Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Koshy and Soo are Malaysian citizens and married. Koshy has been employed by Dynamic Sdn Bhd (DSB) as a computer engineer for the past

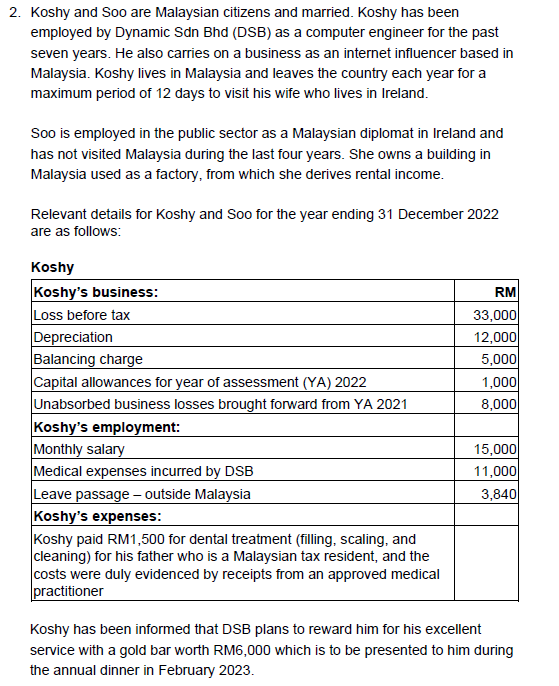

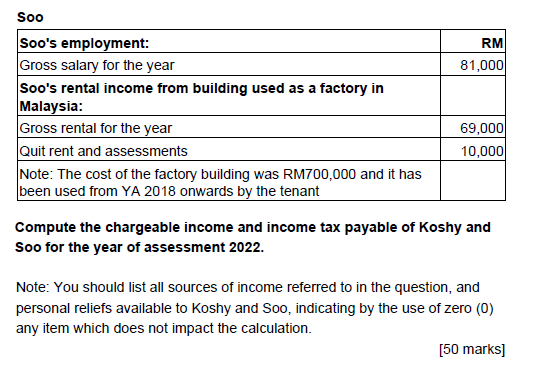

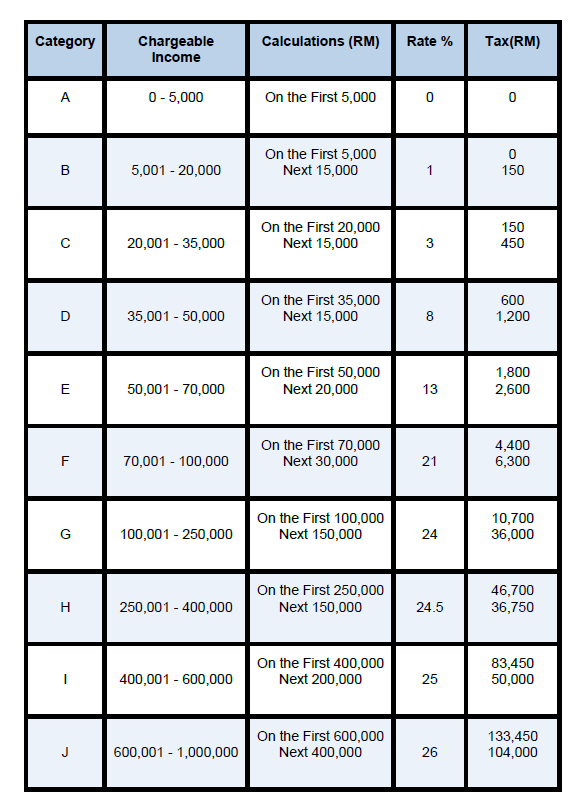

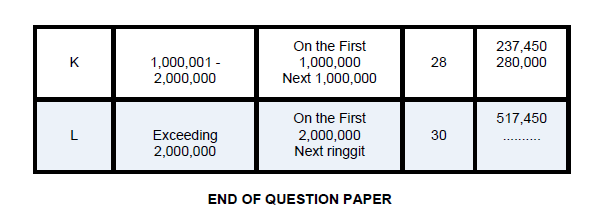

2. Koshy and Soo are Malaysian citizens and married. Koshy has been employed by Dynamic Sdn Bhd (DSB) as a computer engineer for the past seven years. He also carries on a business as an internet influencer based in Malaysia. Koshy lives in Malaysia and leaves the country each year for a maximum period of 12 days to visit his wife who lives in Ireland. Soo is employed in the public sector as a Malaysian diplomat in Ireland and has not visited Malaysia during the last four years. She owns a building in Malaysia used as a factory, from which she derives rental income. Relevant details for Koshy and Soo for the year ending 31 December 2022 are as follows: Koshy Koshy has been informed that DSB plans to reward him for his excellent service with a gold bar worth RM6,000 which is to be presented to him during the annual dinner in February 2023. Soo Compute the chargeable income and income tax payable of Koshy and Soo for the year of assessment 2022. Note: You should list all sources of income referred to in the question, and personal reliefs available to Koshy and Soo, indicating by the use of zero (0) any item which does not impact the calculation. [50 marks] APPENDIX : TAX INFORMATION - General rates of capital allowance * QE for non-commercial vehicle is restricted to the maximum amount below: Maximum QE (RM) New vehicles purchased where the total cost is RM150,000 100,000 or less Vehicles other than the above 50,000 - Expenditure on an asset with a lifespan of not more than 2 years is allowed on a replacement basis. \begin{tabular}{|c|c|c|c|c|} \hline K & OntheFirst1,000,0002,000,000 & 28 & 237,450280,000Next1,000,000 \\ \hline L & Exceeding2,000,000 & OntheFirst2,000,000Nextringgit & 30 & \\ \hline \end{tabular} END OF QUESTION PAPER 2. Koshy and Soo are Malaysian citizens and married. Koshy has been employed by Dynamic Sdn Bhd (DSB) as a computer engineer for the past seven years. He also carries on a business as an internet influencer based in Malaysia. Koshy lives in Malaysia and leaves the country each year for a maximum period of 12 days to visit his wife who lives in Ireland. Soo is employed in the public sector as a Malaysian diplomat in Ireland and has not visited Malaysia during the last four years. She owns a building in Malaysia used as a factory, from which she derives rental income. Relevant details for Koshy and Soo for the year ending 31 December 2022 are as follows: Koshy Koshy has been informed that DSB plans to reward him for his excellent service with a gold bar worth RM6,000 which is to be presented to him during the annual dinner in February 2023. Soo Compute the chargeable income and income tax payable of Koshy and Soo for the year of assessment 2022. Note: You should list all sources of income referred to in the question, and personal reliefs available to Koshy and Soo, indicating by the use of zero (0) any item which does not impact the calculation. [50 marks] APPENDIX : TAX INFORMATION - General rates of capital allowance * QE for non-commercial vehicle is restricted to the maximum amount below: Maximum QE (RM) New vehicles purchased where the total cost is RM150,000 100,000 or less Vehicles other than the above 50,000 - Expenditure on an asset with a lifespan of not more than 2 years is allowed on a replacement basis. \begin{tabular}{|c|c|c|c|c|} \hline K & OntheFirst1,000,0002,000,000 & 28 & 237,450280,000Next1,000,000 \\ \hline L & Exceeding2,000,000 & OntheFirst2,000,000Nextringgit & 30 & \\ \hline \end{tabular} END OF QUESTION PAPER

