, boo Falcon Frelght has been busing capital bodgeting declsions on a project's hped; however, ns new cro wants to start using the ine method for capital budgeting decisions. The CFO says that the 1R.A is a beiter methed because returns in percentage form are eatier to understand and compare ko required returns. Falcon Fretghils wacC is 7wy and progect Sigma has the same risk as the firm anerage preject. The project is sxpected to generate the following net cash flows: Which of the following is the correct calculation of project Sigma's 1RR? Which of the following is the cerrect cakcutation of proiect Sigma's taR? 95.75%h 37.31% 91.0946 24.87% If this is an independent project, the lRQ method states that the frrm should If the project's cost of capital were to increase, how would that aftect the IRA? The IRR would not change The tRR would decrease. The IR. Eould increase. 2. Inteinal rate of return (IRR) The internal rate of refum (tEA) fefers to the cempound anmal rate of rebum that a project generates based bs its up-frier cost and satictacent cith fhaw5, Consider the case of faleon Freight: Falcen Freight is evalumung a proposed chpital budgeting project (broject 5 gma) that wit requle an ritial inveutment od sabo, boo Falcon Frelght has been busing capital bodgeting declsions on a project's hped; however, ns new cro wants to start using the ine method for capital budgeting decisions. The CFO says that the 1R.A is a beiter methed because returns in percentage form are eatier to understand and compare ko required returns. Falcon Fretghils wacC is 7wy and progect Sigma has the same risk as the firm anerage preject. The project is sxpected to generate the following net cash flows: Which of the following is the correct calculation of project Sigma's 1RR? Which of the following is the cerrect cakcutation of proiect Sigma's taR? 95.75%h 37.31% 91.0946 24.87% If this is an independent project, the lRQ method states that the frrm should If the project's cost of capital were to increase, how would that aftect the IRA? The IRR would not change The tRR would decrease. The IR. Eould increase