Question

2. Intercompany equipment sale (20 points) On Jan 2, 2020, a subsidiary sells to its parent equipment that had cost $40,000. The selling price

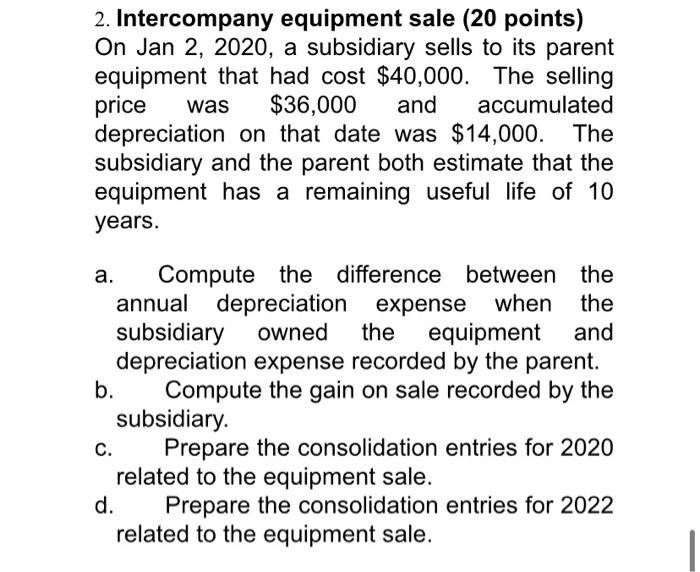

2. Intercompany equipment sale (20 points) On Jan 2, 2020, a subsidiary sells to its parent equipment that had cost $40,000. The selling price was $36,000 and accumulated depreciation on that date was $14,000. The subsidiary and the parent both estimate that the equipment has a remaining useful life of 10 years. a. Compute the difference between the annual depreciation expense when the subsidiary owned the equipment and depreciation expense recorded by the parent. Compute the gain on sale recorded by the subsidiary. b. C. d. Prepare the consolidation entries for 2020 related to the equipment sale. Prepare the consolidation entries for 2022 related to the equipment sale.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting In Canada

Authors: Hilton Murray, Herauf Darrell

7th Edition

1259066487, 978-1259066481

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App