2. Koshy and Soo are Malaysian citizens and married. Koshy has been employed by Dynamic Sdn Bhd (DSB) as a computer engineer for the past seven years. He also carries on a business as an internet influencer based in Malaysia. Koshy lives in Malaysia and leaves the country each year for a maximum period of 12 days to visit his wife who lives in Ireland. Soo is employed in the public sector as a Malaysian diplomat in Ireland and has not visited Malaysia during the last four years. She owns a building in Malaysia used as a factory, from which she derives rental income. Relevant details for Koshy and Soo for the year ending 31 December 2022 are as follows: Koshy Koshy has been informed that DSB plans to reward him for his excellent service with a gold bar worth RM6,000 which is to be presented to him during the annual dinner in February 2023. Soo Compute the chargeable income and income tax payable of Koshy and Soo for the year of assessment 2022. Note: You should list all sources of income referred to in the question, and personal reliefs available to Koshy and Soo, indicating by the use of zero (0) any item which does not impact the calculation. [50 marks] APPENDIX : TAX INFORMATION - General rates of capital allowance * QE for non-commercial vehicle is restricted to the maximum amount below: Maximum QE (RM) New vehicles purchased where the total cost is RM150,000 100,000 or less Vehicles other than the above 50,000 - Expenditure on an asset with a lifespan of not more than 2 years is allowed on a replacement basis. \begin{tabular}{|c|c|c|c|c|} \hline K & OntheFirst1,000,0002,000,000 & 28 & 237,450280,000Next1,000,000 \\ \hline L & Exceeding2,000,000 & OntheFirst2,000,000Nextringgit & 30 & \\ \hline \end{tabular} END OF QUESTION PAPER 2. Koshy and Soo are Malaysian citizens and married. Koshy has been employed by Dynamic Sdn Bhd (DSB) as a computer engineer for the past seven years. He also carries on a business as an internet influencer based in Malaysia. Koshy lives in Malaysia and leaves the country each year for a maximum period of 12 days to visit his wife who lives in Ireland. Soo is employed in the public sector as a Malaysian diplomat in Ireland and has not visited Malaysia during the last four years. She owns a building in Malaysia used as a factory, from which she derives rental income. Relevant details for Koshy and Soo for the year ending 31 December 2022 are as follows: Koshy Koshy has been informed that DSB plans to reward him for his excellent service with a gold bar worth RM6,000 which is to be presented to him during the annual dinner in February 2023. Soo Compute the chargeable income and income tax payable of Koshy and Soo for the year of assessment 2022. Note: You should list all sources of income referred to in the question, and personal reliefs available to Koshy and Soo, indicating by the use of zero (0) any item which does not impact the calculation. [50 marks] APPENDIX : TAX INFORMATION - General rates of capital allowance * QE for non-commercial vehicle is restricted to the maximum amount below: Maximum QE (RM) New vehicles purchased where the total cost is RM150,000 100,000 or less Vehicles other than the above 50,000 - Expenditure on an asset with a lifespan of not more than 2 years is allowed on a replacement basis. \begin{tabular}{|c|c|c|c|c|} \hline K & OntheFirst1,000,0002,000,000 & 28 & 237,450280,000Next1,000,000 \\ \hline L & Exceeding2,000,000 & OntheFirst2,000,000Nextringgit & 30 & \\ \hline \end{tabular} END OF QUESTION PAPER Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started