Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2-)) Luxury Clothing in a manufacturer of age For June 2017 each its budgeted to the labor hour. The budgeted number of this to be

2-))

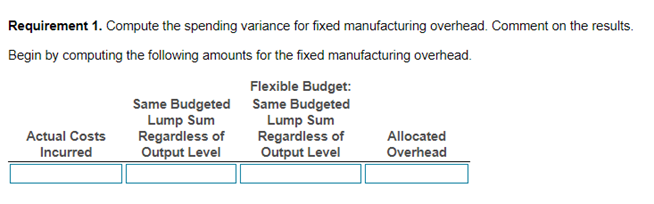

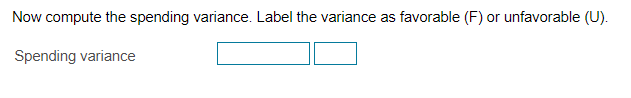

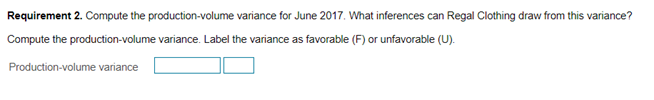

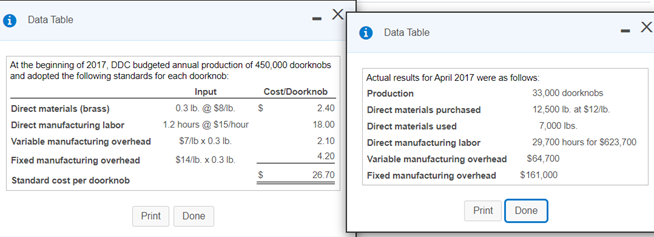

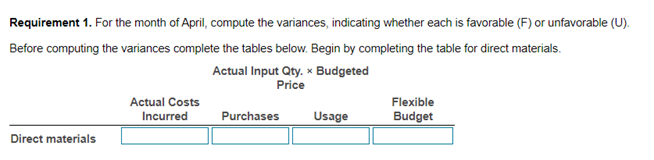

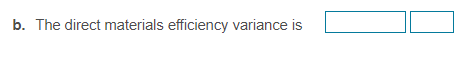

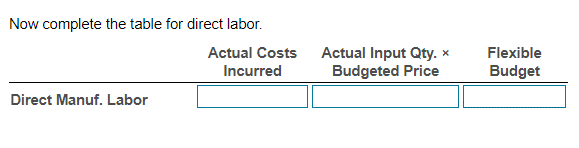

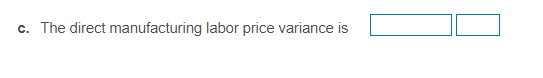

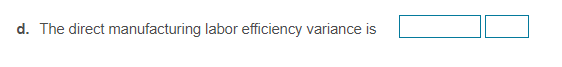

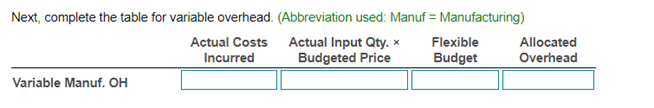

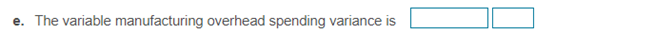

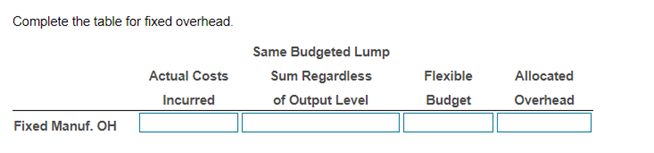

Luxury Clothing in a manufacturer of age For June 2017 each its budgeted to the labor hour. The budgeted number of this to be manufactured in June 2017 1000 Ly Gothing located and manufacturing overhead to each ting budgeted direct manufacturing bor hours per w Duta pertaining to find manufacturing ved contesto June 2017 are busted 10.120 and 1915 inre 2017 there were started and competed There were being rendementones dots 1. Compute the spending verance and manufacturing overhead Comment on the results 2. Compute the production volume verance for Aune 2017. What ference Luxury Gothing from Requirement 1. Compute the spending variance for fixed manufacturing overhead. Comment on the results. Begin by computing the following amounts for the fixed manufacturing overhead. Flexible Budget: Same Budgeted Same Budgeted Lump Sum Lump Sum Actual Costs Regardless of Regardless of Allocated Incurred Output Level Output Level Overhead Now compute the spending variance. Label the variance as favorable (F) or unfavorable (U). Spending variance Requirement 2. Compute the production-volume variance for June 2017. What inferences can Regal Clothing draw from this variance? Compute the production-volume variance. Label the variance as favorable (F) or unfavorable (U). Production-volume variance Data Table Data Table - $ At the beginning of 2017, DDC budgeted annual production of 450,000 doorknobs and adopted the following standards for each doorknob: Input Cost/Doorknob Direct materials (brass) 0.3 lb. @$8/1b. 2.40 Direct manufacturing labor 12 hours @ $15/hour 18.00 Variable manufacturing overhead $71bx0.3 16. 2.10 4.20 Fixed manufacturing overhead $14/b. x 0.316. $ 26.70 Standard cost per doorknob Actual results for April 2017 were as follows: Production 33,000 doorknobs Direct materials purchased 12,500 lb, at $1216. Direct materials used 7,000 lbs Direct manufacturing labor 29,700 hours for $623,700 Variable manufacturing overhead $64,700 Fixed manufacturing overhead $161,000 Print Done Print Done Requirement 1. For the month of April, compute the variances, indicating whether each is favorable (F) or unfavorable (U). Before computing the variances complete the tables below. Begin by completing the table for direct materials. Actual Input Qty. * Budgeted Price Actual Costs Flexible Incurred Purchases Usage Budget Direct materials a. Direct materials price variance (based on purchases) is b. The direct materials efficiency variance is Now complete the table for direct labor. Actual Costs Incurred Direct Manuf. Labor Actual Input Qty. * Budgeted Price Flexible Budget c. The direct manufacturing labor price variance is d. The direct manufacturing labor efficiency variance is Next, complete the table for variable overhead. (Abbreviation used: Manuf = Manufacturing) Actual Costs Actual Input Qty. * Flexible Allocated Incurred Budgeted Price Budget Overhead Variable Manuf. OH e. The variable manufacturing overhead spending variance is f. The variable manufacturing overhead efficiency variance is Complete the table for fixed overhead. Actual Costs Incurred Same Budgeted Lump Sum Regardless of Output Level Flexible Budget Allocated Overhead Fixed Manuf. OH g. The production-volume variance is h. The fixed manufacturing overhead spending variance is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started