Question

2 j Suppose there are three risky assets (indexed by j = 1,2,3) with the following ; and ; when regressed on the market

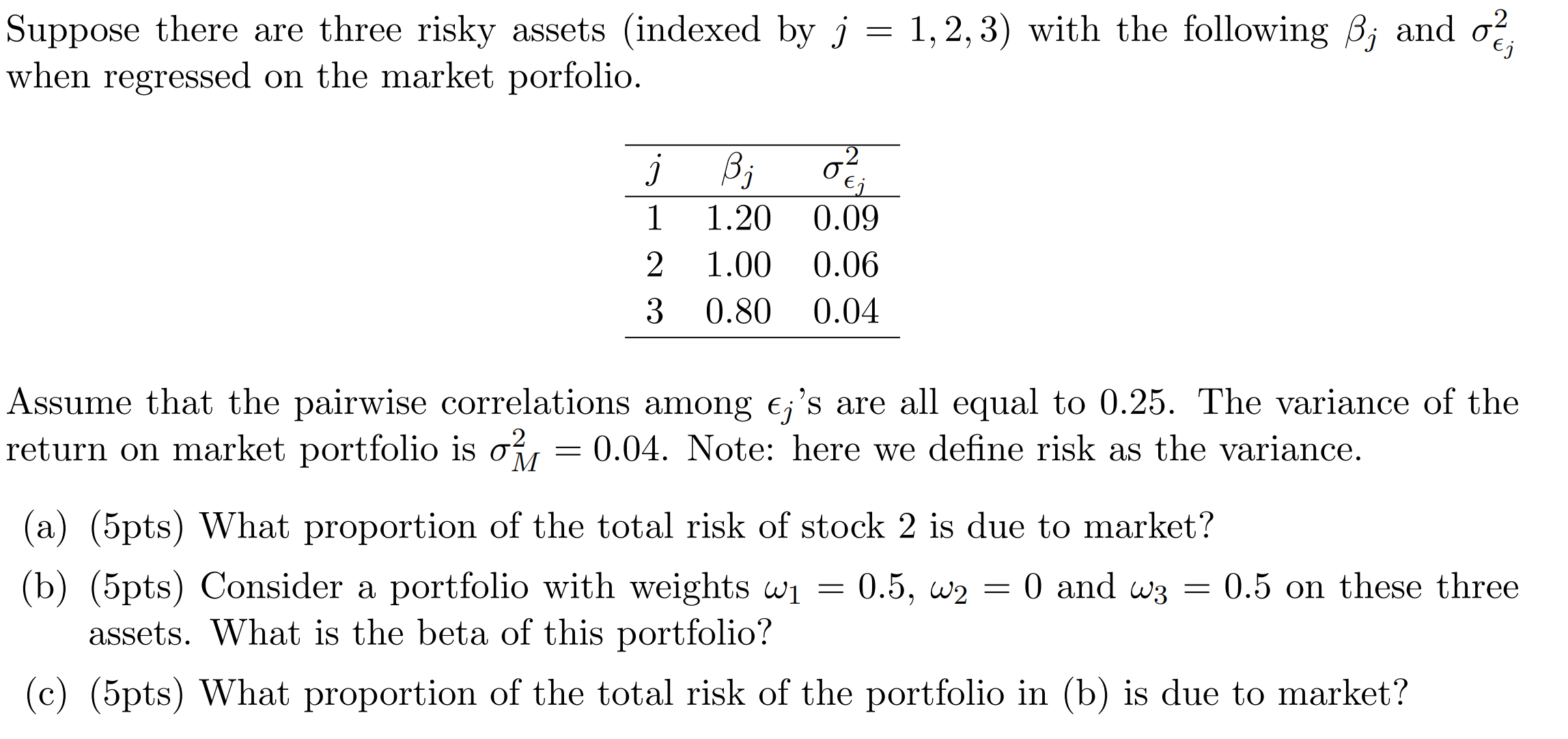

2 j Suppose there are three risky assets (indexed by j = 1,2,3) with the following ; and ; when regressed on the market porfolio. j Bj Ej 1 1.20 0.09 2 1.00 0.06 3 0.80 0.04 Assume that the pairwise correlations among ;'s are all equal to 0.25. The variance of the return on market portfolio is = 0.04. Note: here we define risk as the variance. M (a) (5pts) What proportion of the total risk of stock 2 is due to market? 0 and w3 = (b) (5pts) Consider a portfolio with weights wi 0.5, W2 = assets. What is the beta of this portfolio? 0.5 on these three (c) (5pts) What proportion of the total risk of the portfolio in (b) is due to market?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Risk Due to Market and Portfolio Beta We can analyze the risk of stock 2 and the portfolio using the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App