Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Let's say the Ford bond above is secured by collateral, does not have a sinking fund, is callable, and does not have protective

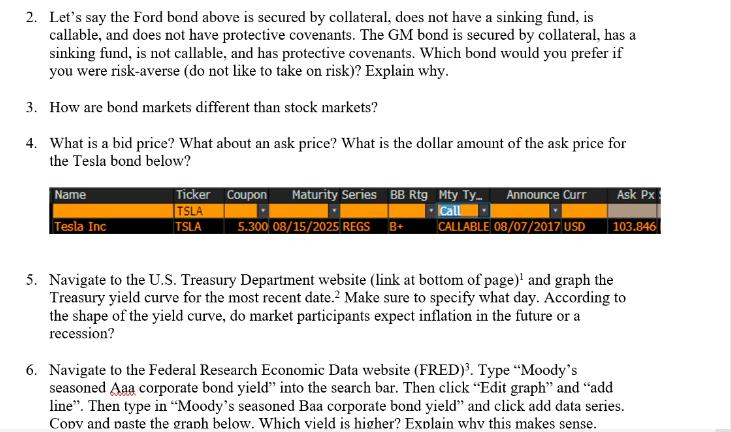

2. Let's say the Ford bond above is secured by collateral, does not have a sinking fund, is callable, and does not have protective covenants. The GM bond is secured by collateral, has a sinking fund, is not callable, and has protective covenants. Which bond would you prefer if you were risk-averse (do not like to take on risk)? Explain why. 3. How are bond markets different than stock markets? 4. What is a bid price? What about an ask price? What is the dollar amount of the ask price for the Tesla bond below? Name Tesla Inc Ticker Coupon TSLA TSLA Maturity Series BB Rtg Mty Ty.... Announce Curr Call 5.300 08/15/2025 REGS B+ CALLABLE 08/07/2017 USD 103.846 Ask Px 5. Navigate to the U.S. Treasury Department website (link at bottom of page)' and graph the Treasury yield curve for the most recent date. Make sure to specify what day. According to the shape of the yield curve, do market participants expect inflation in the future or a recession? 6. Navigate to the Federal Research Economic Data website (FRED). Type "Moody's seasoned Aaa corporate bond yield" into the search bar. Then click "Edit graph" and "add line". Then type in "Moody's seasoned Baa corporate bond yield" and click add data series. Copy and paste the graph below. Which vield is higher? Explain why this makes sense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

2 Preference for RiskAverse Investor Considering the details provided a riskaverse investor would li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started